- United States

- /

- Diversified Financial

- /

- NasdaqGM:SNFC.A

Here's Why Shareholders Will Not Be Complaining About Security National Financial Corporation's (NASDAQ:SNFC.A) CEO Pay Packet

It would be hard to discount the role that CEO Scott Quist has played in delivering the impressive results at Security National Financial Corporation (NASDAQ:SNFC.A) recently. Coming up to the next AGM on 25 June 2021, shareholders would be keeping this in mind. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. Here is our take on why we think CEO compensation is not extravagant.

View our latest analysis for Security National Financial

Comparing Security National Financial Corporation's CEO Compensation With the industry

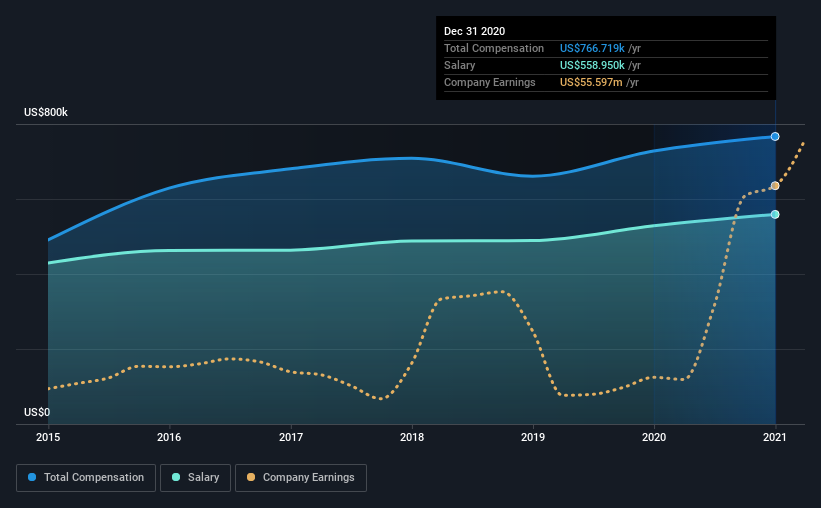

According to our data, Security National Financial Corporation has a market capitalization of US$151m, and paid its CEO total annual compensation worth US$767k over the year to December 2020. That's a fairly small increase of 5.3% over the previous year. Notably, the salary which is US$559.0k, represents most of the total compensation being paid.

On comparing similar companies from the same industry with market caps ranging from US$100m to US$400m, we found that the median CEO total compensation was US$827k. From this we gather that Scott Quist is paid around the median for CEOs in the industry. Moreover, Scott Quist also holds US$4.4m worth of Security National Financial stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$559k | US$528k | 73% |

| Other | US$208k | US$199k | 27% |

| Total Compensation | US$767k | US$728k | 100% |

On an industry level, roughly 51% of total compensation represents salary and 49% is other remuneration. According to our research, Security National Financial has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Security National Financial Corporation's Growth

Security National Financial Corporation's earnings per share (EPS) grew 30% per year over the last three years. It achieved revenue growth of 74% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Security National Financial Corporation Been A Good Investment?

We think that the total shareholder return of 64%, over three years, would leave most Security National Financial Corporation shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 2 warning signs for Security National Financial that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Security National Financial, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:SNFC.A

Security National Financial

Engages in the life insurance, cemetery and mortuary, and mortgage businesses.

Excellent balance sheet and good value.

Market Insights

Community Narratives