- United States

- /

- Banks

- /

- NYSE:BKU

How Investors May Respond To BankUnited (BKU) Earnings Growth and Rising Net Interest Income

Reviewed by Sasha Jovanovic

- BankUnited, Inc. reported its third quarter 2025 results, highlighting year-over-year increases in net interest income to US$250.11 million and net income to US$71.85 million, with basic earnings per share from continuing operations rising to US$0.96 from US$0.82 a year ago.

- Despite reporting higher net charge-offs for the quarter, the company's operational performance showed strengthened earnings and margin growth compared to the previous year.

- We'll examine how BankUnited's increased net interest income and improved earnings may influence its overall investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

BankUnited Investment Narrative Recap

To be a shareholder in BankUnited, you need to see long-term value in its core lending platform, deposit growth in high-potential regions, and its ability to manage credit quality amid changing market dynamics. The recent quarterly results appear supportive of the main short-term catalyst, continued growth in net interest income and margins, but higher net charge-offs are a reminder that rising credit costs, especially in commercial real estate, remain a key risk. Overall, the fundamental narrative around margin expansion and profitable growth looks intact for now, while credit quality trends warrant close monitoring.

Among recent company updates, the declaration of a US$0.31 per share quarterly dividend remains most relevant, signaling management’s continued confidence and commitment to shareholder returns even as charge-offs tick higher. For investors focused on catalysts, ongoing dividend payments reinforce the company’s efforts to balance growth with returning capital, highlighting its income appeal and financial resilience in the face of sector uncertainties.

By contrast, investors should be aware of the persistent increases in net charge-offs and how this could signal...

Read the full narrative on BankUnited (it's free!)

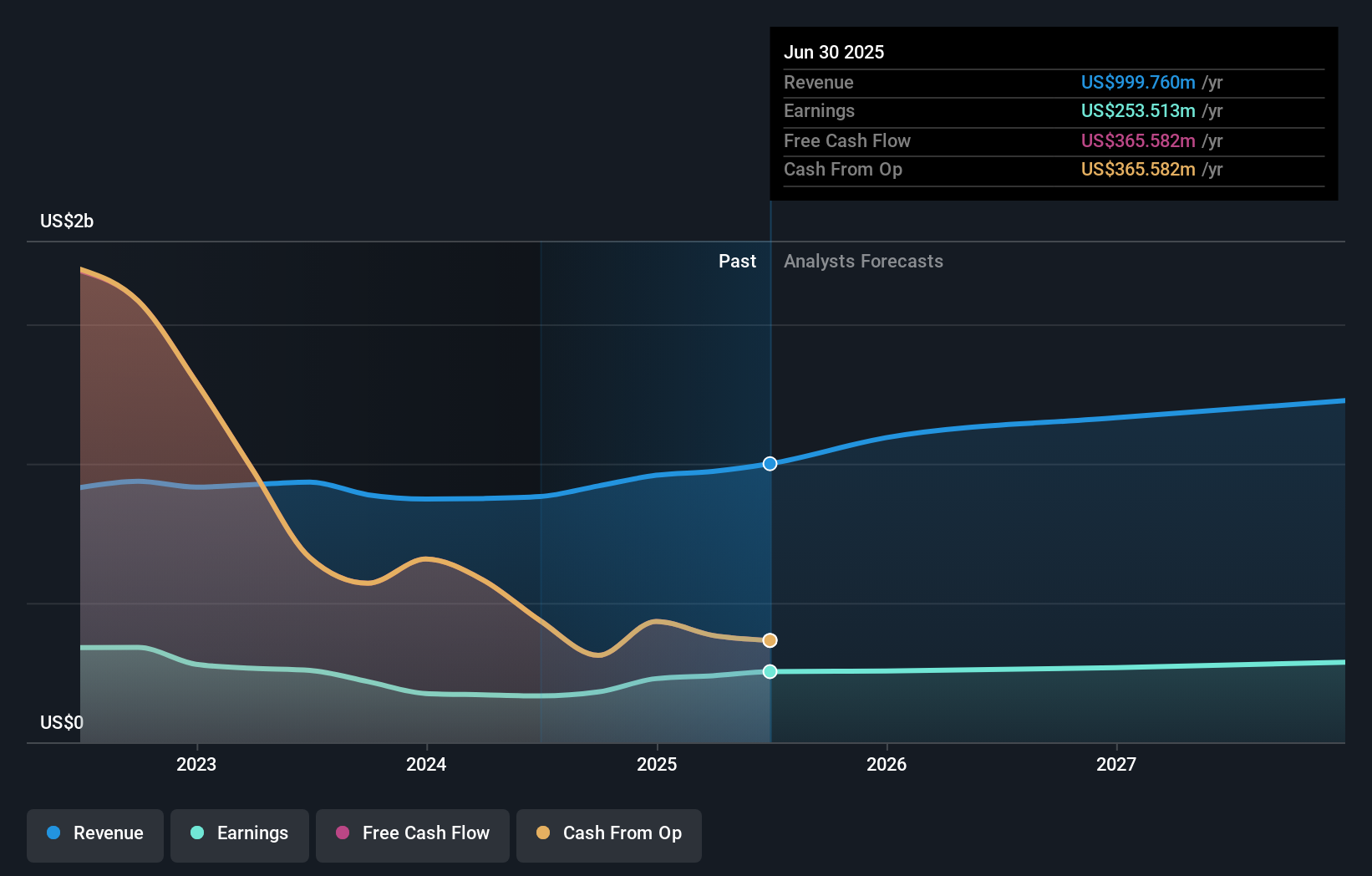

BankUnited's outlook calls for $1.3 billion in revenue and $291.8 million in earnings by 2028. This projection is based on an 8.9% annual revenue growth rate and a $38.3 million increase in earnings from the current $253.5 million.

Uncover how BankUnited's forecasts yield a $42.02 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate from the Simply Wall St Community puts BankUnited shares at US$42.02. Credit quality risks, especially from commercial real estate exposure, are top of mind and could influence the company’s future performance; compare several viewpoints for a fuller picture.

Explore another fair value estimate on BankUnited - why the stock might be worth just $42.02!

Build Your Own BankUnited Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BankUnited research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BankUnited research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BankUnited's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BankUnited might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKU

BankUnited

Operates as the bank holding company for BankUnited, a national banking association that provides a range of banking services in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives