- United States

- /

- Banks

- /

- NasdaqGS:VLY

Can Keating’s Appointment Reshape Valley National’s Lending Ambitions and Growth Narrative? (VLY)

Reviewed by Sasha Jovanovic

- Valley National Bancorp recently announced the appointment of Terry M. Keating as Head of Asset-Based Lending, following the retirement of John DePledge who established the bank’s ABL platform.

- Keating’s three-decade career in commercial finance and specialty lending signals Valley’s continued emphasis on expanding tailored financing solutions for middle-market clients.

- We will explore how Keating’s leadership and expertise in specialty lending may influence Valley National Bancorp’s growth outlook and investment story.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Valley National Bancorp Investment Narrative Recap

For shareholders to stay invested in Valley National Bancorp, confidence centers on the bank’s ability to reduce reliance on commercial real estate and accelerate growth via specialty lending and market expansion. The appointment of Terry M. Keating as Head of Asset-Based Lending positions Valley to further build its specialty lending business, though the move is unlikely to materially alter the short-term impact of persistent regional concentration and competitive risks in deposit and loan growth.

The recent naming of Patrick Smith as President of Consumer Banking, just ahead of Keating’s appointment, underscores management’s push to strengthen both specialty and consumer segments, key drivers for broader deposit and fee income growth potential. As Valley scales new verticals and market exposure, success hinges on addressing the core risk of market concentration and ongoing competition in core deposit gathering and lending.

Yet, investors should be aware that even with new leadership in place, regional economic pressure and demographic shifts still pose...

Read the full narrative on Valley National Bancorp (it's free!)

Valley National Bancorp's outlook calls for revenues of $2.5 billion and earnings of $807.5 million by 2028. Achieving this would require 16.6% annual revenue growth and an earnings increase of $381.8 million from the current $425.7 million.

Uncover how Valley National Bancorp's forecasts yield a $13.46 fair value, a 25% upside to its current price.

Exploring Other Perspectives

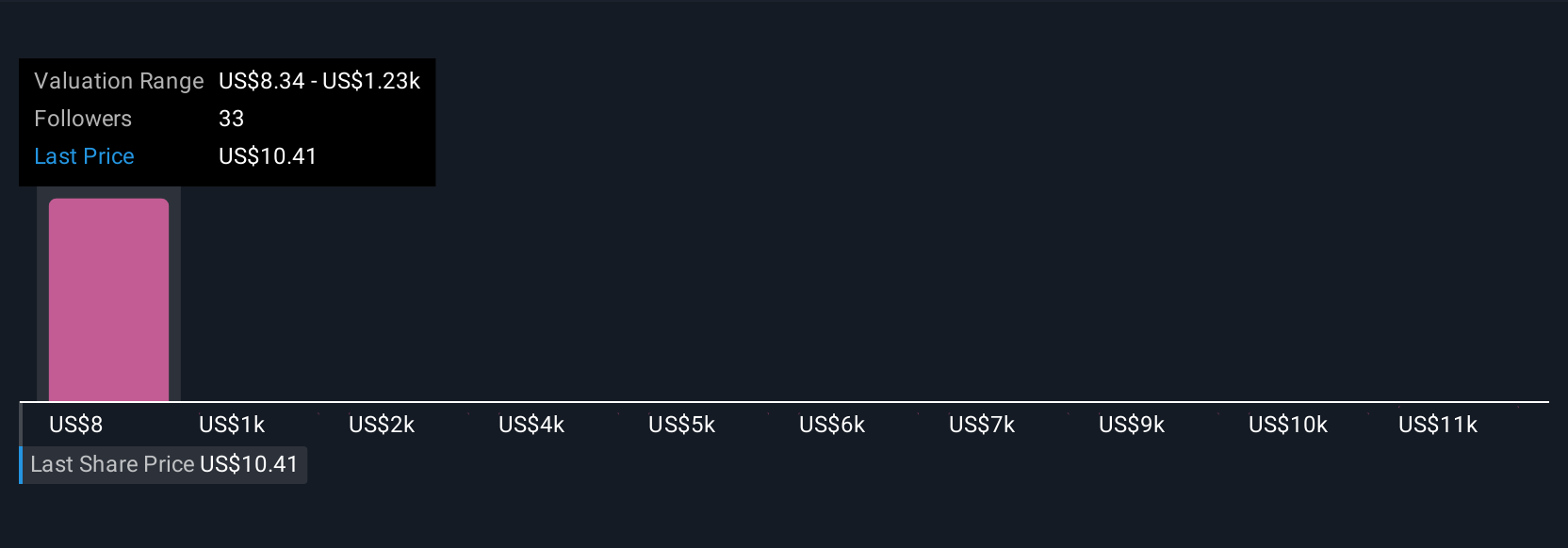

Simply Wall St Community members offered 2 different fair value estimates for Valley National Bancorp, spanning from US$13.46 to US$19.76 per share. While growth in specialty lending is expected to broaden opportunities, regional market risks may shape the company’s future path, see how other investors assess the trade-offs.

Explore 2 other fair value estimates on Valley National Bancorp - why the stock might be worth just $13.46!

Build Your Own Valley National Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valley National Bancorp research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Valley National Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valley National Bancorp's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VLY

Valley National Bancorp

Operates as the holding company for Valley National Bank that provides various commercial, private banking, retail, insurance, and wealth management financial services products.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives