- United States

- /

- Banks

- /

- NasdaqGS:WSFS

WSFS Financial (WSFS) Valuation: Are Shares Undervalued After Recent Momentum?

Reviewed by Simply Wall St

WSFS Financial (WSFS) shares have caught some attention recently, prompting investors to weigh the company’s steady performance against broader market trends. Its stock has ticked higher in the past month, outpacing recent sector moves.

See our latest analysis for WSFS Financial.

WSFS Financial’s $55.65 share price marks a steady climb over the past month, up nearly 5 percent. Year-to-date returns have outpaced much of its sector, though the 1-year total shareholder return remains in negative territory. Momentum has picked up lately, which suggests cautious optimism is building around the bank’s recent moves. However, its long-term trajectory still rewards patient investors.

If you’re curious to see what else is capturing investors’ attention right now, it could be the perfect time to broaden your scope and discover fast growing stocks with high insider ownership

While recent momentum hints at renewed investor interest, the real question is whether WSFS Financial’s current valuation presents an opportunity to buy in before further upside, or if the market has already factored in its growth prospects.

Most Popular Narrative: 13.7% Undervalued

With WSFS Financial closing at $55.65, the most widely followed narrative sees fair value much higher, spotlighting analyst confidence in future growth. This sets the stage for a pivotal assumption about where the bank’s competitive edge might come from as it evolves.

"The company is proactively investing in digital transformation and technology (enhanced online/mobile banking platforms, automation, and customer experience initiatives), which is expected to reduce operating expenses, improve efficiency ratio, and expand net margins over time as digital adoption rises across all customer segments."

Want to know what bold financial moves support this narrative's higher target? Hidden within are bullish assumptions around future revenues, slimmer margins, and ambitious cost reductions. See what’s driving the estimates that got Wall Street talking.

Result: Fair Value of $64.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing integration risks from acquisitions and reliance on Mid-Atlantic markets could present challenges to the company’s projected steady growth and earnings stability.

Find out about the key risks to this WSFS Financial narrative.

Another View: Multiples Tell a Different Story

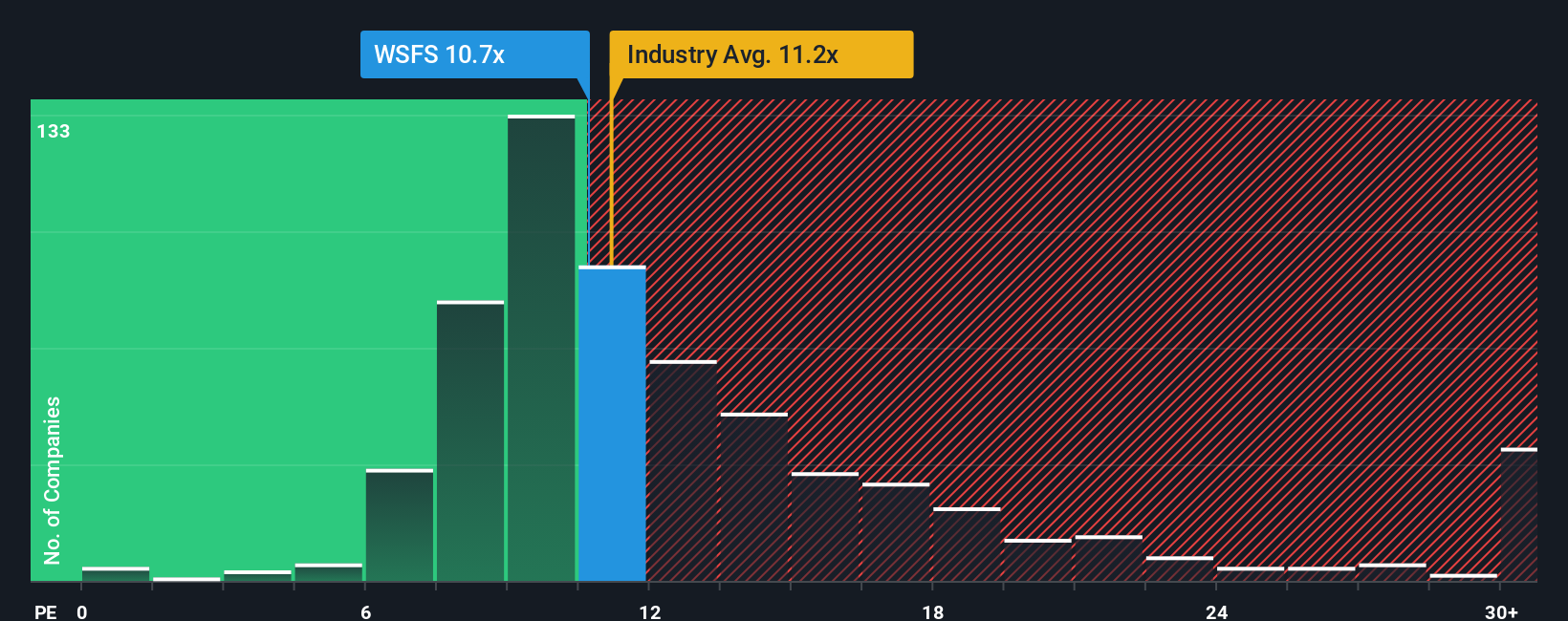

When we look at WSFS Financial’s valuation through earnings multiples, a more cautious picture emerges. The company trades at a 10.9x earnings ratio, just below the US Banks industry average of 11.2x and significantly lower than the peer average of 16.1x. However, this is slightly higher than its fair ratio of 10x, which signals some valuation risk if the market pivots toward this benchmark. Does this suggest that upside is limited, or are investors under-appreciating future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WSFS Financial Narrative

If you see things differently or simply want to draw your own conclusions from the numbers, you can pull together your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding WSFS Financial.

Looking for more investment ideas?

Don’t limit your strategy to just one stock. See what else is catching investors’ attention and unlock your chance to make smarter, diversified moves. Some of the most exciting trends are one click away:

- Capitalize on strong, high-yield opportunities by reviewing these 16 dividend stocks with yields > 3% that consistently outperform market averages for income-focused investors.

- Target rapid growth in tomorrow’s breakthrough fields by checking out these 26 AI penny stocks shaping the future of artificial intelligence innovation.

- Seize undervalued picks by scanning these 926 undervalued stocks based on cash flows that could offer substantial upside as the market re-rates hidden gems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WSFS Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WSFS

WSFS Financial

Operates as the savings and loan holding company for the Wilmington Savings Fund Society, FSB that provides various banking services in the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives