- United States

- /

- Banks

- /

- NYSE:BANC

Banc of California (BANC): Exploring Valuation After Strong Q3 Results and New Dividend Announcement

Reviewed by Simply Wall St

Banc of California (BANC) just released third-quarter financials that topped expectations, and the board has approved dividends for both common and preferred shareholders. These fresh updates could influence how investors view the bank’s stock as the year comes to a close.

See our latest analysis for Banc of California.

Banc of California’s third-quarter results and fresh dividend declarations have helped sustain positive investor sentiment, as seen in the recent 90-day share price return of 18.3%. Although momentum has cooled slightly this month, the total shareholder return over the past year remains in positive territory, indicating that confidence in its steady outlook persists.

If you’re looking to expand your search beyond the banking sector, now is a great time to explore fast growing stocks with high insider ownership.

With shares still trading at around a 20% discount to analyst price targets and with annual revenue and net income growth both trending upward, the real question is whether Banc of California is undervalued or if the market has already factored in its future gains.

Most Popular Narrative: 15.7% Undervalued

With Banc of California last closing at $17.06 and the most popular narrative assigning a fair value of $20.23, there is a notable gap that could reshape investor expectations if the story plays out as projected.

The ongoing shift to digital financial services across all demographics is accelerating Banc of California's ability to attract new customers, reduce its customer acquisition and operating costs, and expand core deposit growth. This, in turn, is driving improved efficiency, net interest margins, and sustained earnings growth.

What’s fueling this price gap? The narrative points to a bold pivot in technology and a new approach to customer growth, paired with ambitious profit targets and a future multiple that rivals industry leaders. Think you know what’s behind the upbeat outlook? The specific assumptions and forecasts at the heart of this valuation might just surprise you.

Result: Fair Value of $20.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant reliance on Southern California commercial real estate and fierce deposit competition could quickly disrupt Banc of California’s current growth trajectory.

Find out about the key risks to this Banc of California narrative.

Another View: Is the Market Pricing In Too Much?

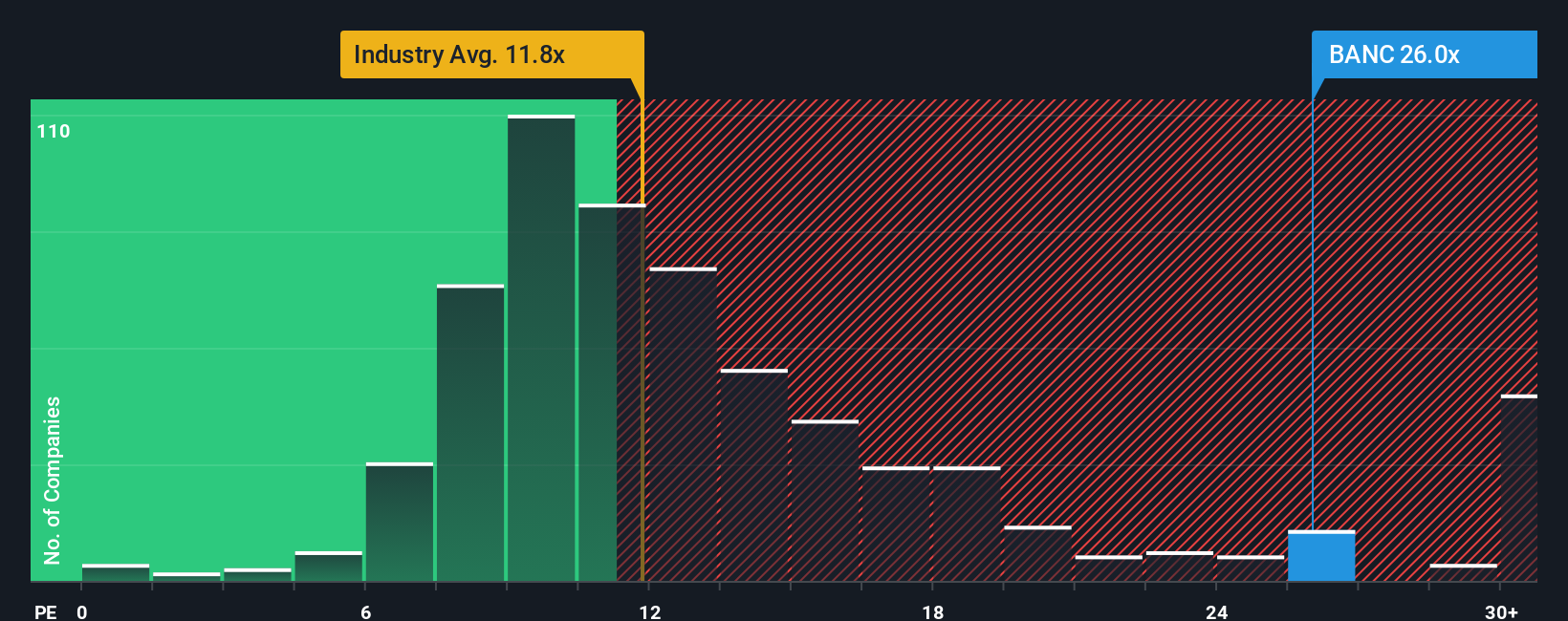

Looking through the lens of price-to-earnings, Banc of California trades at 15.7x, which is higher than both its industry average of 11x and peer average of 14x. Compared to its fair ratio of 15.4x, the stock appears slightly expensive. This raises questions about how much optimism is already built into the price.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Banc of California Narrative

If you see things differently or want a deeper look into the numbers, you can craft your own narrative and gain fresh insights in just a few minutes. Do it your way.

A great starting point for your Banc of California research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Take action now to expand your portfolio with unique ideas you can trust. Don’t miss your chance to uncover what’s next in high-potential markets.

- Tap into new growth by following these 25 AI penny stocks that are powering the latest wave in intelligent automation, machine learning, and digital transformation.

- Maximize your yield by enhancing your search with these 20 dividend stocks with yields > 3% offering strong returns and attractive, consistent income potential for long-term investors.

- Capitalize on the under-the-radar advantage: gain early access to value by checking out these 836 undervalued stocks based on cash flows before broader market sentiment catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banc of California might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BANC

Banc of California

Operates as the bank holding company for Banc of California that provides various banking products and services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives