- United States

- /

- Banks

- /

- NasdaqGM:QCRH

QCR Holdings (QCRH): Assessing Valuation After New Dividend Declaration Signals Confidence

Reviewed by Simply Wall St

QCR Holdings (QCRH) has declared a cash dividend of $0.06 per share, with payment set for January 2026. This move highlights management’s commitment to sharing company profits and signals financial stability to shareholders.

See our latest analysis for QCR Holdings.

After a rocky stretch earlier in the year, QCR Holdings’ recent 1-month share price return of nearly 10% marks a noticeable shift in momentum, especially as the market digests news of the upcoming dividend. Despite a dip in total shareholder return over the past year, those who held on since late 2022 are still enjoying a more than 50% three-year total return and a remarkable 118% over five years, indicating that the long-term story remains intact.

If you’re curious what else is drawing investor attention right now, it could be the perfect moment to broaden your outlook and discover fast growing stocks with high insider ownership

With QCR Holdings trading at a sizable 47% discount to its estimated intrinsic value and analyst price targets still well above current levels, investors have to wonder: is the market overlooking upside, or is future growth already priced in?

Most Popular Narrative: 12% Undervalued

QCR Holdings last closed at just over $78, with the most popular narrative placing its fair value significantly higher. That gap deserves a closer look at the driving factors and bold projections shaping sentiment right now.

Ongoing digital transformation, specifically the implementation of a unified, efficient core banking system and new online banking platforms, is anticipated to enhance operational efficiency and reduce noninterest expenses over the next several years. This could support net margin and earnings growth starting in 2027.

The stage is set for sweeping changes and aggressive growth targets. But what are the key assumptions shaping this upbeat view? Some surprising figures drive the bullish projection, setting expectations for both revenue and profit that might challenge even the optimists. Ready to see what could propel QCR Holdings far beyond its current price?

Result: Fair Value of $89.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent digital transformation challenges or regulatory changes affecting core lending or income streams could quickly disrupt even the most optimistic outlook.

Find out about the key risks to this QCR Holdings narrative.

Another View: Is the Market Pricing Risk Correctly?

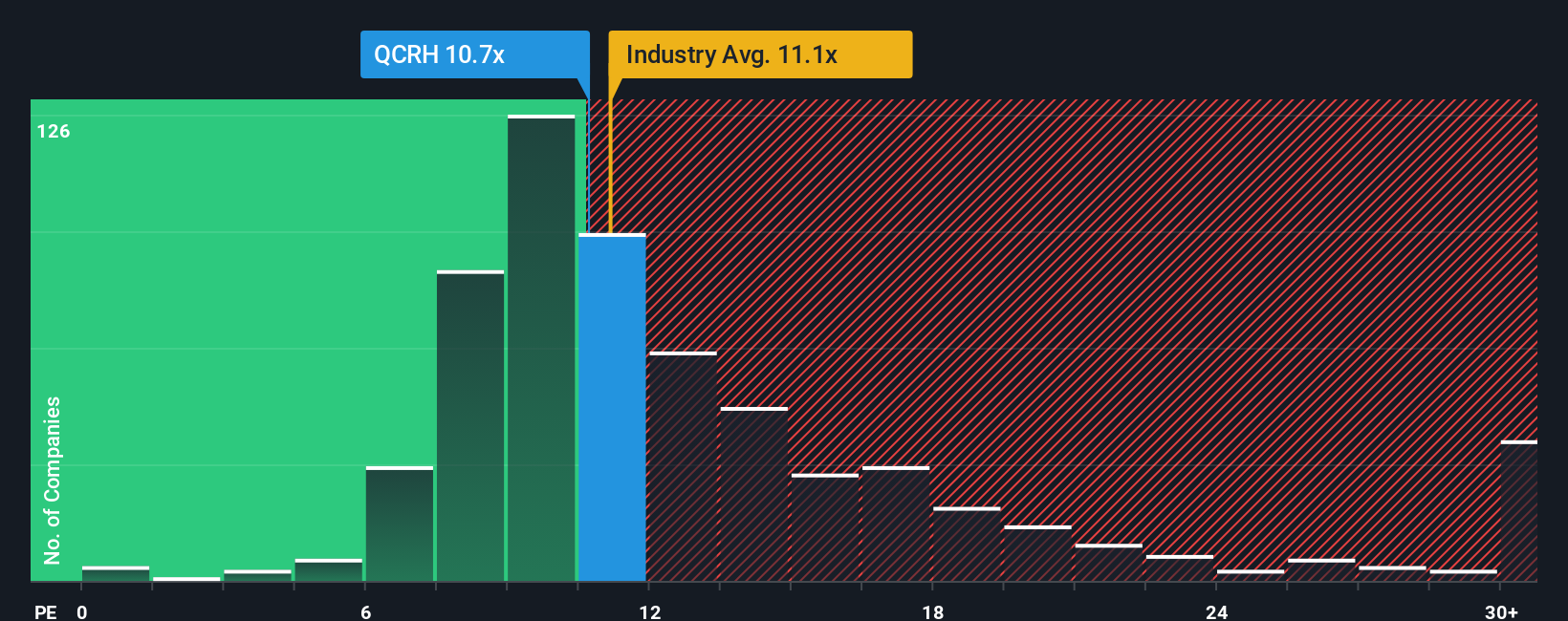

Looking at QCR Holdings through the lens of its price-to-earnings ratio tells a more cautious story. The stock trades at 10.9x earnings, which is slightly above the peer group average of 10.1x and higher than its fair ratio of 10.3x. This suggests the current price leaves less margin for error. Should investors be wary that the market is already pricing in much of the upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own QCR Holdings Narrative

If you have a different perspective, or prefer digging into the numbers yourself, you can develop your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding QCR Holdings.

Looking for More Investment Ideas?

Smart investors always cast a wider net. Gain the edge today by checking out stock ideas that match your preferred risk, growth, or income profile.

- Uncover serious income potential by targeting market leaders with steady yields through these 17 dividend stocks with yields > 3%.

- Spark your portfolio's upside with opportunities in the world of decentralized finance by reviewing these 81 cryptocurrency and blockchain stocks.

- Fuel your strategy with next-generation healthcare innovation by seeing which companies are making waves via these 30 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QCR Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:QCRH

QCR Holdings

A multi-bank holding company, provides commercial and consumer banking, and trust and asset management services.

Flawless balance sheet and fair value.

Market Insights

Community Narratives