- United States

- /

- Banks

- /

- NYSE:BOH

Bank of Hawaii (BOH): Assessing Valuation on Strong Q3 Earnings and Steady Dividend

Reviewed by Simply Wall St

Bank of Hawaii (BOH) just released its third quarter earnings, revealing a clear uptick in both net interest income and net income compared to last year. The board also maintained its quarterly dividend.

See our latest analysis for Bank of Hawaii.

Bank of Hawaii’s most recent quarterly results and steady dividend provided a welcome boost for investor sentiment and may help to explain the stock’s gradual rebound in recent months. While the share price slipped earlier in the year, the latest earnings momentum has contributed to a 3.8% gain over the past 90 days, but the one-year total shareholder return still sits at -12.1%, a reminder that meaningful recovery will take time.

With banks showing fresh signs of resilience, now could be the perfect moment to broaden your watchlist and discover fast growing stocks with high insider ownership.

With Bank of Hawaii trading at a discount to analyst targets and showing solid financial momentum, the real question is whether shares are now undervalued, or if the recent gains already reflect future growth prospects.

Most Popular Narrative: 6.9% Undervalued

The narrative’s fair value calculation places Bank of Hawaii’s shares meaningfully above their last close. This suggests room for upside if its projections play out. Here is one of the core drivers behind that outlook.

Ongoing digital transformation and sustained investments in digital banking platforms are expected to enhance operational efficiency, improve customer acquisition and retention, and support controlled expense growth, boosting long-term net margins.

Want to know why growth expectations are riding high? The foundation of this narrative is built on bold productivity gains, powered by technology and shifting customer habits. Curious which future profit levers analysts believe will lift earnings and justify that higher price? Unlock the details and see what numbers are moving the market’s target.

Result: Fair Value of $70.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, as Bank of Hawaii’s concentration in local real estate and reliance on Hawaiian markets could increase the impact of economic downturns.

Find out about the key risks to this Bank of Hawaii narrative.

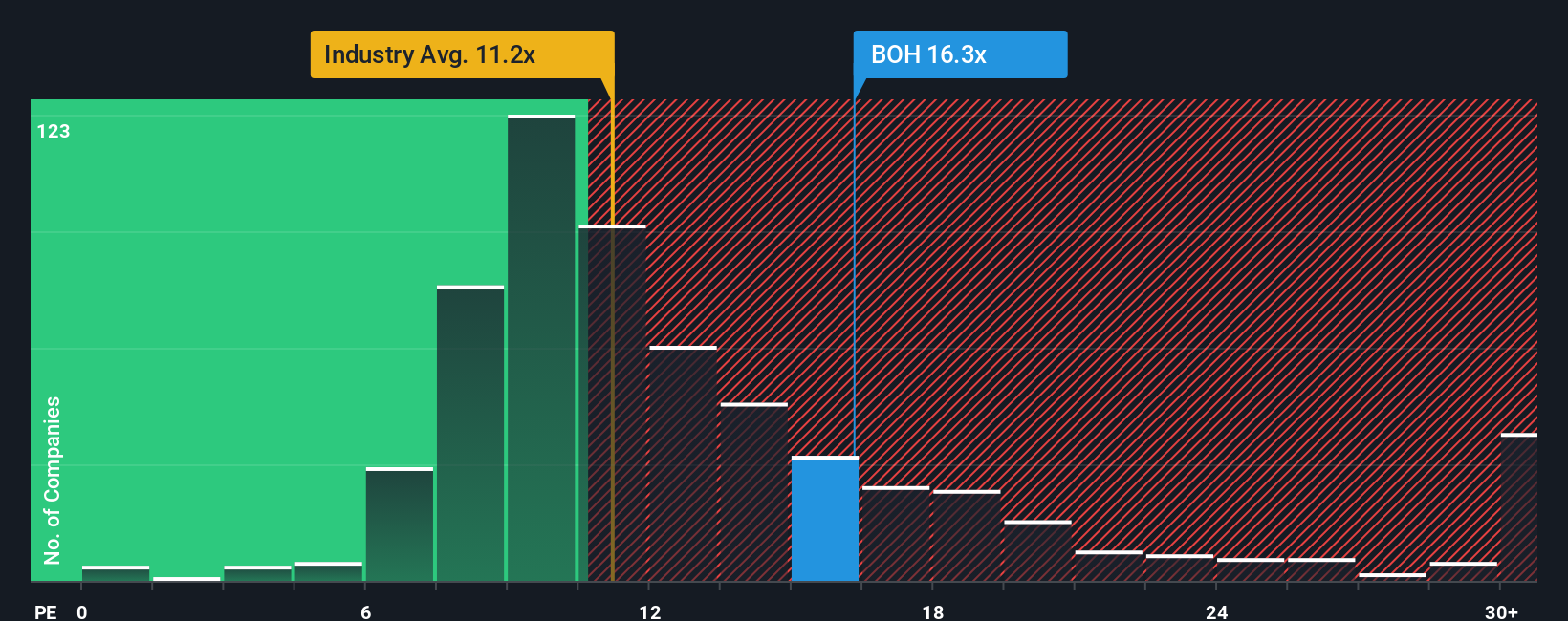

Another View: Looking at Market Ratios

While the narrative-driven valuation describes Bank of Hawaii as undervalued, a look at typical market comparisons paints a different picture. Its price-to-earnings ratio is currently 16x, higher than both the US Banks industry average of 11x and the fair ratio estimate of 12.8x. This suggests the stock may be priced richer than its peers. Does this mean today's optimism is already baked in, or is there still room to run?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bank of Hawaii Narrative

If you have a different perspective or want to dig into the figures yourself, you can shape your own Bank of Hawaii outlook in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Bank of Hawaii.

Ready for More Smart Investment Moves?

Spotting your next opportunity starts now. Expand your horizons and boost your portfolio with intelligent picks designed to match your ambition and give you an advantage before everyone else takes notice.

- Accelerate your search for market momentum by checking out these 870 undervalued stocks based on cash flows, which could be trading below their true potential.

- Seize long-term growth with these 16 dividend stocks with yields > 3%, offering robust yields and steady income streams to strengthen your returns.

- Tap into tomorrow’s breakthroughs by exploring these 24 AI penny stocks, reshaping industries with the latest advancements in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Hawaii might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOH

Bank of Hawaii

Operates as the bank holding company for Bank of Hawaii that provides various financial products and services in Hawaii, Guam, and other Pacific Islands.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives