- United States

- /

- Banks

- /

- NasdaqGS:VLY

Has Valley National Bancorp’s 22.4% Rally in 2025 Left Further Value on the Table?

Reviewed by Bailey Pemberton

- Ever wondered if Valley National Bancorp is a hidden gem or just fairly priced right now? Let's dive into what the numbers are telling us about its true value.

- The stock has quietly climbed 22.4% year-to-date, with a 0.2% gain over the past month. This suggests shifting investor sentiment or growing optimism in the market.

- Notably, Valley National Bancorp's recent positive momentum has followed sector-wide discussions on regional bank stability and a renewed focus on loan growth. Increased analyst attention and broader industry news have pushed banking stocks like this one back onto investors' radars.

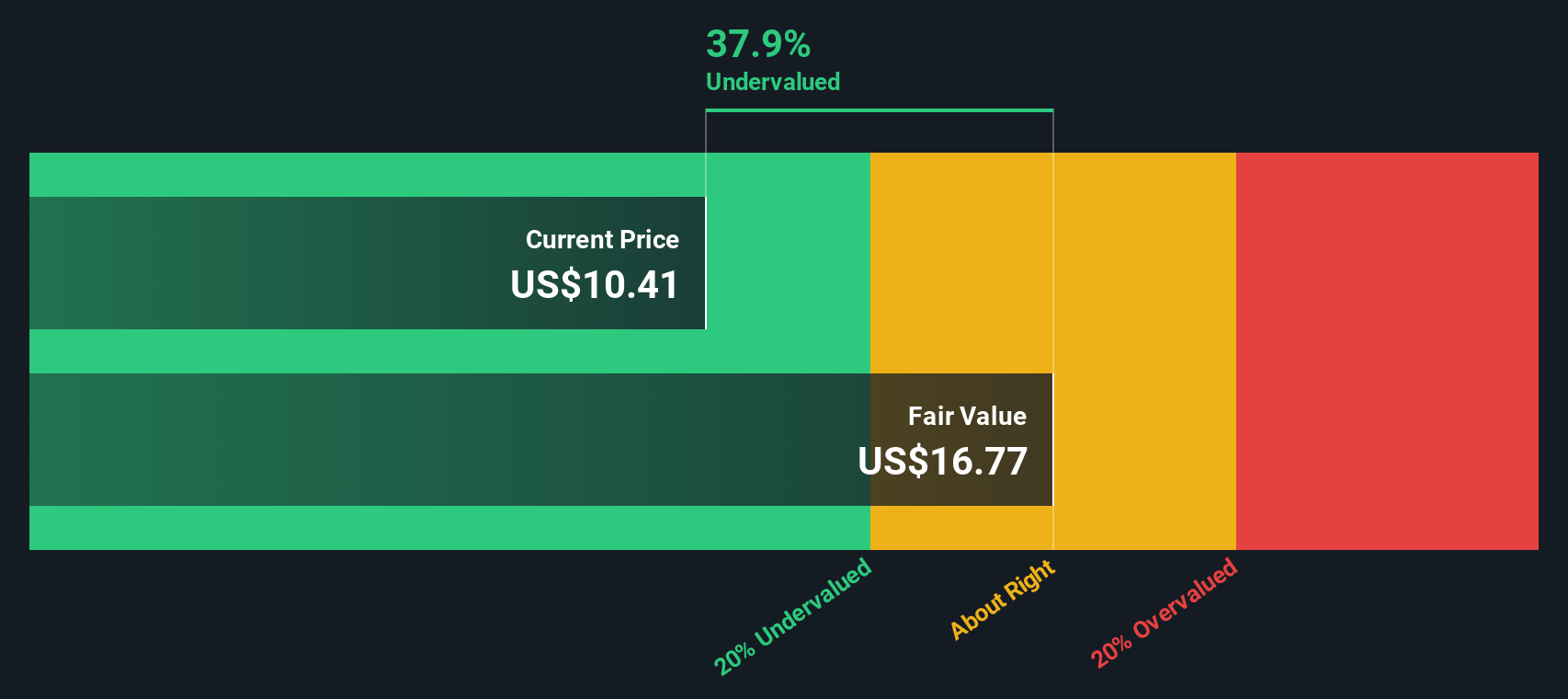

- When it comes to valuation, Valley National Bancorp scores 5 out of 6 on our comprehensive checks for undervalued companies. We will break down the methods behind this result next and hint at an even more insightful way to think about value at the end of this article.

Find out why Valley National Bancorp's 8.8% return over the last year is lagging behind its peers.

Approach 1: Valley National Bancorp Excess Returns Analysis

The Excess Returns valuation model differs from traditional approaches by assessing how much value a company creates above the minimum required by its cost of equity. In short, it measures the returns Valley National Bancorp generates on its invested capital versus what investors require for bearing risk, then projects this excess into the future.

According to analyst forecasts, Valley National Bancorp has a Book Value of $13.09 per share and is expected to maintain a Stable Book Value of $14.13 per share. The company’s stable earnings per share are $1.23, based on weighted future Return on Equity estimates from 8 analysts, with an average Return on Equity of 8.68%. The cost of equity stands at $0.99 per share, resulting in an Excess Return of $0.24 for shareholders, capturing how much profit the business is generating over its equity cost baseline.

This model estimates an intrinsic value that is 46.2% above the current share price, signaling a meaningful margin of safety for investors. The results strongly suggest that, when valued by its excess returns, Valley National Bancorp is trading well below its fundamental value.

Result: UNDERVALUED

Our Excess Returns analysis suggests Valley National Bancorp is undervalued by 46.2%. Track this in your watchlist or portfolio, or discover 849 more undervalued stocks based on cash flows.

Approach 2: Valley National Bancorp Price vs Earnings

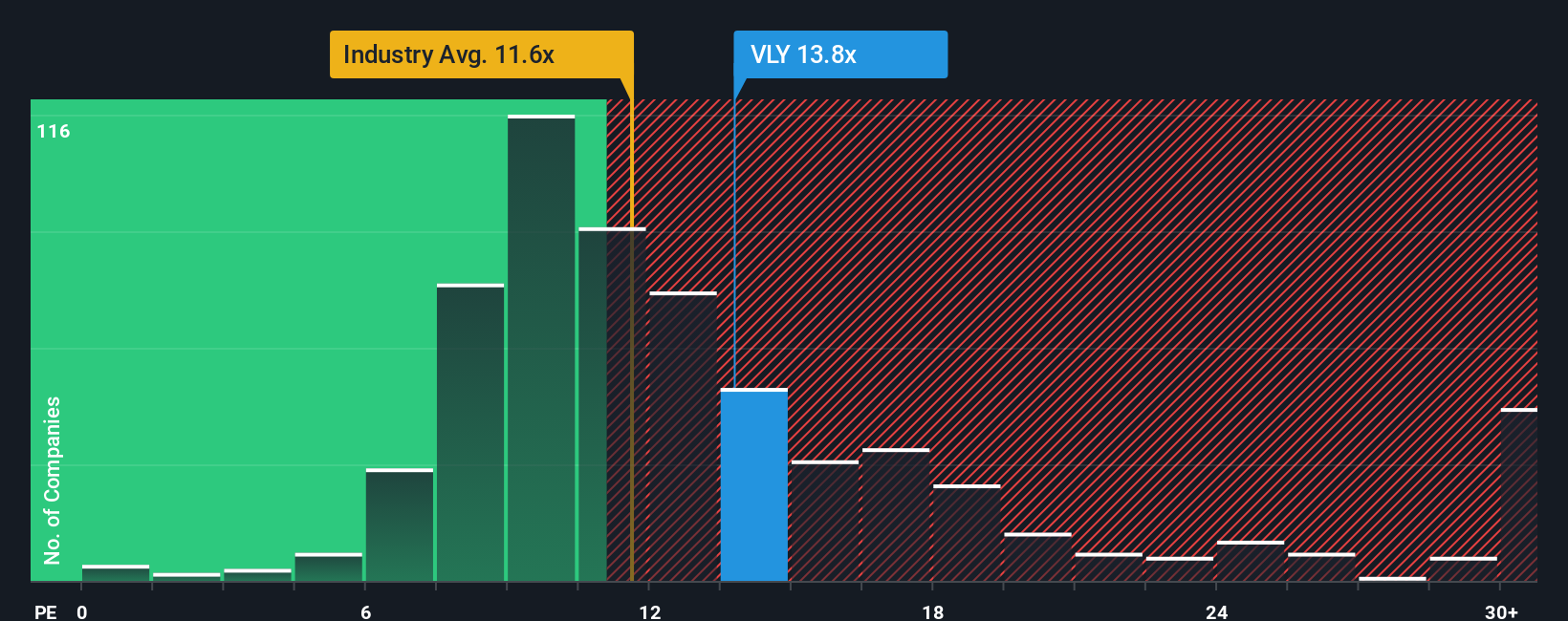

Price-to-Earnings (PE) is a go-to valuation metric for profitable companies like Valley National Bancorp because it directly relates the company's stock price to its underlying earnings power. In essence, PE helps investors gauge how much they are paying for each dollar of earnings, making it particularly useful when comparing companies that generate reliable profits.

A "normal" or "fair" PE ratio can vary widely depending on factors like future growth prospects and risk profile. Higher growth expectations or a lower risk profile typically justify a higher PE, while slower growth or greater uncertainty can push the fair multiple downward. This context is key in understanding whether a stock’s PE really makes it cheap or expensive.

Valley National Bancorp currently trades at a PE ratio of 12.5x. This sits just below its peer group average of 13.2x and is above the banking industry average of 11.1x. On the surface, this seems reasonable, but using only peer and industry multiples can overlook unique company-specific factors.

That is where Simply Wall St’s proprietary “Fair Ratio” comes in. For Valley National Bancorp, the Fair PE Ratio stands at 14.6x. This Fair Ratio considers not just sector and size, but also the company’s earnings growth outlook, profit margin, risk level, and market capitalization. By integrating these specifics, it offers a fuller picture of what the PE should be for Valley National Bancorp, rather than a rough comparison against the crowd.

Since the company’s actual PE ratio (12.5x) is meaningfully lower than its Fair Ratio (14.6x), this suggests the stock is undervalued on a price-to-earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Valley National Bancorp Narrative

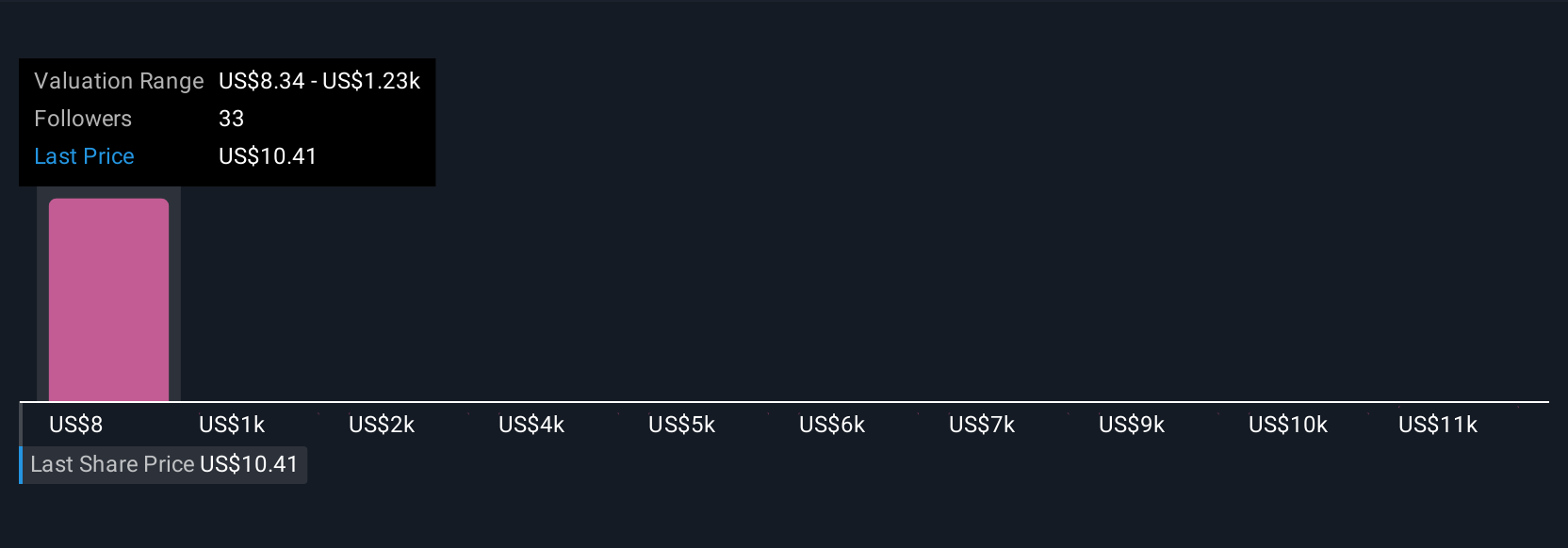

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply the story behind your investment; it reflects your own view on how Valley National Bancorp’s business will evolve, captured by the fair value, future revenue, earnings, and margins you expect.

With Narratives, you are not just looking at a number. You are connecting the company’s unique business story to your own financial forecast and resulting fair value. This approach is easy and accessible, and it is available to anyone on Simply Wall St’s Community page, where millions of investors share perspectives and update their outlooks as news or earnings are released.

By building or following Narratives, you can confidently decide when to buy or sell by comparing your estimated Fair Value with the current Price. You will also automatically get notified if new information shifts the outlook. For example, the most bullish current Narrative for Valley National Bancorp estimates a fair value of $13.00 per share, based on strong deposit momentum and loan growth. In contrast, the most cautious Narrative sees just $10.00, reflecting concerns about margin risk and slower revenue expansion. Which story fits your view, and your investment strategy?

Do you think there's more to the story for Valley National Bancorp? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VLY

Valley National Bancorp

Operates as the holding company for Valley National Bank that provides various commercial, private banking, retail, insurance, and wealth management financial services products.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives