- United States

- /

- Banks

- /

- NasdaqGS:TCBK

TriCo Bancshares (TCBK): Assessing Valuation as Profitability Outpaces Net Interest Income Growth

Reviewed by Simply Wall St

TriCo Bancshares (TCBK) has caught investors’ attention as its strong long-term growth in earnings per share and tangible book value stands in contrast to slower net interest income gains. This balance of strengths and challenges sets up an intriguing conversation about its valuation in the future.

See our latest analysis for TriCo Bancshares.

TriCo Bancshares has seen its share price build momentum lately, climbing nearly 9% over the past 90 days after a softer start to the year. Its total shareholder return over the past twelve months is still slightly negative. This mix of recent strength with longer-term underperformance highlights changing market sentiment as investors reassess both TriCo’s growth prospects and current valuation.

If you’re curious how other stocks are catching investor interest this quarter, consider broadening your search with our fast growing stocks with high insider ownership.

With TriCo’s impressive track record in profit growth but softer net interest income, the key question is whether the current share price reflects untapped value or if future growth is already factored in. Could this be a buying opportunity?

Price-to-Earnings of 12.5x: Is it justified?

TriCo Bancshares is currently trading at a price-to-earnings (P/E) ratio of 12.5x, just below the average for its direct peers but above the broader US Banks industry. With a recent close at $44.90, this pricing suggests the market assigns a premium relative to some rivals, likely reflecting confidence in TriCo's stability and past performance.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of earnings. For banks, this multiple can reflect expectations for consistent profitability and growth, as well as trust in management and asset quality. In TriCo’s case, the market appears to be paying up for the company’s track record of high-quality earnings, reliable dividends, and seasoned leadership. This is despite the fact that its recent earnings growth has lagged industry benchmarks.

However, compared to the US Banks industry average P/E of 11.1x, TriCo looks somewhat expensive. Notably, our analysis also suggests the estimated fair price-to-earnings ratio should be 10.4x. This implies that if the market reverts closer to this level, the current premium could shrink significantly.

Explore the SWS fair ratio for TriCo Bancshares

Result: Price-to-Earnings of 12.5x (OVERVALUED)

However, slower industry-wide earnings and TriCo’s recent underperformance over one and three years could weigh on valuations if sentiment shifts again.

Find out about the key risks to this TriCo Bancshares narrative.

Another View: Discounted Cash Flow Sheds New Light

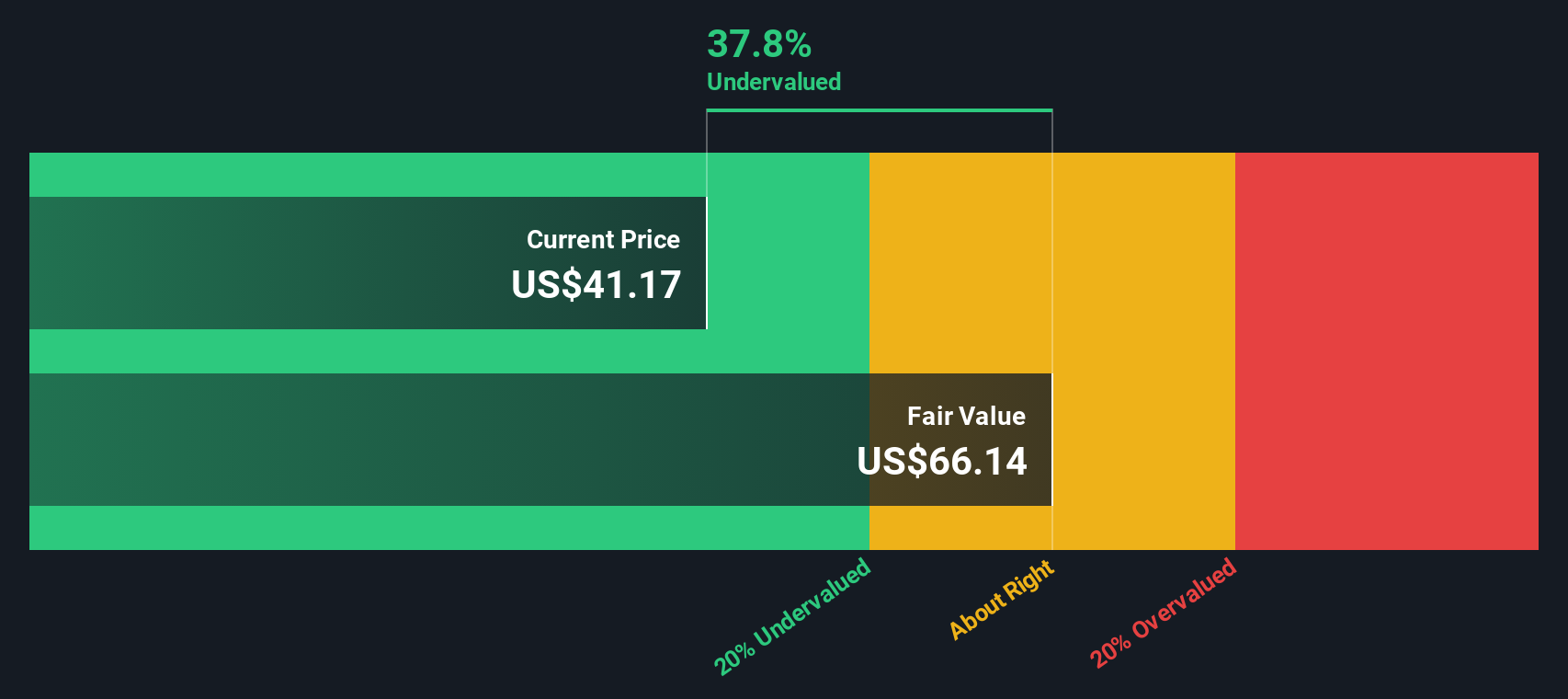

While the price-to-earnings ratio suggests TriCo Bancshares is trading at a premium, the SWS DCF model tells a much more optimistic story. According to this approach, TriCo may actually be undervalued by over 36%, which hints at a far greater upside than what multiples alone reveal. Which perspective will prove right as the market digests these conflicting signals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TriCo Bancshares for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TriCo Bancshares Narrative

If you want to dive deeper or approach TriCo Bancshares from your own angle, it only takes a few minutes to build your own perspective. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding TriCo Bancshares.

Looking for more investment ideas?

Great investing means looking beyond just one stock. Get ahead of trends and seize opportunities that others might miss by exploring these unique angles today:

- Tap into future profits by checking out these 876 undervalued stocks based on cash flows, filled with stocks trading well below their true worth.

- Catch the AI boom as it happens by reviewing these 25 AI penny stocks, which are making headlines for their game-changing technology and growth.

- Begin building steady income by searching through these 16 dividend stocks with yields > 3%, featuring companies known for reliable and attractive dividend yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TriCo Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TCBK

TriCo Bancshares

Operates as a bank holding company for Tri Counties Bank that provides commercial banking services to individual and corporate customers.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives