- United States

- /

- Banks

- /

- NasdaqGS:PFIS

Peoples Financial Services (PFIS) Net Profit Margin Surges, Reinforcing Bullish Views on Earnings Quality

Reviewed by Simply Wall St

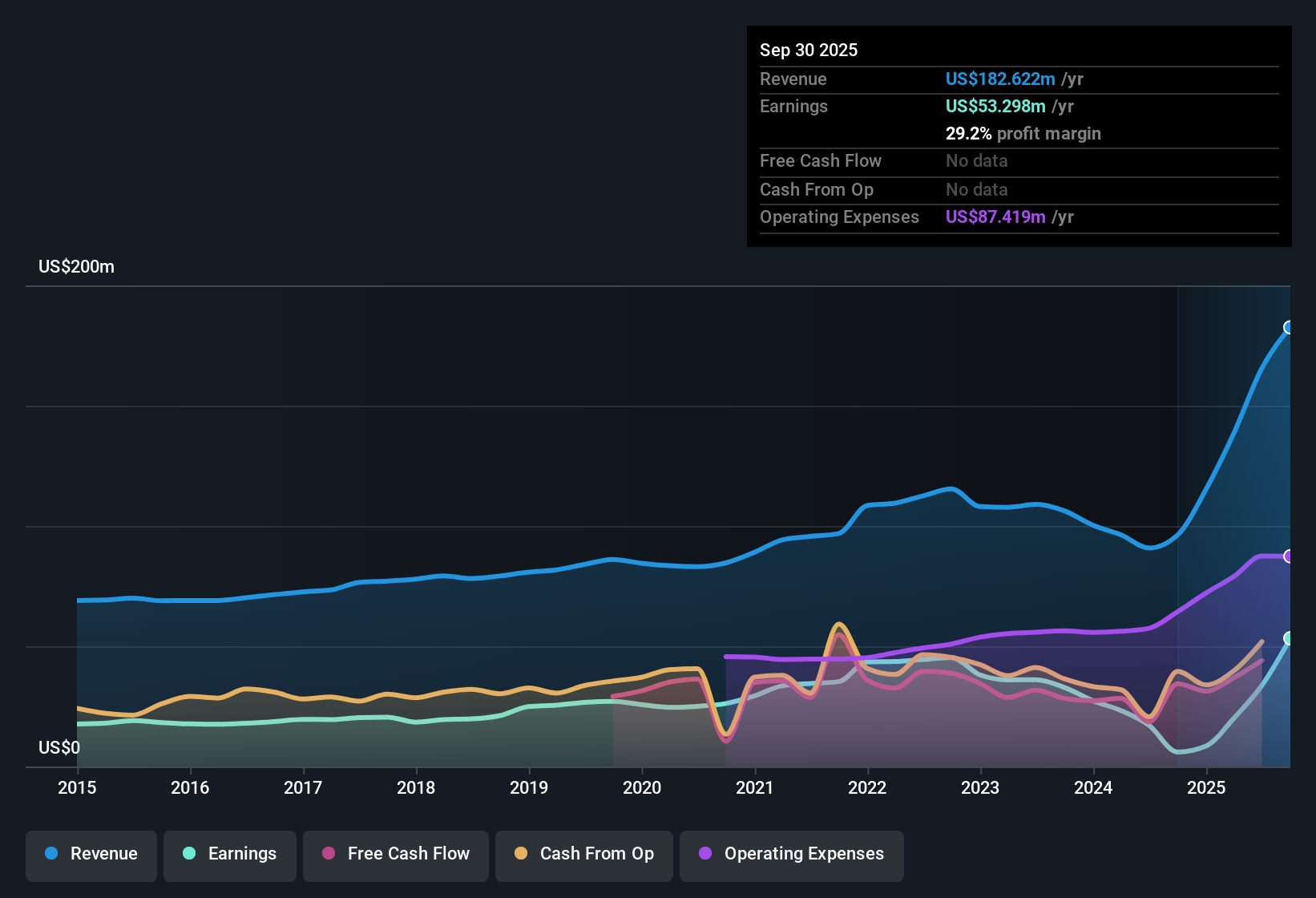

Peoples Financial Services (PFIS) posted a net profit margin of 29.2%, soaring well above last year’s 6.3%, with EPS growth of 782.3% over the past year compared to a five-year average decline of 7.3% per year. Shares are trading at a price-to-earnings ratio of 8.4x, notably below both the US Banks industry average of 11.2x and peers at 10.5x. The current share price of $44.54 sits significantly beneath the estimated fair value of $76.53. With improved profit margins and robust recent earnings momentum, investors are likely to view the latest results as further confirmation of PFIS’s attractive valuation and high-quality earnings profile, although growth forecasts remain more modest than the market average.

See our full analysis for Peoples Financial Services.Next up, let’s see how these headline figures compare to the dominant narratives shaping consensus views. We will also look at where expectations might get tested by the new results.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Set a New Bar

- PFIS’s net profit margin surged to 29.2%, far surpassing last year’s 6.3%, highlighting a significant shift in how much revenue is turning into bottom-line profit.

- What is notable is that recent earnings growth of 782.3% in the past year supports the view that operational efficiency and cost controls have meaningfully improved.

- This accelerates profit conversion far above the company’s own five-year average trend of -7.3% EPS annually.

- Such a sharp margin rebound provides a clear counterpoint to any narrative doubting the sustainability of PFIS’s underlying business model.

Growth Forecasts Trail the Market

- Earnings are projected to grow at 11.7% per year and revenue at 7.7% per year, both trailing the broader US market’s expected rates.

- The prevailing view is that while current profitability impresses, forward-looking growth rates limit PFIS’s potential for outperformance as valuations reset sector-wide.

- Consensus narrative notes that investors may stay focused on the quality of recent improvements, but muted growth expectations could temper enthusiasm compared to faster-growing banks.

- Comparisons to the higher market averages could keep a lid on re-rating, especially as new results confirm the company lags sector growth pace.

Valuation Still Sits at a Deep Discount

- With a price-to-earnings ratio of 8.4x, PFIS trades below both the US Banks industry (11.2x) and its peer group (10.5x). The current share price of $44.54 also remains below its DCF fair value of $76.53.

- The market’s stance is that these inexpensive valuation multiples boost the appeal for income and value-focused investors, especially since no flagged risks have surfaced.

- This discount is reinforced by high profit margins and improved earnings quality, supporting arguments for a possible catch-up in valuation if sentiment or sector confidence rises.

- However, smaller forecasted growth means some investors may need extra catalysts beyond fundamental cheapness to drive stronger share price moves.

To see how analysts frame the full story for PFIS, including where quality and value diverge, check out the consensus narrative linked below. 📊 Read the full Peoples Financial Services Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Peoples Financial Services's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

PFIS’s below-market growth forecasts and limited upside potential could restrict performance, even as profit margins and valuation metrics appear attractive.

If you want more consistent momentum and long-term rewards, our stable growth stocks screener (2103 results) highlights companies demonstrating steady earnings and revenue expansion where future prospects look brighter.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PFIS

Peoples Financial Services

Provides commercial and retail banking services.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives