- United States

- /

- Banks

- /

- NYSE:KEY

KeyCorp (KEY): Valuation Insights Following Q3 2025 Turnaround and Profit Recovery

Reviewed by Simply Wall St

KeyCorp (KEY) has caught attention with its Q3 2025 numbers, swinging from last year’s loss to a $489 million profit. While many regional banks struggle, this turnaround highlights KeyCorp’s approach to growth in the face of industry headwinds.

See our latest analysis for KeyCorp.

KeyCorp’s share price has edged higher in 2025, reflecting cautious optimism as investors digest its turnaround and recent strong quarterly results. This comes even as regional banks broadly face industry pressures. While the 1-year total shareholder return is essentially flat, the 5-year total return of nearly 55% signals the company’s longer-term potential and resilience.

If KeyCorp’s jump in earnings has you rethinking where momentum might be building, now’s a smart moment to discover fast growing stocks with high insider ownership.

But with the stock's recent rally and robust results, is KeyCorp still undervalued given its double-digit growth? Or is the market already pricing in all this momentum and future recovery?

Most Popular Narrative: 15.8% Undervalued

KeyCorp’s most influential narrative estimates a fair value comfortably above the latest closing price. This reflects confidence in its growth and profit outlook as the market recalibrates expectations.

Expansion in the wealth management and commercial payments sectors, marked by record production volumes and significant client growth, is poised to drive noninterest income upwards. This could influence both revenue and net margins positively. Strong growth in the national third-party commercial loan servicing business provides a counter-cyclical revenue stream and insights into the commercial real estate market. These factors may bolster diversified revenue streams and enhance earnings stability.

What’s fueling this premium? The story behind fair value is filled with bold profit forecasts, strategic diversification and a future profit multiple more often seen in high-flyers. Want a peek at the ambitious assumptions and the financial momentum the market may be missing? Dive in and see why this valuation could have surprises for even seasoned bank investors.

Result: Fair Value of $21.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent worries such as rising nonperforming loans and sluggish loan demand could threaten KeyCorp’s profit trajectory. As a result, investors are monitoring these trends closely.

Find out about the key risks to this KeyCorp narrative.

Another View: A Look at Market Comparisons

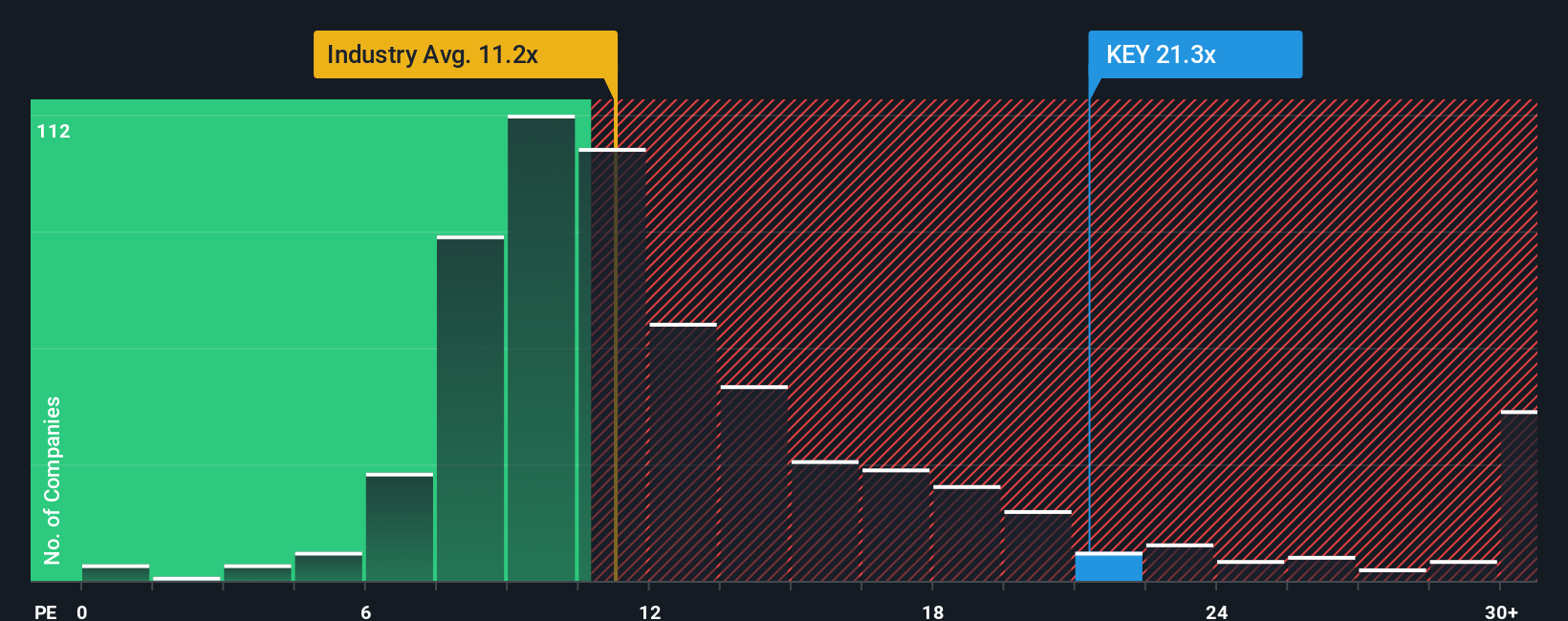

Using the price-to-earnings ratio, KeyCorp stands out as more expensive than both the industry average (21.2x vs 11x) and its peer group (21.2x vs 12.1x). It also sits above its own fair ratio of 17.4x. While the market is paying up for recent momentum, this premium suggests limited margin for error. Is the optimism fully justified or could expectations be getting ahead of themselves?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KeyCorp Narrative

If you see things differently, or want hands-on insight into KeyCorp yourself, you can quickly build your own narrative in just minutes. Do it your way.

A great starting point for your KeyCorp research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Angles?

Don’t let your research stop here. Unlock more opportunities and stay ahead of the crowd by checking out these hand-picked screens. Each could reveal your next winning investment before everyone else notices:

- Target solid income potential as you tap into companies offering reliable yields with these 16 dividend stocks with yields > 3% for your portfolio’s staying power.

- Ride the wave of artificial intelligence by moving your research to these 24 AI penny stocks that are at the forefront of transformative technology trends.

- Gain an early edge in disruptive finance by acting on these 82 cryptocurrency and blockchain stocks harnessing blockchain innovation and shaping tomorrow’s markets today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KeyCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEY

KeyCorp

Operates as the holding company for KeyBank National Association that provides various retail and commercial banking products and services in the United States.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives