- United States

- /

- Banks

- /

- NYSE:CMA

Comerica (CMA): Exploring Valuation Following Strong YTD Gains and Pending Fifth Third Merger

Reviewed by Simply Wall St

Comerica (CMA) shares have seen a mix of gains and pullbacks over the past month, reflecting shifting market sentiment around regional banks. Looking at the numbers, Comerica’s performance offers a few insights worth unpacking for investors.

See our latest analysis for Comerica.

This latest move for Comerica follows a strong run so far this year, with a 27.3% year-to-date share price return, even after a recent, modest dip. When viewed alongside its 20.1% total shareholder return over the past year, momentum is still building. This suggests investors are recognizing the stock’s improving outlook while remaining alert to sector risks.

If you’re interested in spotting other companies with robust growth and insider support, now’s a great time to discover fast growing stocks with high insider ownership

But with Comerica’s shares hovering just shy of analyst price targets, the big question remains: Is the current valuation signaling room for upside, or has the market already baked in all the expected gains?

Most Popular Narrative: 1.9% Undervalued

Comerica’s last close of $78.23 sits slightly below the most up-to-date narrative fair value at $79.78. This reflects a modest undervaluation and renewed investor optimism following the merger. Anticipation is building as a pivotal corporate event reshapes expectations for the bank’s financial outlook.

Bullish analysts point to the merger with Fifth Third as a clear catalyst for upward revisions to Comerica's fair value and price targets. They note expectations for regulatory and shareholder approval of the deal. The acquisition is projected to be accretive to earnings per share by 2027, supported by expanded market access and operational synergies. Fifth Third is also expected to gain entry to Texas and California.

Wondering what’s really fueling that higher predicted fair value? The most closely watched narrative hinges on several bold financial forecasts that could change Comerica’s growth story for years. Unlock the crucial assumptions driving this price call by diving into the full valuation breakdown.

Result: Fair Value of $79.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising expenses and muted loan growth could challenge Comerica's outlook if these factors are not offset by efficiency gains or stronger loan demand in the future.

Find out about the key risks to this Comerica narrative.

Another View: Looking at Price-to-Earnings

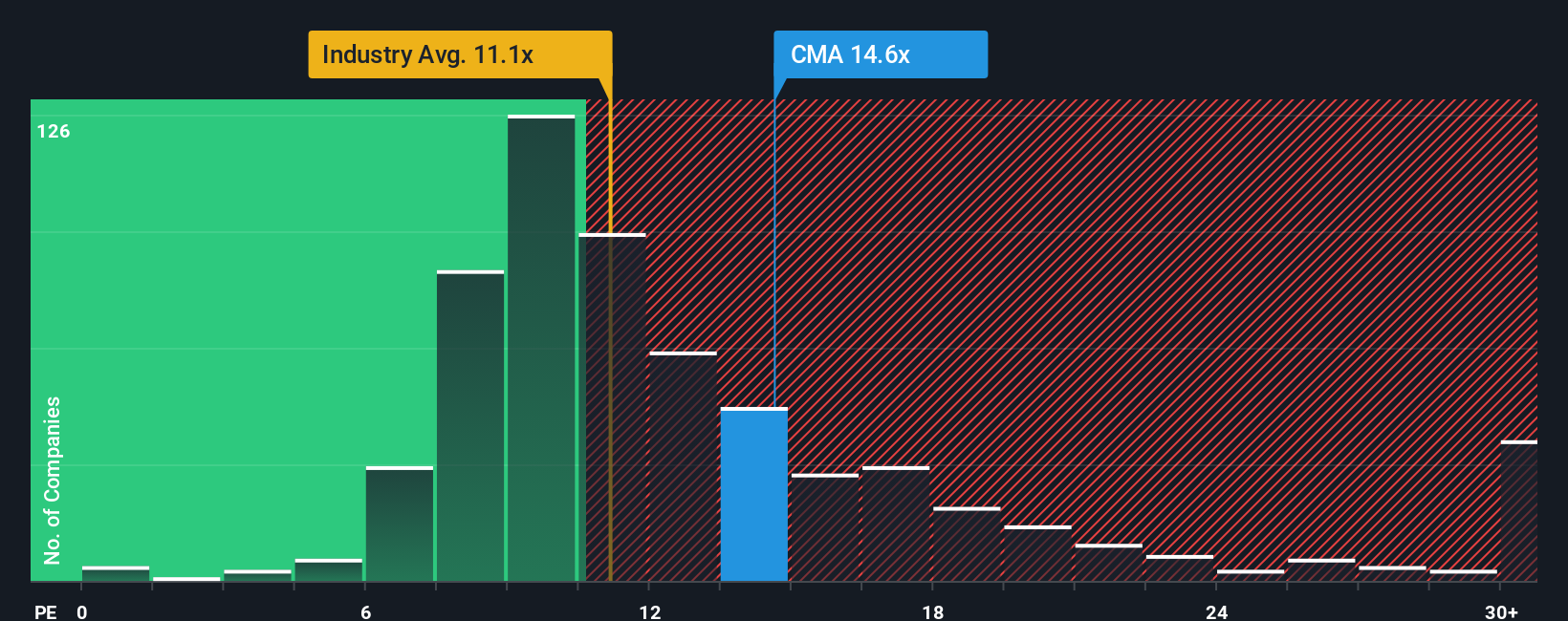

While our first approach points to Comerica trading below its estimated fair value, a look at its price-to-earnings ratio tells a different story. Comerica's P/E of 14.5x is noticeably higher than both its industry average (11.1x) and peer group (13.5x), and also above its fair ratio of 11.1x. This suggests investors are paying a premium, potentially reflecting optimism about the merger but also increasing valuation risk if growth falls short. What if the market adjusts down to the fair ratio? In this scenario, further upside could be limited.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Comerica Narrative

If you’d rather draw your own conclusions or take a deeper dive into the data, you can build your own narrative in just a few minutes: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Comerica.

Looking for More Investment Ideas?

Smart investors know there is always another opportunity around the corner. Use the Simply Wall Street Screener now to find standout stocks you might be missing.

- Capture reliable income potential by checking out these 17 dividend stocks with yields > 3% offering yields above 3 percent. This approach can be useful for building a resilient portfolio.

- Leap ahead of trends with these 25 AI penny stocks which are at the forefront of artificial intelligence innovation and industry disruption.

- Capitalize on deep market value by reviewing these 861 undervalued stocks based on cash flows which are trading below their intrinsic worth based on strong cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMA

Comerica

Provides financial services in the United States, Canada, and Mexico.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives