- United States

- /

- Banks

- /

- NYSE:NBHC

Is National Bank Holdings' (NBHC) Dividend Hike and Buyback Activity Shaping Its Investment Case?

Reviewed by Sasha Jovanovic

- National Bank Holdings Corporation recently increased its quarterly dividend to US$0.31 per share, authorized dividend payments for December 2025, and provided updates on its share buyback program and third-quarter financial results.

- Alongside higher net earnings year-on-year, the company reported a reduction in charge-offs and continued active return of capital to shareholders.

- We will explore how National Bank Holdings’ improved earnings and higher dividend influence the company’s outlook and investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

National Bank Holdings Investment Narrative Recap

To be a shareholder in National Bank Holdings, you need to believe the company can leverage its regional growth, disciplined commercial banking approach, and digital initiatives to drive core earnings and steady returns despite industry and economic pressures. The recent dividend increase and continued share buybacks support the company’s return-of-capital focus, but these moves do not materially alter the near-term catalyst of loan growth in core markets, nor do they reduce the biggest current risk: concentrated regional and sector exposure.

Of the latest announcements, the decline in charge-offs stands out in the context of supporting stable earnings and managing credit risk, especially important as regional and sector concentrations can expose the bank to outsized losses if local economic conditions deteriorate. While net interest income and earnings ticked up, the reduction in charge-offs reinforces resilience, which remains a key consideration given the ongoing risk of revenue pressure tied to regional or sector-specific downturns.

However, investors should also be aware that despite these improvements, concentration risk in specific industries persists...

Read the full narrative on National Bank Holdings (it's free!)

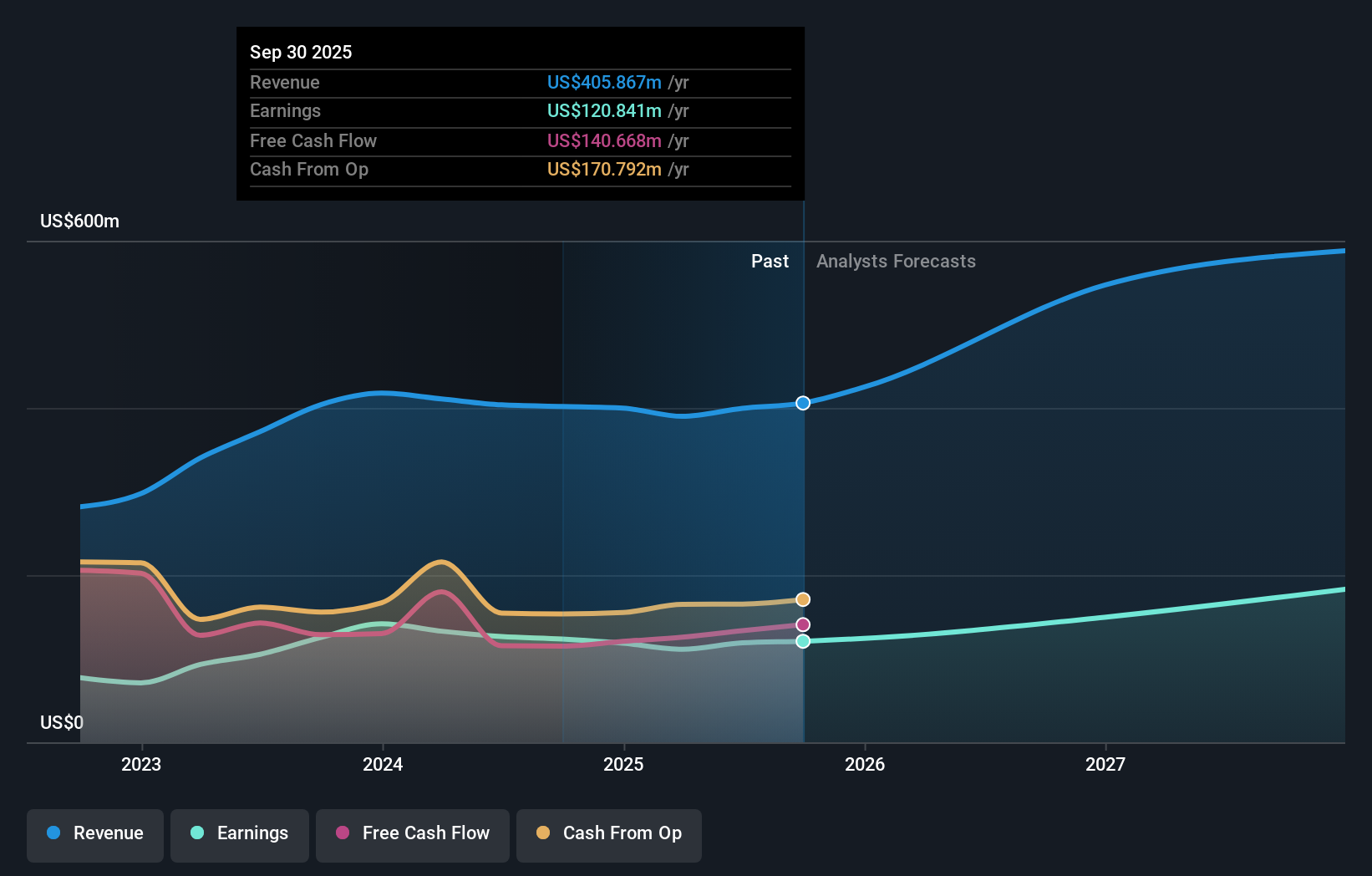

National Bank Holdings is projected to reach $500.3 million in revenue and $142.3 million in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 7.8% and a $23.4 million increase in earnings from the current level of $118.9 million.

Uncover how National Bank Holdings' forecasts yield a $43.75 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members shared two fair value estimates for National Bank Holdings, spanning from US$43.75 to a striking US$59,691.06. With lending concentration risk still at the forefront, consider how widely these views can diverge when forming your own opinion.

Explore 2 other fair value estimates on National Bank Holdings - why the stock might be a potential multi-bagger!

Build Your Own National Bank Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Bank Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free National Bank Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Bank Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Bank Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NBHC

National Bank Holdings

Operates as the bank holding company for NBH Bank that provides various banking products and financial services to commercial, business, and consumer clients in the United States.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives