- United States

- /

- Banks

- /

- NasdaqGS:UMBF

Will Strong Earnings and a Dividend Hike Reshape UMB Financial's (UMBF) Capital Allocation Narrative?

Reviewed by Sasha Jovanovic

- UMB Financial Corporation recently reported robust third-quarter results, including net income of US$188.32 million and a dividend increase on its common stock, payable in early January 2026.

- Alongside earnings growth, the company opted not to repurchase shares during the latest period, while maintaining its history of stable and rising dividends.

- We'll examine how UMB Financial's strong third-quarter earnings and higher dividend inform the company's current investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

UMB Financial Investment Narrative Recap

To be a shareholder in UMB Financial, you generally need to believe in the bank’s ability to grow through its Midwest-Southwest focus and capitalize on the expected synergies from integrating Heartland’s operations. Recent strong earnings and the increased dividend support the primary short-term catalyst of integration-driven cost savings, while near-term risks like higher net charge-offs and ongoing integration complexity remain. These news events do not materially shift either the core catalyst or the central risk right now.

The decision to raise the common stock dividend, now at US$0.43 per share for early January 2026, is especially relevant. This move directly reflects management’s confidence in the sustainability of its earnings stream even in the midst of integration efforts with Heartland, and highlights the importance of reliable shareholder returns as a supporting factor for the bank’s outlook.

However, against this backdrop of stable dividends and rising income, investors should be aware that a significant increase in net charge-offs could affect...

Read the full narrative on UMB Financial (it's free!)

UMB Financial's narrative projects $3.3 billion revenue and $1.2 billion earnings by 2028. This requires 19.2% yearly revenue growth and a $675.7 million increase in earnings from $524.3 million.

Uncover how UMB Financial's forecasts yield a $137.54 fair value, a 28% upside to its current price.

Exploring Other Perspectives

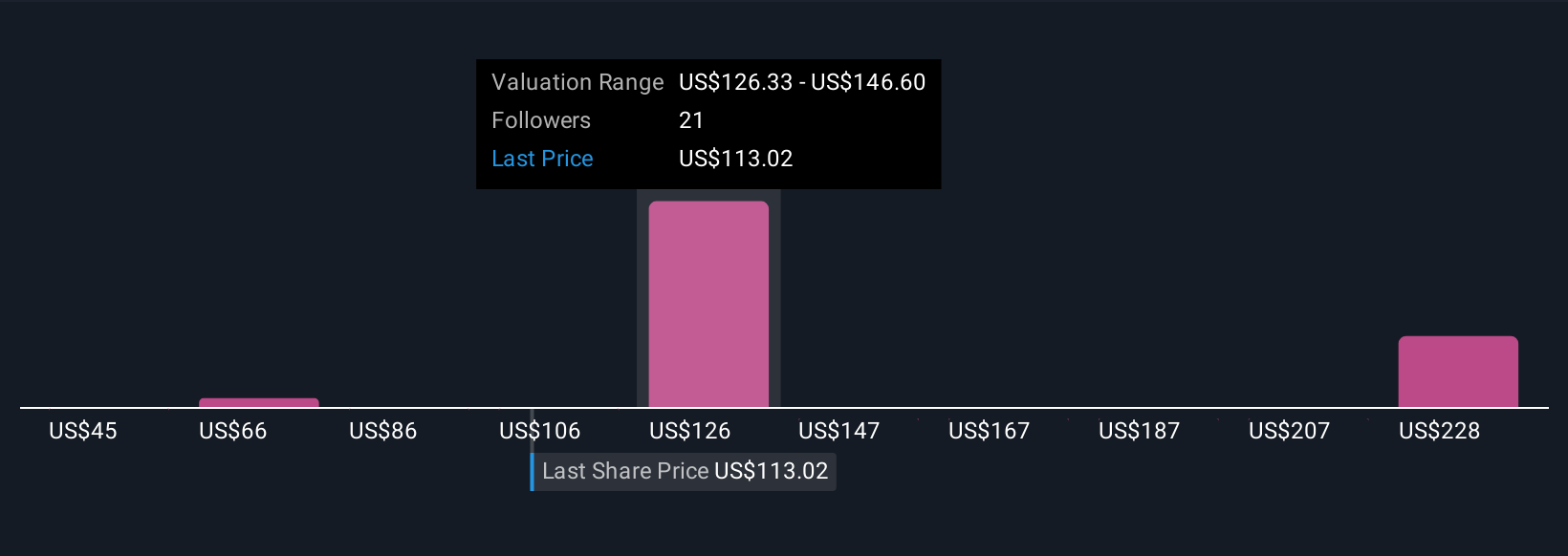

Six members of the Simply Wall St Community place UMB Financial’s fair value between US$45.28 and US$231.02. While some see extensive upside potential, many also remain focused on the integration of Heartland, underscoring how confidence in operational execution can shape expectations for future performance.

Explore 6 other fair value estimates on UMB Financial - why the stock might be worth less than half the current price!

Build Your Own UMB Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UMB Financial research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free UMB Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UMB Financial's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 34 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UMBF

UMB Financial

Operates as the bank holding company that provides banking services and asset servicing in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives