The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like M&T Bank (NYSE:MTB). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for M&T Bank

M&T Bank's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that M&T Bank has managed to grow EPS by 21% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

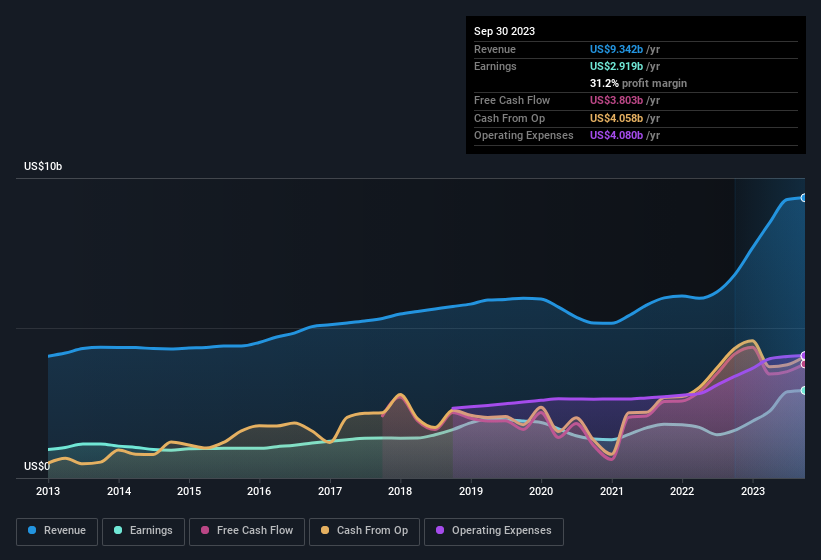

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of M&T Bank's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. M&T Bank maintained stable EBIT margins over the last year, all while growing revenue 38% to US$9.3b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of M&T Bank's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are M&T Bank Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The US$929k worth of shares that insiders sold during the last 12 months pales in comparison to the US$1.8m they spent on acquiring shares in the company. This bodes well for M&T Bank as it highlights the fact that those who are important to the company having a lot of faith in its future. We also note that it was the Senior EVP & Chief Financial Officer, Daryl Bible, who made the biggest single acquisition, paying US$1.2m for shares at about US$121 each.

The good news, alongside the insider buying, for M&T Bank bulls is that insiders (collectively) have a meaningful investment in the stock. Notably, they have an enviable stake in the company, worth US$120m. This comes in at 0.5% of shares in the company, which is a fair amount of a business of this size. This still shows shareholders there is a degree of alignment between management and themselves.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because on our analysis the CEO, Ren Jones, is paid less than the median for similar sized companies. For companies with market capitalisations over US$8.0b, like M&T Bank, the median CEO pay is around US$12m.

M&T Bank offered total compensation worth US$8.8m to its CEO in the year to December 2022. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add M&T Bank To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into M&T Bank's strong EPS growth. Furthermore, company insiders have been adding to their significant stake in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. Still, you should learn about the 1 warning sign we've spotted with M&T Bank.

The good news is that M&T Bank is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MTB

M&T Bank

Operates as a bank holding company for Manufacturers and Traders Trust Company and Wilmington Trust, National Association that engages in the provision of retail and commercial banking products and services in the United States.

Flawless balance sheet established dividend payer.