- United States

- /

- Banks

- /

- NYSE:BBT

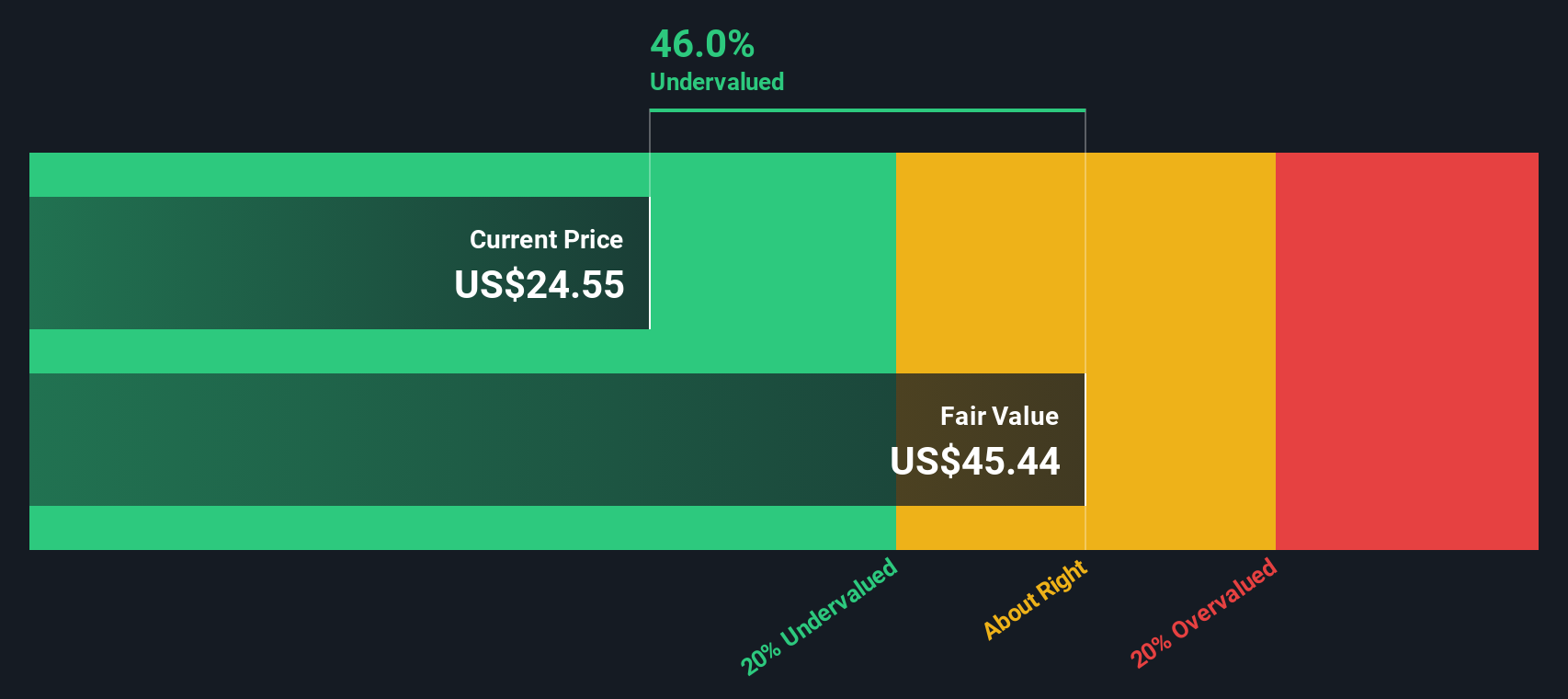

Beacon Financial (BBT): Is the Stock Undervalued After Recent Modest Share Price Rebound?

Reviewed by Simply Wall St

See our latest analysis for Beacon Financial.

Beacon Financial’s share price has rebounded slightly this month, but the broader trend points to momentum fading, with a 1.67% share price return over the past 30 days and a year-to-date decline near 13%. This pattern hints at cautious optimism among investors, as they weigh both recent upticks and longer-term headwinds.

If today’s modest gain has you wondering what else could be on the move, it might be time to expand your search and uncover fast growing stocks with high insider ownership

With Beacon Financial showing only a modest rebound despite solid revenue and net income growth, the key question now is whether shares are undervalued or if the market has already priced in expected improvements. Is this a genuine buying opportunity, or is future growth already reflected in the stock price?

Price-to-Book Ratio of 0.9x: Is it justified?

Beacon Financial trades at a price-to-book ratio of 0.9x, which is just below both its peer average and the broader US Banks industry average of 1x. With the stock closing at $24.34, investors are getting shares at a slight discount to book value compared to competitors.

The price-to-book ratio compares a company’s market price to its book value. This reflects how much investors are willing to pay for each dollar of net assets. For banks, this multiple is important given the tangible nature of their balance sheets.

A ratio below the industry average may suggest the market is cautious about Beacon Financial’s future profitability or asset quality. It could also represent an opportunity if the company’s fundamentals improve, but caution is warranted in light of recent profit margin and return on equity trends.

Beacon Financial’s price-to-book ratio stands out as compelling compared to the industry. However, it also signals that the market has reservations about future growth and profitability. There is no fair ratio available for further context, so the discount remains as the immediate reference point for value.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 0.9x (UNDERVALUED)

However, persistent declines in share price this year, along with uncertainty about future profitability, could signal caution for investors weighing potential upside.

Find out about the key risks to this Beacon Financial narrative.

Another View: What Does the SWS DCF Model Say?

While the price-to-book ratio paints Beacon Financial as undervalued compared to industry averages, the SWS DCF model offers a different perspective. Based on our DCF analysis, Beacon Financial's current share price of $24.34 is actually higher than our estimated fair value of $19.31, suggesting the stock may be overvalued. This contrast raises an important question for investors: which measure should be trusted more for determining true value?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Beacon Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Beacon Financial Narrative

If you want to interpret the numbers yourself or challenge these conclusions, you can easily craft your own perspective in just a few minutes. Do it your way

A great starting point for your Beacon Financial research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait on the sidelines while smarter investors seize tomorrow’s best opportunities. Use the Simply Wall Street Screener to unlock investment themes you could be missing right now.

- Power your portfolio with high yields by checking out these 22 dividend stocks with yields > 3% which offers above-average income potential and steady cash flows.

- Spot emerging trends in artificial intelligence by exploring these 26 AI penny stocks with strong momentum and market disruption potential.

- Catch the wave of growth in rapidly advancing technology and discover these 28 quantum computing stocks that are shaping the next era of computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beacon Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBT

Beacon Financial

Operates as the bank holding company for Beacon Bank & Trust that provides various banking solutions in New England and New York, the United States.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives