- United States

- /

- Banks

- /

- NasdaqGS:SYBT

Stock Yards Bancorp (SYBT): Assessing Valuation After Strong Third Quarter Earnings Growth

Reviewed by Simply Wall St

Stock Yards Bancorp (SYBT) released its third quarter and year-to-date earnings, showing higher net interest income and net income compared to last year. The results highlight continued growth for the regional bank.

See our latest analysis for Stock Yards Bancorp.

Stock Yards Bancorp’s strong earnings update arrived at a time when its share price has lost some ground, with a 30-day share price return of -7.17% pushing the year-to-date move to -7.05%. While total shareholder return over the past five years still sits at an impressive 72.87%, recent momentum has slowed as the market digests this shifting growth and risk outlook.

If you’re interested in broadening your search beyond the latest financial headlines, now’s a great time to discover fast growing stocks with high insider ownership.

With solid financial growth but a share price still lagging, the question becomes whether Stock Yards Bancorp is trading at a discount or if the market already anticipates further improvements. Is now the moment to buy, or is everything priced in?

Price-to-Earnings of 14.2x: Is it justified?

Stock Yards Bancorp’s shares currently trade at a price-to-earnings (P/E) ratio of 14.2x, which is noticeably lower than the average of its peers but above the industry benchmark. This level suggests the market may not be fully recognizing the company’s earnings growth profile, or it could be pricing in different expectations compared to the broader sector.

The P/E ratio gauges what investors are willing to pay for each dollar of earnings. In the banking sector, this multiple reflects anticipated earnings growth, risk outlook, and the stability of profit streams. For Stock Yards Bancorp, its P/E signals comparative value relative to similar banks, even as the sector faces shifting growth prospects.

Against its peers, Stock Yards Bancorp appears attractively valued, as its 14.2x P/E falls below the peer group average of 19.5x. This suggests that the market may be more cautious about its near-term growth or risk profile. Compared to the overall US Banks industry, however, its shares trade at a premium to the industry average multiple of 11x and sit even higher than the estimated Fair Price-to-Earnings Ratio of 10.3x. This premium points to investor expectations that may exceed underlying fundamentals, or perhaps confidence in company-specific factors that set it apart from the wider sector.

Explore the SWS fair ratio for Stock Yards Bancorp

Result: Price-to-Earnings of 14.2x (ABOUT RIGHT)

However, slower revenue and net income growth or continued share price declines could weigh on investor sentiment. This could potentially challenge the current valuation story.

Find out about the key risks to this Stock Yards Bancorp narrative.

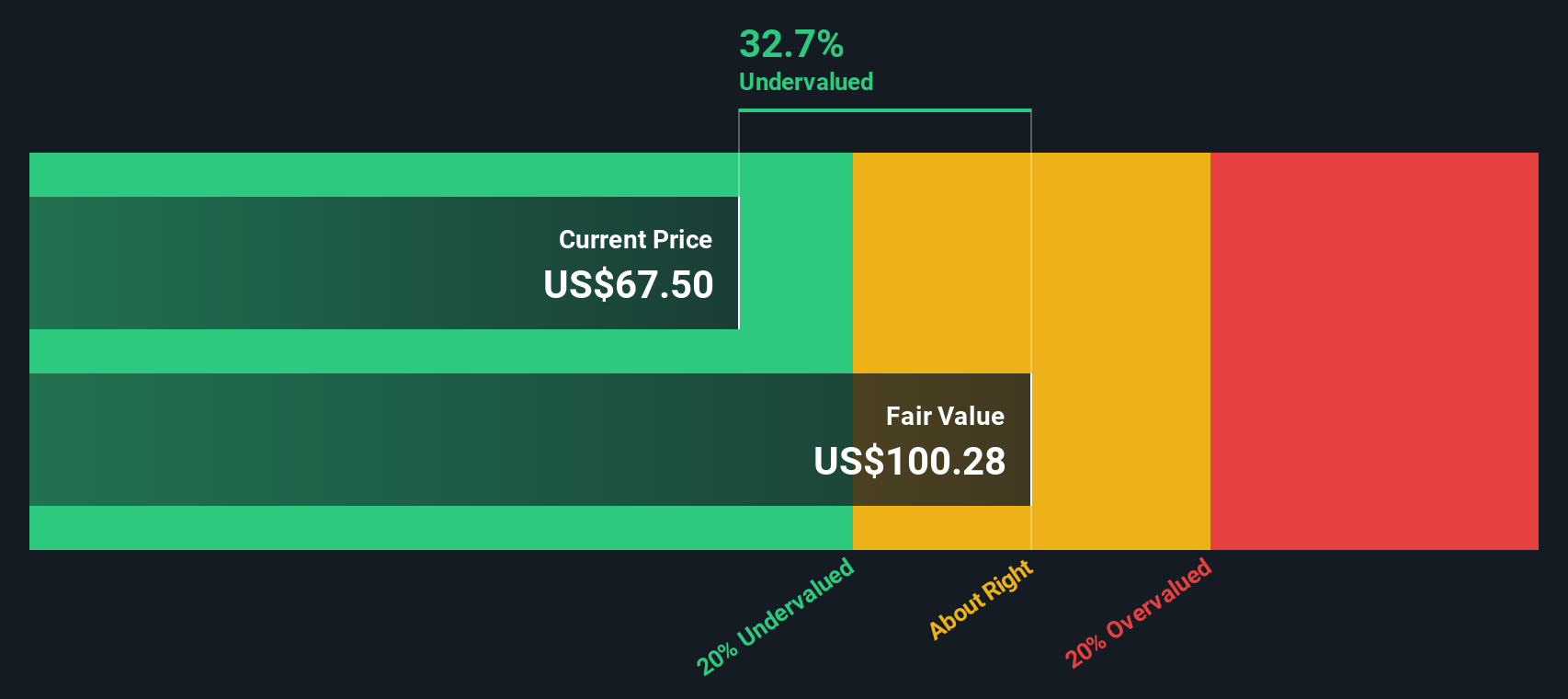

Another View: Discounted Cash Flow Model Paints a Different Picture

Looking at Stock Yards Bancorp through the lens of our DCF model, the results diverge from the P/E story. The SWS DCF model estimates a fair value of $105.13 per share, which is well above the current price. This suggests the stock may be meaningfully undervalued on a cash flow basis.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Stock Yards Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 842 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Stock Yards Bancorp Narrative

If you have different insights or want to explore the numbers on your terms, it's easy to shape your own perspective in just a few minutes with Do it your way.

A great starting point for your Stock Yards Bancorp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Expand your portfolio by acting now on high-conviction stock picks that could transform your returns. Don’t let opportunity pass you by.

- Tap into fresh breakthroughs by checking out these 26 AI penny stocks that are propelling progress in automation, neural networks, and data analytics.

- Boost your income stream by accessing these 20 dividend stocks with yields > 3% with attractive yields above the market average.

- Capitalize on tomorrow’s leaders in decentralized tech by reviewing these 82 cryptocurrency and blockchain stocks focused on blockchain solutions and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SYBT

Stock Yards Bancorp

Operates as a holding company for Stock Yards Bank & Trust Company that provides various financial services for individuals, corporations, and others in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives