- United States

- /

- Banks

- /

- NasdaqGS:TBBK

Assessing Bancorp (TBBK) Valuation Following Recent Share Price Decline

Reviewed by Simply Wall St

See our latest analysis for Bancorp.

Bancorp’s recent share price slump caps off a volatile stretch, but it’s worth noting that momentum is still positive if you zoom out. While the stock has stumbled with a 16% decline in share price over the past month, its year-to-date share price return remains up 15.5%. Long-term holders have done even better, with a three-year total shareholder return just shy of 100% and nearly 400% over five years. This points to meaningful gains despite short-term turbulence.

If you’re weighing where momentum or value might materialize next, now is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With the share price now trading at a 28% discount to analyst targets and nearly 48% below some intrinsic value estimates, is Bancorp a hidden bargain, or is the market already anticipating the bank’s next stage of growth?

Most Popular Narrative: 21.9% Undervalued

With the narrative estimating Bancorp's fair value at $76.50 and a recent close of $59.72, there is a substantial implied upside, setting the stage for a deeper look at the conviction behind this view.

The Fintech Solutions Group's addition of new partnerships and expansion of existing programs, particularly in credit sponsorship, is anticipated to drive significant increases in future earnings. This is due to expected balances reaching $1 billion by the end of 2025.

What kind of bold assumptions power such a big gap between share price and the narrative’s fair value? This call hinges on an earnings surge and a dramatic shift in future profit margins. The tension is whether those fintech-fueled growth projections truly hold up. Read on for all the pivotal numbers and see what could move the needle.

Result: Fair Value of $76.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks remain, especially regarding the stability of fintech partnerships and ongoing margin pressures. These factors could quickly shift sentiment or influence future projections.

Find out about the key risks to this Bancorp narrative.

Another View: Are Multiples Telling a Different Story?

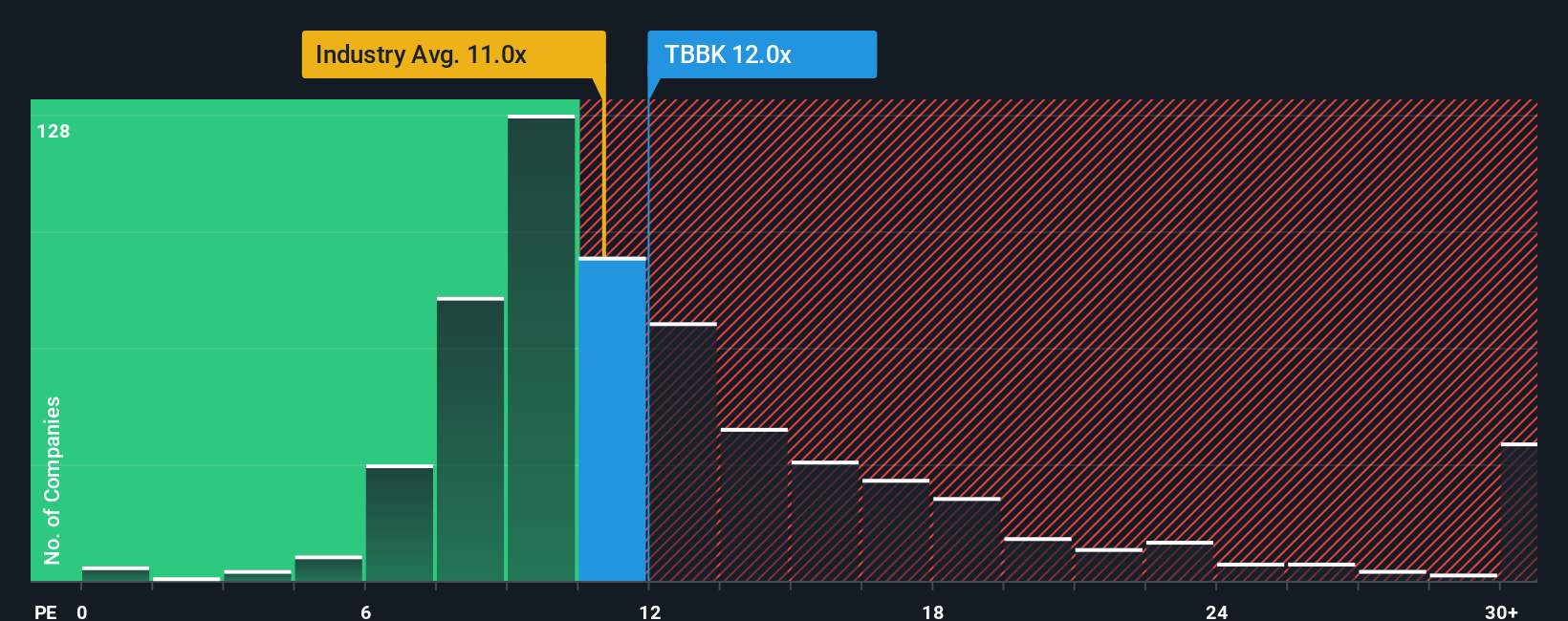

Looking at standard price-to-earnings levels, Bancorp currently trades at 11.5 times earnings. That is just above the US Banks industry average of 11.2x, but below the peer group average of 13.2x. Notably, its ratio still sits well under our fair ratio estimate of 13.6x. For investors, this gap could signal a value opportunity if the market moves toward the fair ratio, but it could also reflect caution about growth or risk. How much should investors trust traditional earnings multiples in this case?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bancorp Narrative

If you have a different perspective or want to dig into the details yourself, you can build your own Bancorp narrative in just a few minutes. Do it your way

A great starting point for your Bancorp research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Get ahead of the market by using smart tools that surface overlooked winners and future standouts. Do not miss out on these hand-picked opportunities that could power up your portfolio.

- Spot overlooked market gems by checking out these 894 undervalued stocks based on cash flows with strong fundamentals and major upside potential.

- Capture reliable income streams when you review these 18 dividend stocks with yields > 3% featuring strong yields and robust financials.

- Tap into rapid innovation with these 27 AI penny stocks at the forefront of artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TBBK

Bancorp

Operates as the financial holding company for The Bancorp Bank, National Association that provides banking products and services in the United States.

Excellent balance sheet and good value.

Market Insights

Community Narratives