- United States

- /

- Banks

- /

- NasdaqGS:SYBT

Does Stock Yards Bancorp's Net Interest Income Surge Reinforce Its Core Banking Strengths for SYBT Investors?

Reviewed by Sasha Jovanovic

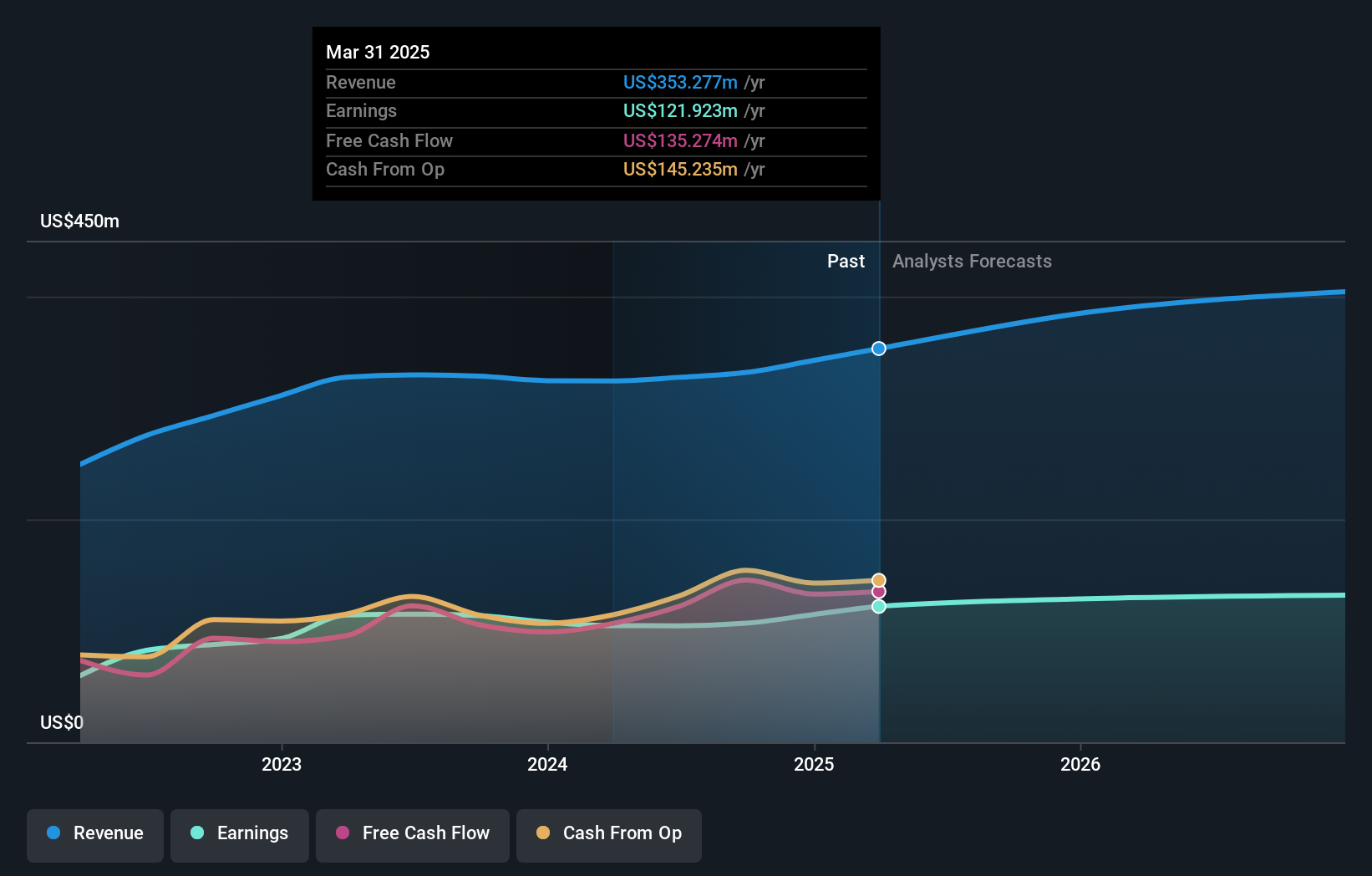

- Stock Yards Bancorp reported its third-quarter and nine-month 2025 earnings, highlighting increases in net interest income to US$77.04 million and net income to US$36.24 million for the quarter compared to the prior year.

- The company's earnings growth outpaced the previous year's results, signaling continued momentum in its core banking operations.

- We'll explore how this solid net interest income growth impacts Stock Yards Bancorp's overall investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

What Is Stock Yards Bancorp's Investment Narrative?

For investors considering Stock Yards Bancorp, the recent string of higher-than-expected net interest income and solid net income offers plenty to factor in. The company’s ability to boost earnings and dividend payouts might ease some concerns around short-term catalysts, especially given recent periods of underperformance versus the broader market and industry. While the latest numbers mark a continuation of earnings momentum, it’s worth reflecting on whether this trend is sustainable amid forecasts of slower revenue and earnings growth going forward. The announcement may prompt the market to reassess near-term risks, including current valuation concerns, competition, and the potential for a lower return on equity over time. Ultimately, the story now hinges on whether these stronger earnings materially change the risk profile or just provide a short-term boost to sentiment.

On the other hand, watch for ongoing questions about valuation versus growth expectations. Despite retreating, Stock Yards Bancorp's shares might still be trading 37% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on Stock Yards Bancorp - why the stock might be worth as much as 16% more than the current price!

Build Your Own Stock Yards Bancorp Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stock Yards Bancorp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Stock Yards Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stock Yards Bancorp's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SYBT

Stock Yards Bancorp

Operates as a holding company for Stock Yards Bank & Trust Company that provides various financial services for individuals, corporations, and others in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives