- United States

- /

- Banks

- /

- NasdaqGS:STBA

S&T Bancorp (STBA): Evaluating Valuation Following Dividend Increase and Board’s Signal of Confidence

Reviewed by Simply Wall St

The Board of Directors at S&T Bancorp (STBA) just approved a higher quarterly dividend, increasing it by 6% compared to last year. Moves like this can signal management’s confidence in future growth.

See our latest analysis for S&T Bancorp.

Recent momentum has picked up, with a 7.8% 1-month share price return and shares closing at $38.25. Despite facing a negative total shareholder return of nearly 7% over the past year, S&T Bancorp’s 5-year total shareholder return of 102% shows the long-term growth story remains intact. Board-level changes and a fresh director appointment indicate the company is also focused on its strategic direction, which adds to a sense of renewed energy.

If you’re searching for your next bank stock with upside potential, take the opportunity to discover fast growing stocks with high insider ownership

With the stock now recovering and management signaling optimism through higher dividends and board changes, investors may be wondering whether S&T Bancorp remains undervalued or if the market has already priced in expectations for future growth.

Most Popular Narrative: 7.1% Undervalued

With S&T Bancorp closing at $38.25 and the narrative setting fair value near $41.17, analysts see upside but only a modest gap between price and target. The difference suggests sentiment is largely balanced and driven by future earnings expectations. How do analysts quantify the optimism? The next quote highlights one major driver.

Analysts are assuming S&T Bancorp's revenue will grow by 5.6% annually over the next 3 years. Analysts assume that profit margins will shrink from 33.7% today to 28.8% in 3 years time.

Do you want to see what ambitious growth projections are backing up this future price? There’s more to this story than meets the eye. The expert valuation is built on a surprising set of revenue and margin assumptions. Find out what’s driving the fair value to this level by reading the full narrative for the inside story.

Result: Fair Value of $41.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, S&T Bancorp’s robust asset quality and consistent loan growth could offset competitive pressures and support earnings resilience, even if the broader risks materialize.

Find out about the key risks to this S&T Bancorp narrative.

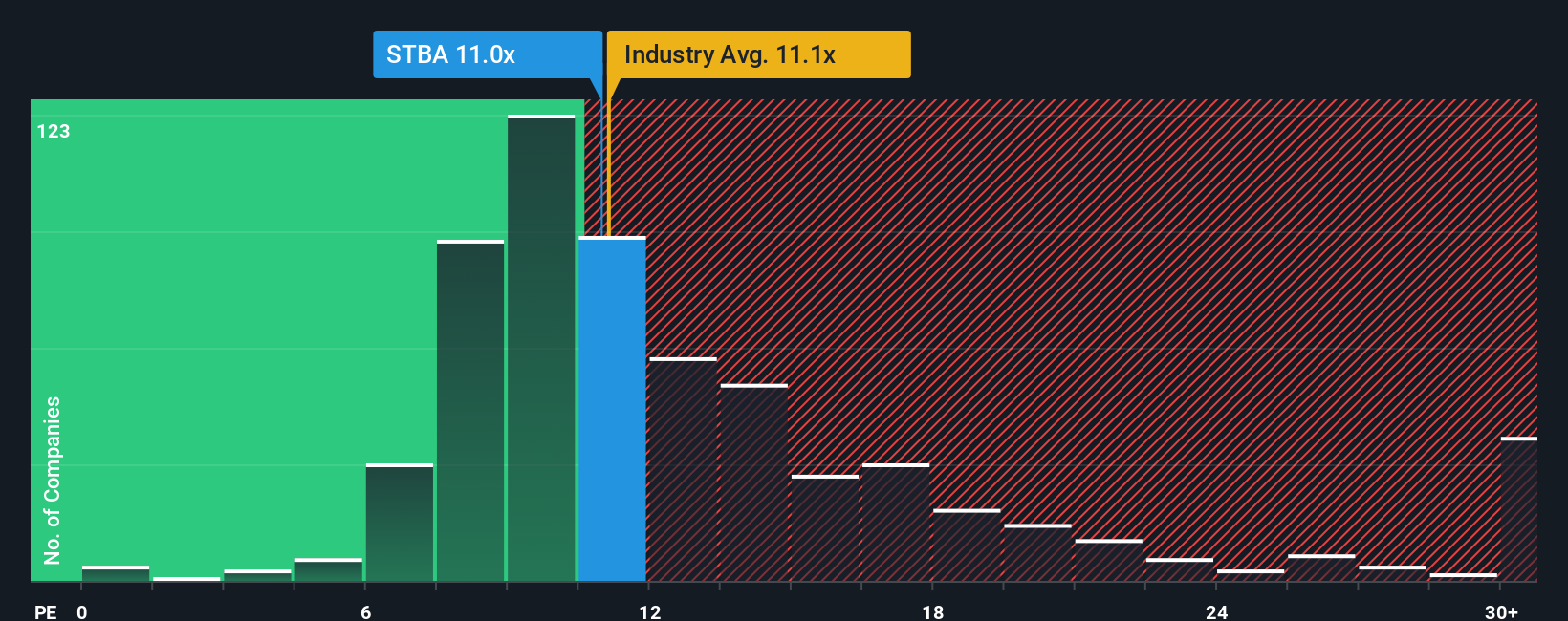

Another View: How Does Value Stack Up on Market Multiples?

While the fair value hints at a bargain, market comparisons tell a slightly different story. S&T Bancorp trades at a price-to-earnings ratio of 11x. This is above the estimated fair ratio of 9.8x and below its peer average of 13.1x, so there is both risk and opportunity depending on which number investors believe the market will move toward. What happens if the market shifts closer to the fair ratio?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own S&T Bancorp Narrative

If you want to go beyond the consensus and test your own ideas, it only takes a few minutes to build your own outlook and narrative here, so Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding S&T Bancorp.

Looking for More Investment Ideas?

Smart investors are always a step ahead. Don’t miss your chance to upgrade your portfolio with standout opportunities that could boost your returns this year.

- Uncover high-yield options and maximize your passive income by checking out these 16 dividend stocks with yields > 3%, which delivers robust yields over 3%.

- Capitalize on breakthroughs in medical technology by exploring these 32 healthcare AI stocks. This screener features companies that are transforming patient care and diagnostics with artificial intelligence.

- Catalyze growth in your portfolio by following blockchain innovators within these 82 cryptocurrency and blockchain stocks, capturing the momentum across cryptocurrency and fintech sectors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STBA

S&T Bancorp

Operates as the bank holding company for S&T Bank that provides retail and commercial banking products and services to consumer, commercial, and small business in Pennsylvania and Ohio.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives