The board of Landmark Bancorp, Inc. (NASDAQ:LARK) has announced that it will pay a dividend of US$0.20 per share on the 25th of August. Based on this payment, the dividend yield will be 2.9%, which is fairly typical for the industry.

See our latest analysis for Landmark Bancorp

Landmark Bancorp's Dividend Is Well Covered By Earnings

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. However, Landmark Bancorp's earnings easily cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

Over the next year, EPS could expand by 15.7% if recent trends continue. Assuming the dividend continues along recent trends, we think the payout ratio could be 16% by next year, which is in a pretty sustainable range.

Landmark Bancorp Has A Solid Track Record

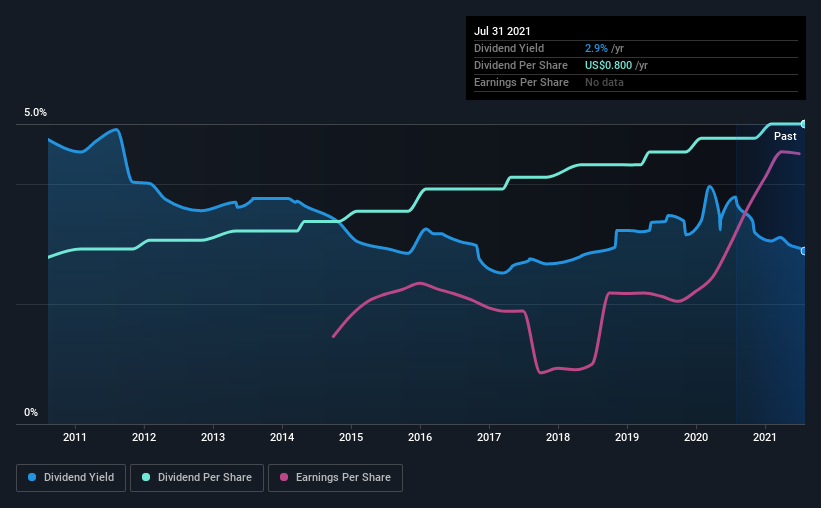

The company has an extended history of paying stable dividends. The dividend has gone from US$0.44 in 2011 to the most recent annual payment of US$0.80. This works out to be a compound annual growth rate (CAGR) of approximately 6.1% a year over that time. Dividends have grown at a reasonable rate over this period, and without any major cuts in the payment over time, we think this is an attractive combination as it provides a nice boost to shareholder returns.

The Dividend Looks Likely To Grow

Investors could be attracted to the stock based on the quality of its payment history. We are encouraged to see that Landmark Bancorp has grown earnings per share at 16% per year over the past five years. Landmark Bancorp definitely has the potential to grow its dividend in the future with earnings on an uptrend and a low payout ratio.

Landmark Bancorp Looks Like A Great Dividend Stock

Overall, we like to see the dividend staying consistent, and we think Landmark Bancorp might even raise payments in the future. The company is easily earning enough to cover its dividend payments and it is great to see that these earnings are being translated into cash flow. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in Landmark Bancorp stock. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

When trading Landmark Bancorp or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:LARK

Landmark Bancorp

Operates as the financial holding company for Landmark National Bank that provides various financial and banking services to its local communities.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives