- United States

- /

- Banks

- /

- NYSE:BAC

Is Bank of America Fairly Priced Amid 18.5% Year-to-Date Rally and Digital Banking Push?

Reviewed by Bailey Pemberton

- Wondering if Bank of America is a hidden gem or fully priced in? You're not alone; many investors are digging into its numbers to see if there's untapped value.

- The stock has moved up 1.6% over the past week and is now sitting at $52.48, contributing to a solid 18.5% gain so far this year.

- Recent headlines spotlighted Bank of America's initiatives in digital banking and renewed focus on loan growth, both of which have kept investors' attention fixed on the stock. Alongside sector-wide optimism, these factors have added fresh momentum and discussion around its outlook.

- Right now, Bank of America clocks a 2 out of 6 on our valuation check. Clearly, there's more to uncover about whether it's a bargain or not. Next up, we'll break down those valuation numbers, then show you an even sharper way to think about what Bank of America is truly worth.

Bank of America scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Bank of America Excess Returns Analysis

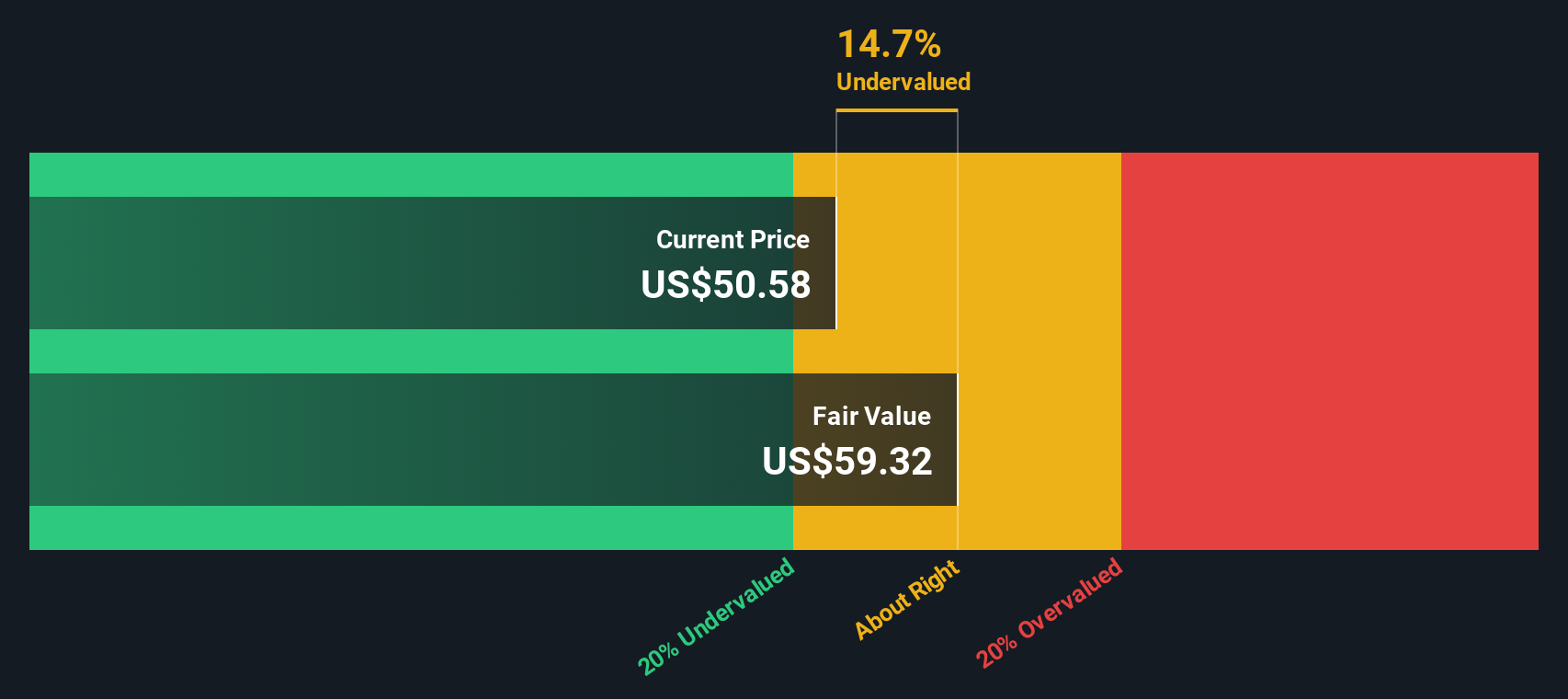

The Excess Returns valuation model evaluates how effectively Bank of America generates returns on its invested capital, beyond the basic cost of equity. By examining how much value is produced above investors’ required return, this approach helps judge whether management is creating economic profit for shareholders over time.

Key figures from the analysis include a Book Value of $37.95 per share and a Stable EPS of $4.57 per share, based on consensus estimates from 11 analysts. The Cost of Equity is estimated at $3.68 per share, meaning Bank of America delivers an Excess Return of $0.89 per share on average. This is underpinned by an average Return on Equity of 11.16%, indicating efficient capital use compared to sector benchmarks. The forecasted Stable Book Value, derived from 14 analysts, stands at $40.94 per share and offers a sense of consistent, long-term asset strength.

Altogether, the Excess Returns methodology produces an estimated intrinsic share value of $56.47. With the current stock price at $52.48, Bank of America trades at a 7.1% discount to this valuation. This suggests its pricing is nearly aligned with its underlying performance and prospects.

Result: ABOUT RIGHT

Bank of America is fairly valued according to our Excess Returns, but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

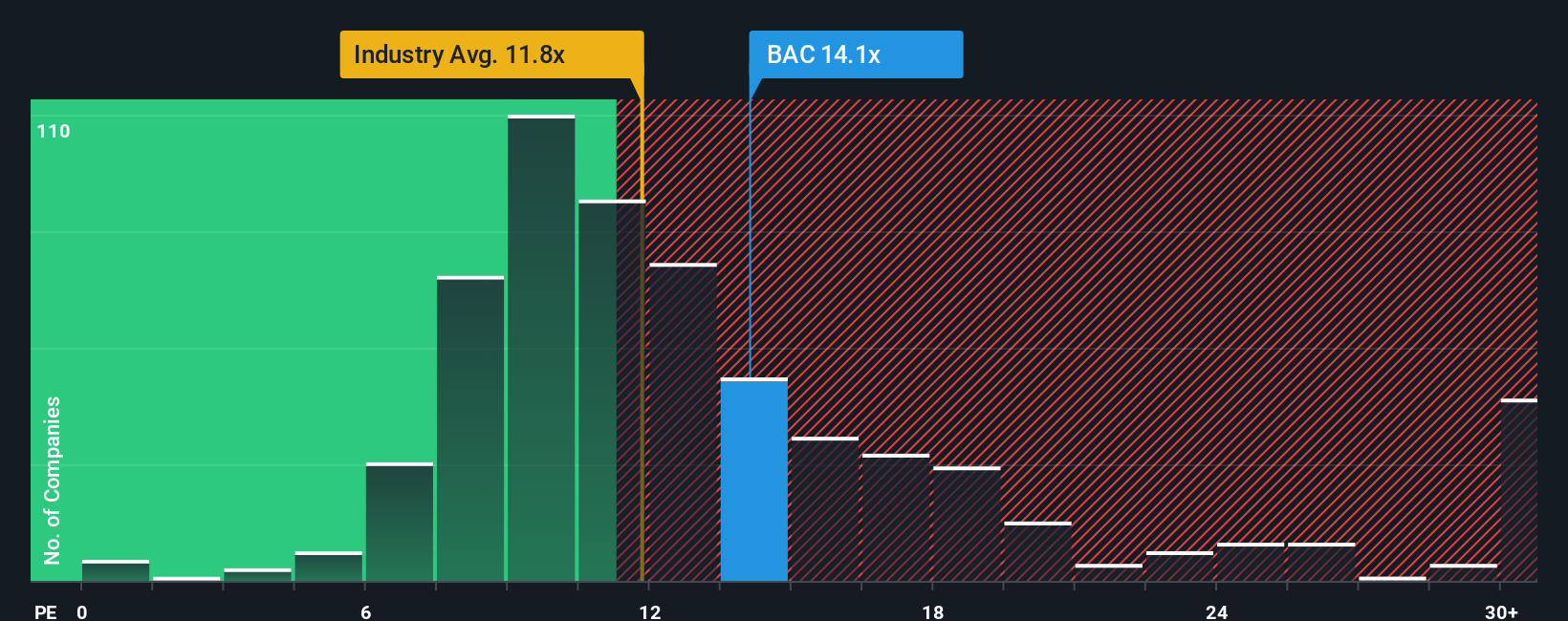

Approach 2: Bank of America Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for established, profitable companies like Bank of America, as it reflects how much investors are willing to pay for each dollar of current earnings. A company’s PE ratio not only signals investor sentiment, but can also be shaped by expectations of future earnings growth and the level of risk in its business model. Typically, faster-growing and lower-risk companies command a higher “normal” or “fair” PE multiple, while slower-growing or riskier firms trade at lower ratios.

Bank of America currently trades at a PE ratio of 13.56x. This is slightly above the average for its banking peers (13.37x) and noticeably higher than the broader industry average (11.42x). However, such comparisons can sometimes be superficial because they do not fully account for company-specific strengths or challenges. This is where the Fair Ratio comes in. Simply Wall St’s proprietary metric tailors the ideal PE multiple for Bank of America’s unique combination of earnings growth, profitability, industry position, scale, and risk factors. For Bank of America, the Fair Ratio is calculated at 14.73x, providing a more precise benchmark than generic peer or industry averages.

Comparing the actual PE ratio (13.56x) to the Fair Ratio (14.73x), Bank of America’s current valuation looks almost perfectly aligned with its underlying fundamentals and outlook. The narrow gap suggests the recent share price already reflects the company’s financial health and growth prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1437 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bank of America Narrative

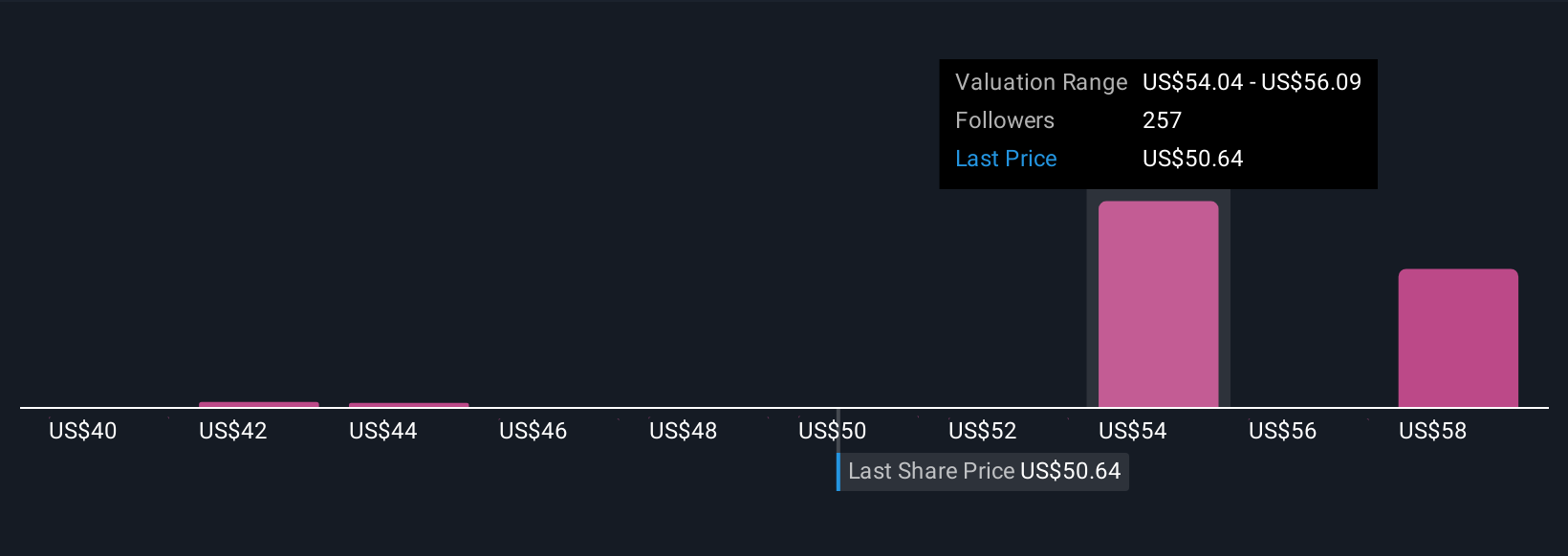

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal story and perspective about a company’s future, where you connect the details behind the numbers, such as expectations around future revenue, earnings, and margins, with a financial forecast and a fair value. Narratives help link a company’s story and outlook to its financial model, offering a clear path from “what you believe” to “how much the company is worth.”

On Simply Wall St’s Community page, millions of investors use Narratives as an accessible toolkit for making smarter decisions. All you do is record your assumptions, and in return you’ll see a dynamic fair value estimate based on your story (not just market trends). As new information like earnings or news is released, your Narrative updates automatically, letting you see in real time if your thesis still holds or needs a refresh. Narratives make it simple to compare your estimated Fair Value with the current share price so you can decide if it’s time to buy or sell. For example, some investors think Bank of America is worth $59 based on strong digital growth, while others see the fair value closer to $43 given concerns about economic risk. Your Narrative can reflect whichever view makes sense to you.

For Bank of America, we'll make it really easy for you with previews of two leading Bank of America Narratives:

Fair Value: $58.94

Undervalued by approximately 11% ((58.94 - 52.48)/58.94 ≈ 0.11)

Expected Revenue Growth: 7.5%

- Analysts point to robust digital investment, AI-driven efficiencies, and strategic asset management as drivers for future profit and revenue growth.

- Forecasts expect steady earnings increases and declining share count, with a consensus price target just above the current share price. This indicates near fair valuation.

- Main risks include economic volatility, policy changes, rising litigation costs, and heightened competition for deposits. These factors could challenge profit margins and growth.

Fair Value: $43.34

Overvalued by approximately 21% ((52.48 - 43.34)/43.34 ≈ 0.21)

Expected Revenue Growth: 10.6%

- While Bank of America demonstrates resilience and steady growth, sector-wide vulnerabilities such as rapid rate changes and regulatory shifts pose ongoing risks.

- Warren Buffett’s gradual stake reduction is monitored as a sentiment signal, while strong loan growth and rising net interest income are potential positives.

- Bear risks focus on potential economic downturn, regulatory tightening, and continued share sales by major holders, which could possibly limit upside for BAC’s stock price.

Do you think there's more to the story for Bank of America? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAC

Bank of America

Through its subsidiaries, provides various financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success