- United States

- /

- Banks

- /

- NYSE:JPM

Does JPMorgan Chase’s California Expansion Reflect a New Approach to Wealth Management Growth for JPM?

Reviewed by Sasha Jovanovic

- JPMorgan Chase & Co. has announced the opening of four new J.P. Morgan Financial Centers in California, aiming to deliver highly personalized banking and wealth management services to affluent clients in San Diego, Palo Alto, Mountain View, and San Francisco, with plans to expand further over the next year.

- This expansion highlights the bank’s focused approach to deepening relationships with high-net-worth clients by combining convenience, privacy, and exclusive wealth management expertise in key growth markets.

- We'll explore how the opening of new Financial Centers in California may influence JPMorgan Chase's investment narrative and future growth trajectory.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

JPMorgan Chase Investment Narrative Recap

JPMorgan Chase shareholders are often believers in the bank’s ability to capitalize on global wealth creation, resilient earnings from diverse operations, and ongoing innovation in banking technology. The latest expansion of J.P. Morgan Financial Centers in key California markets is consistent with this long-term narrative, but does not materially shift the short-term focus, which remains on defending market share against digital disruption and managing regulatory complexity, two of the largest near-term catalysts and risks for the business.

Of the recent developments, the renewed partnership with Yodlee is particularly relevant. As JPMorgan prioritizes highly personalized service for affluent clients, deepening data access helps the bank better compete with fintech entrants and strengthens its open finance capabilities. This may reinforce the catalyst of digital leadership, highlighted by investments across private client and payments segments, but the competitive and regulatory environment remains a critical backdrop for both growth and profitability.

In contrast, investors should be aware that, despite the physical branch expansion, the risk of commoditization in core lending and deposit products through open banking could...

Read the full narrative on JPMorgan Chase (it's free!)

JPMorgan Chase's narrative projects $186.7 billion in revenue and $55.5 billion in earnings by 2028. This requires 4.5% yearly revenue growth and a marginal earnings increase of $0.3 billion from the current $55.2 billion.

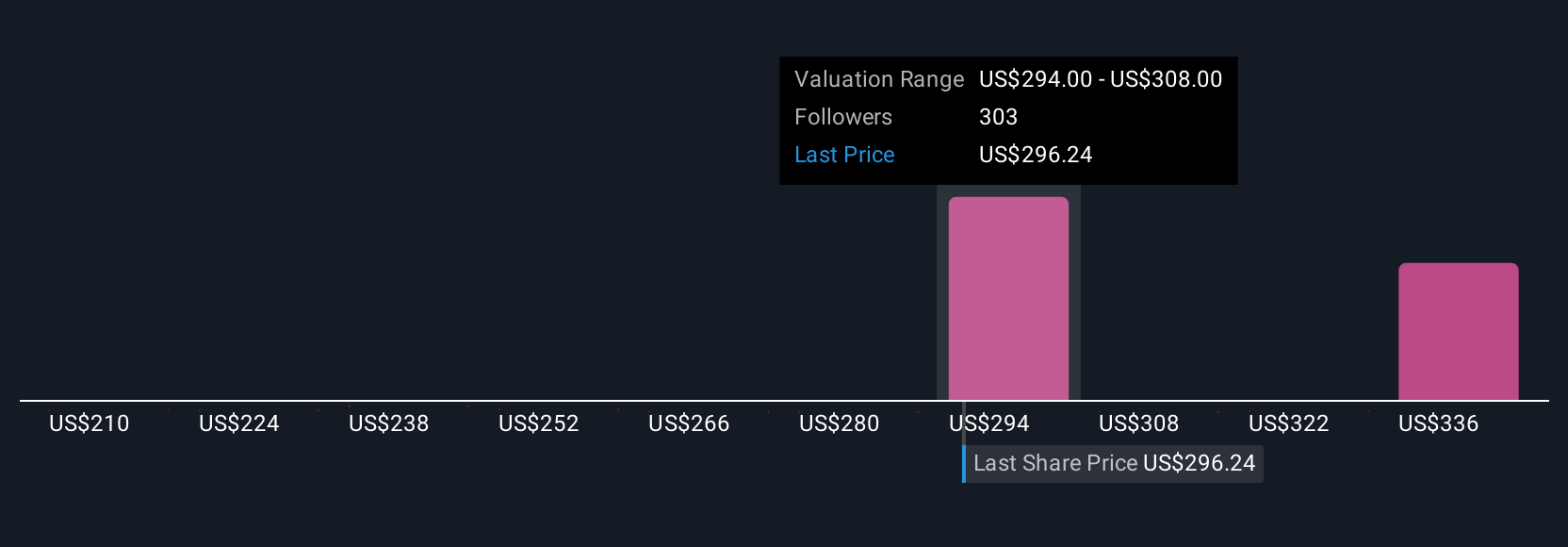

Uncover how JPMorgan Chase's forecasts yield a $327.70 fair value, a 4% upside to its current price.

Exploring Other Perspectives

The lowest analyst estimates offer a more cautious narrative, warning that higher expenses and larger credit loss allowances could shrink net margins. Some projected JPMorgan’s 2028 earnings at US$53.2 billion, compared to US$55.2 billion today. Before this latest expansion, their focus was on rising costs and a potential drop in profitability, reminding us how forecasts and opinions can change quickly, exploring both optimistic and more pessimistic views may be helpful as new headlines emerge.

Explore 23 other fair value estimates on JPMorgan Chase - why the stock might be worth as much as 16% more than the current price!

Build Your Own JPMorgan Chase Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JPMorgan Chase research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free JPMorgan Chase research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JPMorgan Chase's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives