- United States

- /

- Banks

- /

- NYSE:NBHC

National Bank Holdings (NBHC): Valuation Insights After Earnings Reveal Stronger Net Interest and Net Income Growth

Reviewed by Simply Wall St

National Bank Holdings (NBHC) drew investor attention after releasing its third quarter earnings. The report showed both net interest income and net income increasing from a year earlier, suggesting steady operational momentum.

See our latest analysis for National Bank Holdings.

Despite a steady uptick in net interest income and net income, National Bank Holdings’ 1-year total shareholder return stands at -9.0%, reflecting market caution toward regional banks. Short-term share price momentum has faded in recent months. However, longer-term total returns remain positive, with a five-year total shareholder return of 37.6% signaling resilience for patient investors.

If you’re weighing new opportunities beyond banks, now is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

After a year marked by steady improvements but subdued share price returns, the key question for investors is whether National Bank Holdings is trading at a bargain relative to its potential growth or if the market has already factored in its future prospects.

Most Popular Narrative: 15.4% Undervalued

With National Bank Holdings recently closing at $37.01 and a popular narrative placing fair value near $43.75, there is a notable gap between price and expectations. Investors are weighing the realistic potential of the current strategy against this upside.

The successful launch of the 2UniFi platform, with positive early feedback and plans for further feature expansion (including fee-based membership offerings and integrated fintech services for SMBs), positions the company to capitalize on the shift toward digital banking and technology-driven financial solutions. This could potentially drive incremental noninterest income and expand high-margin fee revenue streams.

What is really fueling such a bullish outlook? The most followed narrative is focused on a new digital strategy, margin discipline, and financial expansion. Want to know how much profit and growth they are forecasting to back up that price target? Explore the hidden assumptions powering this valuation.

Result: Fair Value of $43.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if digital adoption falters or regional loan demand weakens, National Bank Holdings could see its revenue and earnings trajectory fall short of expectations.

Find out about the key risks to this National Bank Holdings narrative.

Another View: How Does the Market Really Price NBHC?

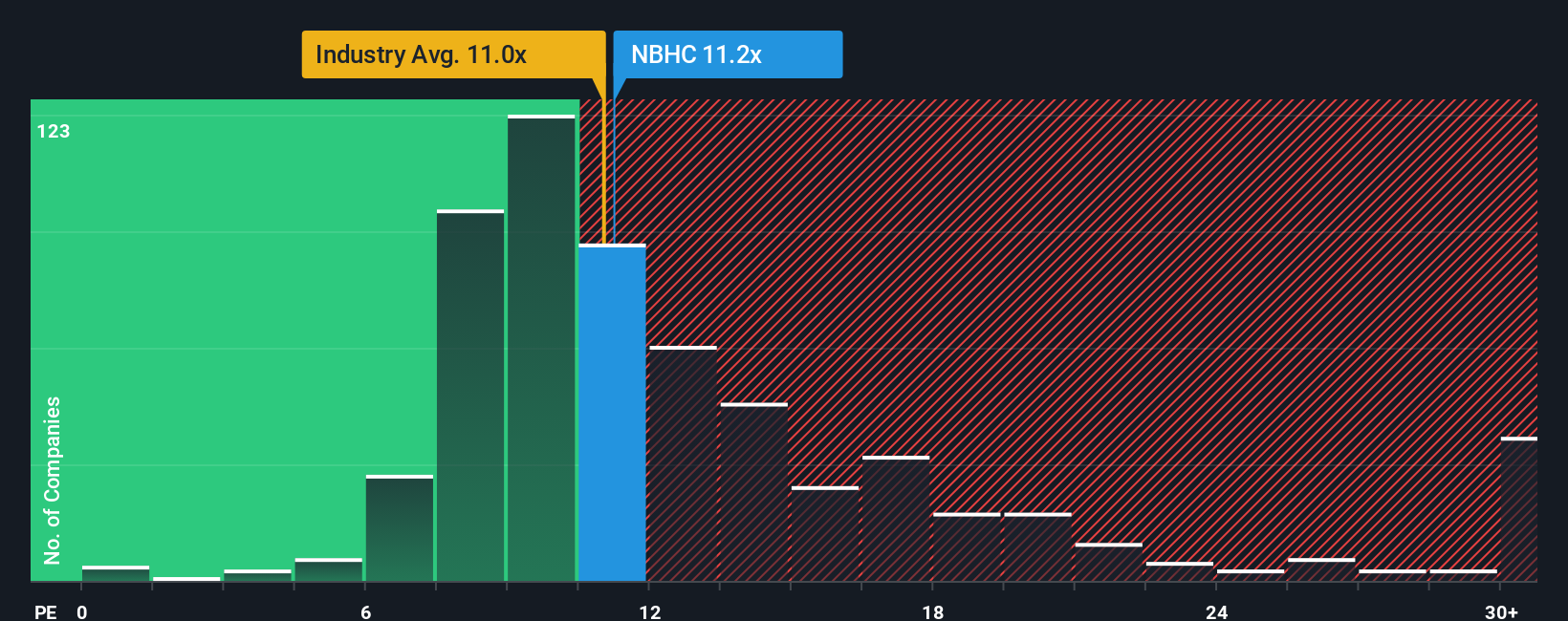

While analysts project upside, the market currently assigns National Bank Holdings a price-to-earnings ratio of 11.8x. This is above its US bank peers at 10.3x and the broader industry average of 11.3x, yet still below its fair ratio of 13.8x. Such a gap could mean missed opportunity or extra valuation risk. Is the market underestimating future strength, or simply being cautious?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own National Bank Holdings Narrative

If you’d rather follow your own research path or have a different take on National Bank Holdings’ outlook, there’s nothing stopping you from building your own case in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding National Bank Holdings.

Looking for more investment ideas?

Sharpen your strategy and move ahead of the crowd. Don't let incredible opportunities pass you by. Put these top growth and value screens to work today.

- Snap up high-potential names aiming for impressive gains with these 3581 penny stocks with strong financials and access companies backed by solid financials, not just hype.

- Capture future health innovation by checking these 33 healthcare AI stocks, where groundbreaking advances in AI and healthcare are already transforming patient outcomes.

- Level up your search for serious yield with these 17 dividend stocks with yields > 3% featuring stocks boasting dividends above 3% for a more rewarding portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Bank Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NBHC

National Bank Holdings

Operates as the bank holding company for NBH Bank that provides various banking products and financial services to commercial, business, and consumer clients in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives