- United States

- /

- Banks

- /

- NYSE:BOH

Did Strong Q3 Earnings and CFO Transition Just Shift Bank of Hawaii's (BOH) Investment Narrative?

Reviewed by Sasha Jovanovic

- Bank of Hawaii Corporation recently reported stronger third-quarter results, with net interest income rising to US$136.68 million and net income reaching US$53.35 million for the period ended September 30, 2025.

- Alongside these earnings, the bank announced an affirmed quarterly dividend and steady credit quality, even as a significant CFO leadership transition may introduce short-term execution risk.

- We'll explore how Bank of Hawaii's improved net income and interest margins could influence its investment narrative and future outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Bank of Hawaii Investment Narrative Recap

To be a shareholder in Bank of Hawaii, you need to believe in the enduring economic resilience and demographic trends in Hawaii supporting stable banking demand, even as geographic concentration poses ongoing risk. The latest news, including robust third-quarter earnings, steady dividends, and no new share buybacks, has not changed the most important catalyst (net interest margin growth) or the biggest risk (local market exposure and leadership transition); any impact from recent events appears immaterial for now.

Of the recent developments, the maintenance of net loan and lease charge-offs at a low level in the third quarter stands out. This consistency in credit quality, despite the management changes, lends support to the catalyst of stable asset quality and earnings, but it also draws focus to the bank’s vulnerability should Hawaii’s local economy face future disruptions.

Yet, even with these strengths, investors should be aware that the concentration risk tied to Hawaii’s unique economic profile means...

Read the full narrative on Bank of Hawaii (it's free!)

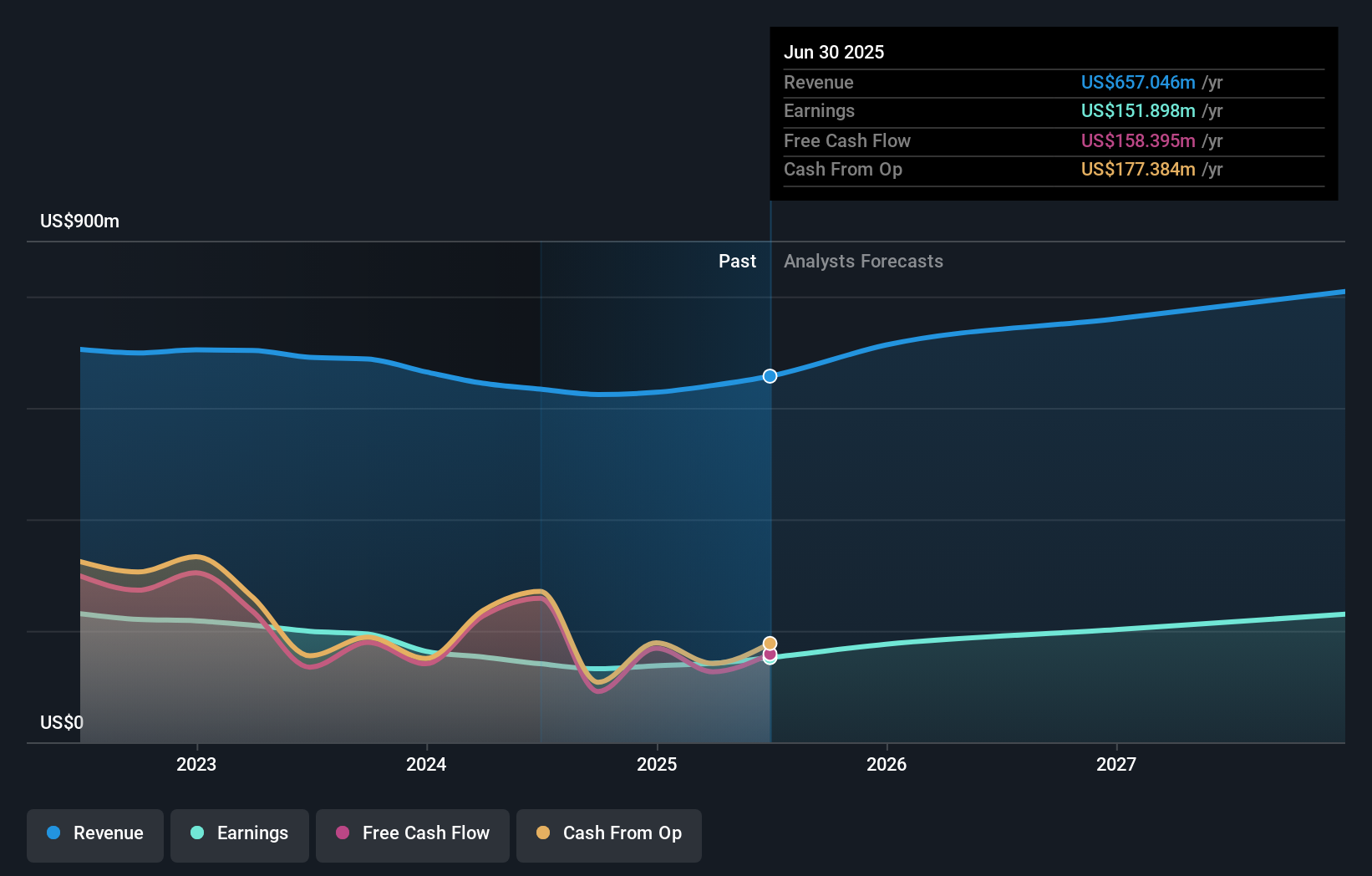

Bank of Hawaii's forecast projects $850.6 million in revenue and $251.7 million in earnings by 2028. This implies a 9.0% annual revenue growth rate and an increase in earnings of about $99.8 million from current earnings of $151.9 million.

Uncover how Bank of Hawaii's forecasts yield a $70.50 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span from US$70.50 to over US$106,031, showing perspectives from two private investors. This diverges sharply as geographic concentration and local risks continue to frame the bank’s outlook, inviting you to review how varied opinions shape overall sentiment.

Explore 2 other fair value estimates on Bank of Hawaii - why the stock might be a potential multi-bagger!

Build Your Own Bank of Hawaii Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank of Hawaii research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Bank of Hawaii research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank of Hawaii's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Hawaii might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOH

Bank of Hawaii

Operates as the bank holding company for Bank of Hawaii that provides various financial products and services in Hawaii, Guam, and other Pacific Islands.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives