- United States

- /

- Banks

- /

- NasdaqGS:VLY

How Strong Q3 Results and Capital Actions at Valley National (VLY) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In the past week, Valley National Bancorp reported strong third quarter results with net interest income of US$446.22 million and net income of US$163.36 million, alongside the completion of a share repurchase program and lower net loan charge-offs compared to prior periods.

- An interesting aspect was the bank’s continued focus on operational discipline, improved asset quality, and technology enablement, supported by recent analyst upgrades and enhancements to its banking platforms through fintech collaboration.

- We'll explore how Valley's improved credit costs and strategic capital actions could influence its future investment outlook and risk profile.

We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Valley National Bancorp Investment Narrative Recap

To be a Valley National Bancorp shareholder, you need to believe in its ability to strengthen core deposit growth, improve asset quality, and drive competitive efficiency in a market where regional risks and commercial real estate exposures remain elevated. The bank’s latest quarter, which brought improved net interest income, lower charge-offs, and the completion of its share buyback, reinforces the near-term catalyst of operating leverage, while the most pressing risk, persistent commercial real estate headwinds, remains unchanged by these events.

Of the recent announcements, Valley’s fintech partnership with Infinant stands out. This move could help modernize banking platforms and bolster digital capabilities, directly supporting management’s focus on operational efficiency, a key driver in offsetting industry-wide pressures such as rising compliance costs and competition for deposits.

In contrast, investors should be cautious of how Valley’s regional commercial real estate concentration could impact future results if economic conditions shift...

Read the full narrative on Valley National Bancorp (it's free!)

Valley National Bancorp's outlook anticipates $2.5 billion in revenue and $807.5 million in earnings by 2028. This scenario assumes a 16.6% annual revenue growth rate and a $381.8 million increase in earnings from the current $425.7 million.

Uncover how Valley National Bancorp's forecasts yield a $12.73 fair value, a 17% upside to its current price.

Exploring Other Perspectives

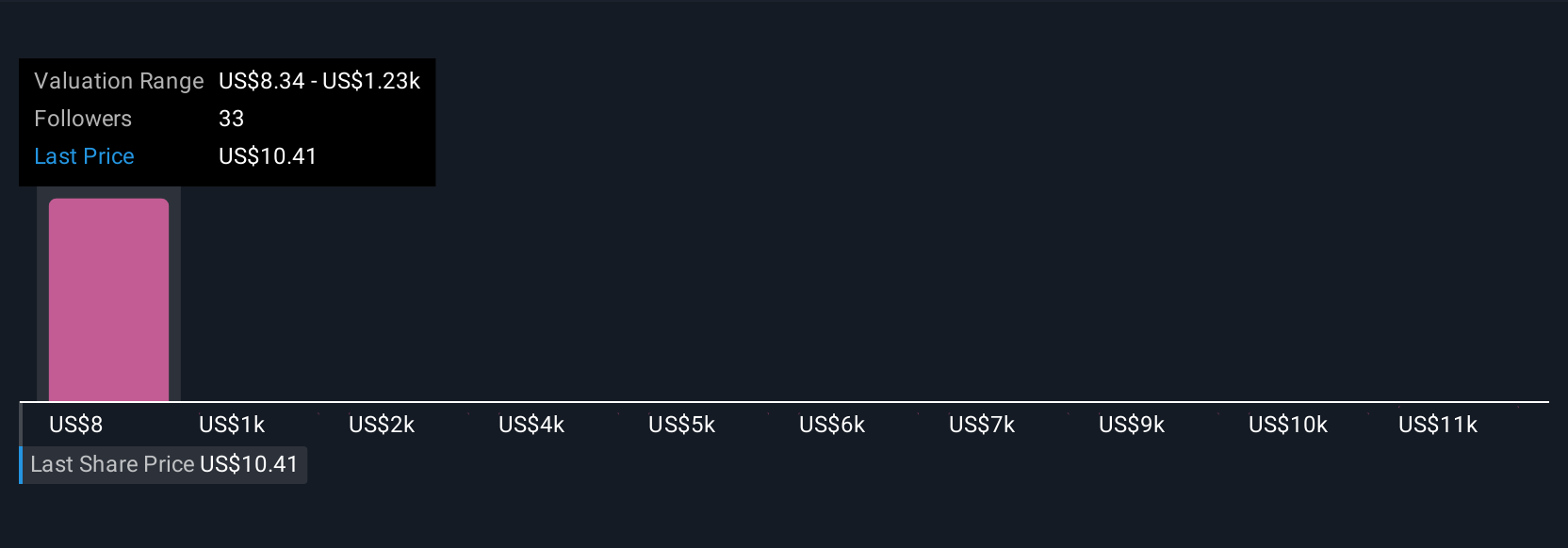

Private fair value opinions from the Simply Wall St Community span from US$12.73 to US$20.02, drawing on two individual forecasts. While many focus on forecast deposit and earnings growth, potential regional risks may have an outsized effect on performance. Explore these views and see why opinions can vary so widely.

Explore 2 other fair value estimates on Valley National Bancorp - why the stock might be worth just $12.73!

Build Your Own Valley National Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valley National Bancorp research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Valley National Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valley National Bancorp's overall financial health at a glance.

No Opportunity In Valley National Bancorp?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VLY

Valley National Bancorp

Operates as the holding company for Valley National Bank that provides various commercial, private banking, retail, insurance, and wealth management financial services products.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives