- United States

- /

- Banks

- /

- NYSE:AUB

Atlantic Union Bankshares (AUB): Assessing Valuation Following Dividend Boost and Management Confidence

Reviewed by Simply Wall St

Atlantic Union Bankshares (AUB) just declared a higher quarterly dividend, raising it by 8.8% to $0.37 per share. This move reflects management’s confidence in the company’s financial strength and ongoing focus on rewarding shareholders.

See our latest analysis for Atlantic Union Bankshares.

Shares of Atlantic Union Bankshares have lost momentum over the past year, with a double-digit share price drop since January and a 1-year total shareholder return of -21.5%. This signals that investors remain cautious, even as the company posts robust dividend growth and improved earnings.

If you’re looking to expand your watchlist beyond the banking sector, now’s a great opportunity to discover fast growing stocks with high insider ownership.

With shares still trading well below analyst price targets and the company posting strong growth in both revenue and net income, investors might wonder if Atlantic Union Bankshares is undervalued or if the market is already factoring in future improvement.

Most Popular Narrative: 21.2% Undervalued

The narrative’s fair value comes in well above the recent share price, highlighting where analyst optimism significantly diverges from the market’s caution.

The successful integration of Sandy Spring Bank and the sale of $2 billion in commercial real estate loans have reduced risk concentrations, freed up lending capacity, and expanded the company's customer base in markets with the lowest unemployment nationally. This supports better credit performance, new fee income, and potential future earnings upside.

What’s the secret behind this aggressive fair value? It’s not just branch expansion or digital banking. The core of the narrative is a dramatic jump in future profit margins and earnings growth, paired with a bold valuation multiple. The numbers driving this story might surprise even seasoned bank investors.

Result: Fair Value of $41.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if economic challenges affect its core Mid-Atlantic markets or digital innovation falls short, projected growth and valuation could quickly come under pressure.

Find out about the key risks to this Atlantic Union Bankshares narrative.

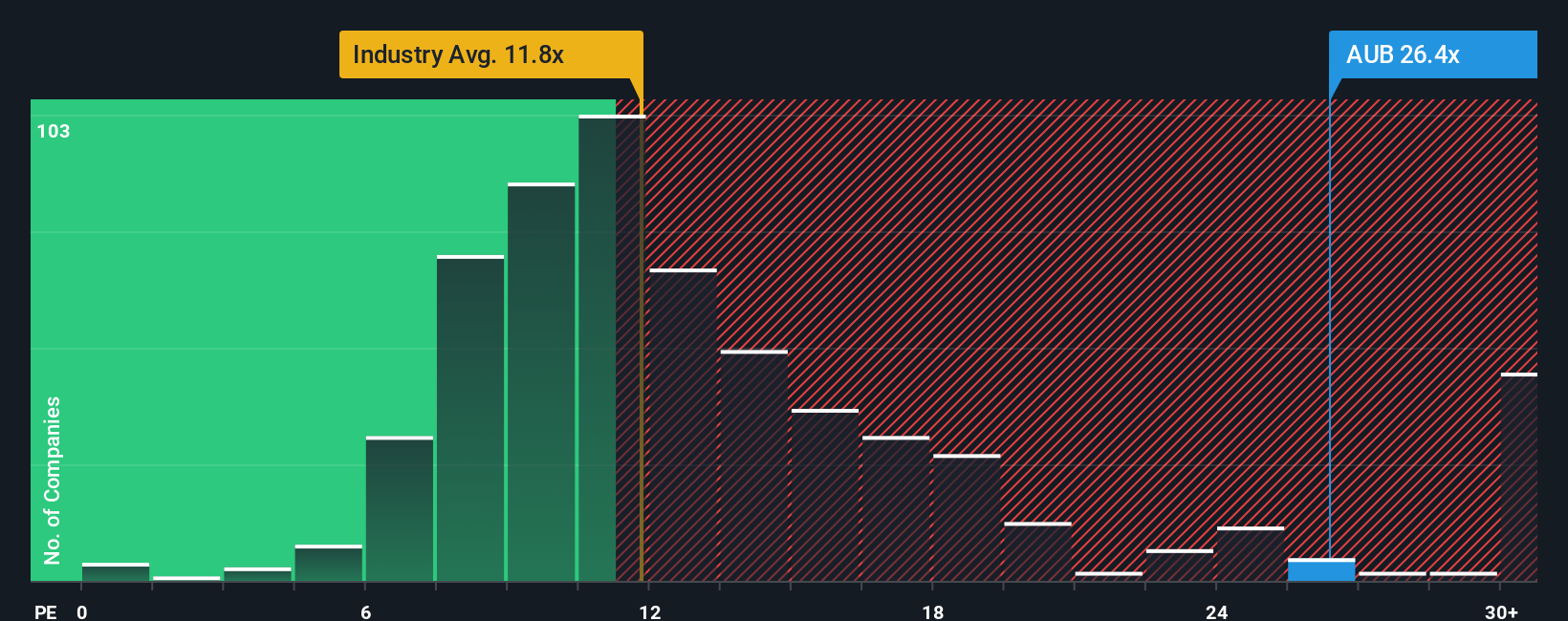

Another View: Market Multiples Tell a Different Story

While a fair value model suggests Atlantic Union Bankshares is undervalued, comparing its price-to-earnings ratio of 22.5x to the US Banks industry average of 11.1x and a fair ratio of 20x puts it at a noticeable premium. This gap could mean elevated valuation risk if growth fails to meet high expectations. So, which outlook will markets follow?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Atlantic Union Bankshares Narrative

If you see things differently or want to analyze the numbers firsthand, you can easily shape your own perspective in just a few minutes, Do it your way.

A great starting point for your Atlantic Union Bankshares research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors constantly open doors to new sectors and trends. Give yourself an edge by checking out unique opportunities beyond banking using these tailored stock lists:

- Capitalize on the rise of digital medicine by scanning these 32 healthcare AI stocks for companies implementing game-changing AI in healthcare.

- Catch the next market momentum with these 881 undervalued stocks based on cash flows and spot stocks trading below their true worth before the crowd notices.

- Seize growth potential in an evolving tech world by reviewing these 82 cryptocurrency and blockchain stocks featuring businesses building the future of crypto and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AUB

Atlantic Union Bankshares

Operates as the bank holding company for Atlantic Union Bank that provides banking and related financial products and services to consumers and businesses in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives