- United States

- /

- Banks

- /

- NasdaqGM:ISTR

Is Investar Holding Still Trading Below Fair Value After Its Strategic Acquisition?

Reviewed by Bailey Pemberton

- Ever wondered if Investar Holding is trading for less than it’s really worth? Let’s dig into what the numbers and market buzz reveal about its current value.

- The stock has climbed 3.4% over the past month and is up 11.9% since the start of the year, signaling renewed investor interest and possibly shifting sentiment around its growth prospects.

- Recently, the company completed a strategic acquisition aimed at expanding its regional presence, which has caught the eye of both analysts and shareholders. This move, along with management’s focus on strengthening its core operations, has provided fresh context to their steady upward trend in share price.

- If you’re looking for a quick score, Investar Holding bags a 6 out of 6 on our valuation checks, meaning it appears undervalued across every metric we track. Of course, not all valuation methods are created equal. Soon, we’ll break down the approaches analysts use and spotlight one way of looking at value that might change how you see the stock.

Find out why Investar Holding's 4.8% return over the last year is lagging behind its peers.

Approach 1: Investar Holding Excess Returns Analysis

The Excess Returns model estimates a company’s intrinsic value by measuring how much profit it generates above the required return for its shareholders, using figures like return on invested capital and book value growth. This approach is especially useful for financial firms such as Investar Holding, where traditional cash flow analysis may not capture the full picture.

For Investar Holding, the Excess Returns model uses a Book Value of $26.96 per share and a Stable Earnings Per Share (EPS) of $2.89, based on the median Return on Equity from the past five years. The cost of equity is $2.08 per share, leaving an Excess Return of $0.81 per share, with an average Return on Equity of 9.71%. Analysts project the Stable Book Value to grow to $29.74 per share, a figure supported by weighted forecasts from three analysts.

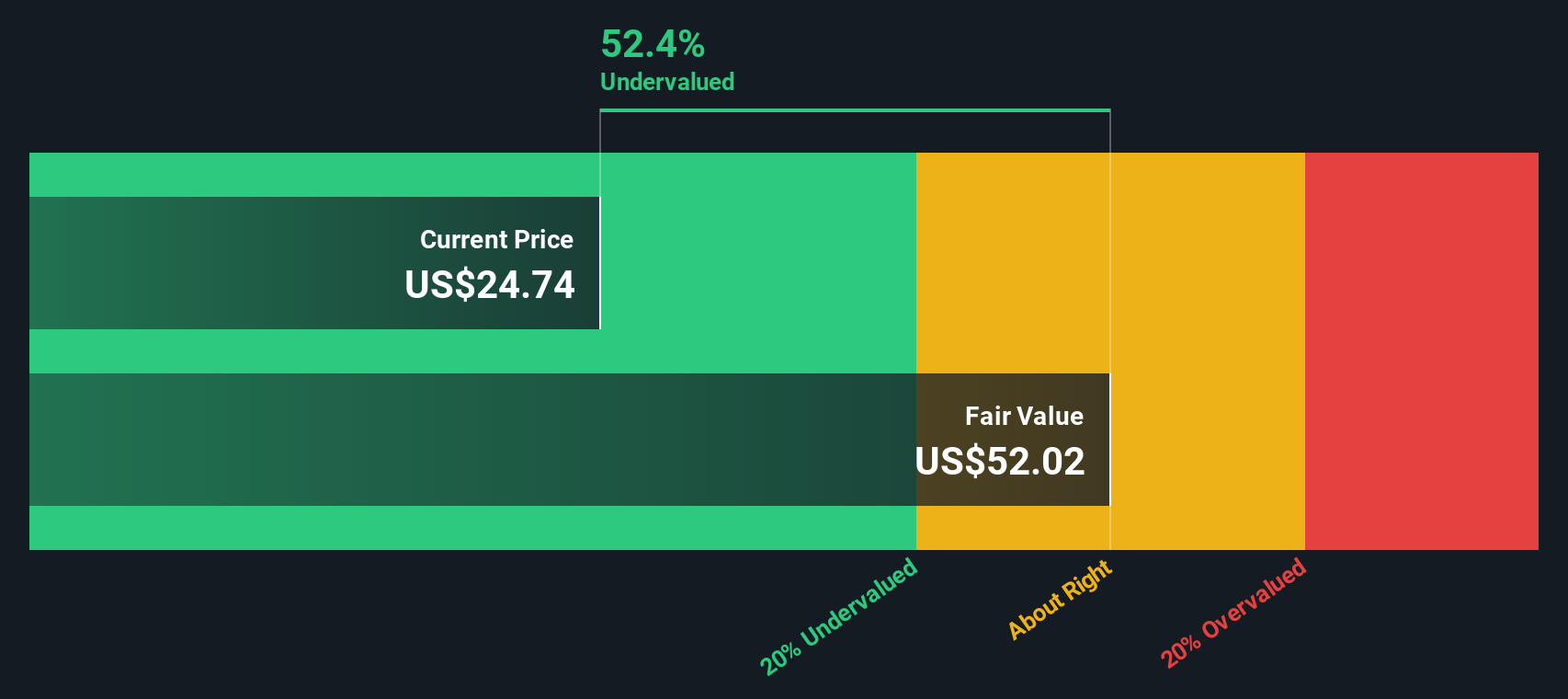

After applying these measurements, the model estimates Investar Holding’s intrinsic value at a significant discount to market price, indicating the stock is currently 53.8 percent undervalued. This suggests investors may be overlooking the company’s ability to deliver consistent returns above its cost of equity.

Result: UNDERVALUED

Our Excess Returns analysis suggests Investar Holding is undervalued by 53.8%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

Approach 2: Investar Holding Price vs Earnings

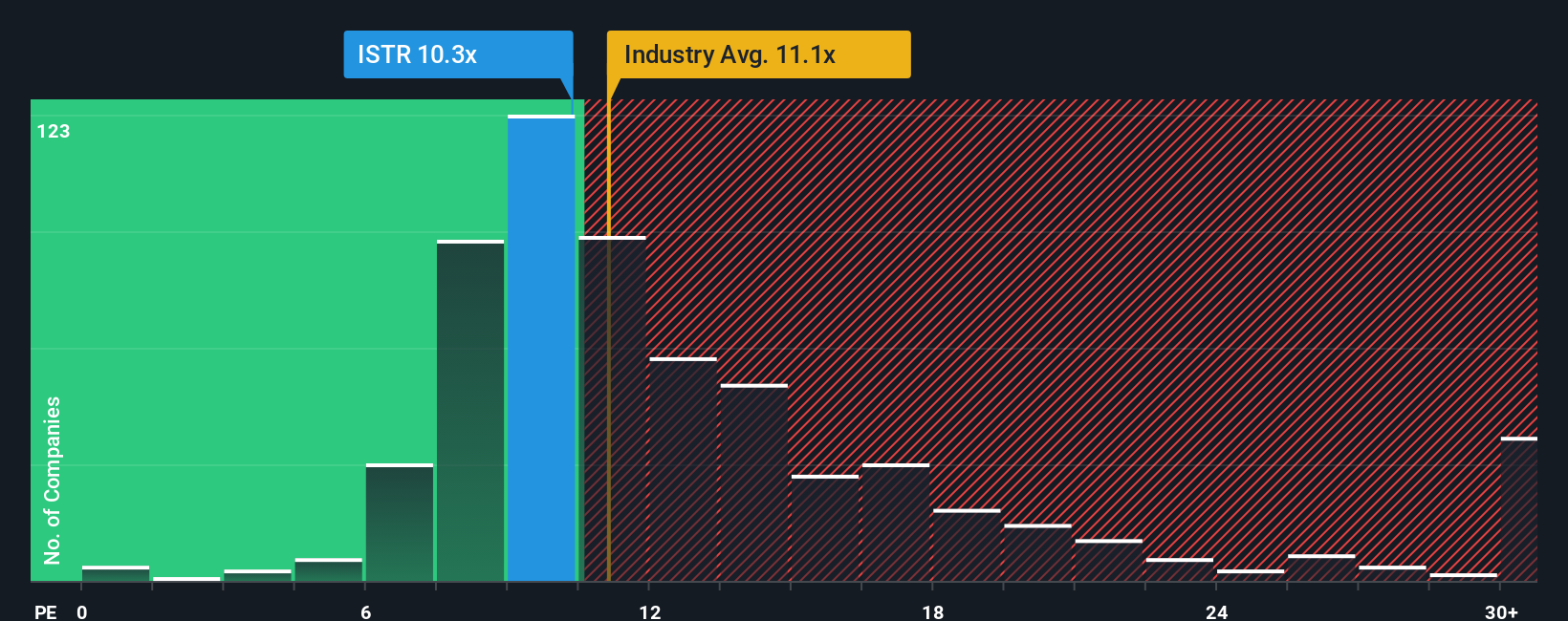

The price-to-earnings (PE) ratio is a preferred valuation metric when analyzing profitable companies like Investar Holding. It reflects how much investors are willing to pay for each dollar of current earnings. This metric is especially relevant for established businesses in steady industries, where profits serve as a strong measure of value and performance.

However, what counts as a "normal" or "fair" PE ratio depends on market expectations for future growth and an assessment of the associated risks. Generally, companies with higher expected growth and lower risk profiles warrant higher PE ratios. In contrast, slower-growing or riskier firms tend to trade at lower multiples.

Currently, Investar Holding trades at a PE ratio of 10.34x, which is below both the industry average of 11.11x and the average among its peers at 16.08x. For a more tailored benchmark, Simply Wall St calculates a proprietary Fair Ratio of 16.31x. This Fair Ratio incorporates not just industry comparisons but also unique factors such as Investar Holding's profit margin, earnings growth, company size, and specific risks. Because it is customized for the company’s full profile, the Fair Ratio provides a more meaningful sense of value than broader industry or peer averages alone.

Given Investar Holding’s current PE of 10.34x compared to a Fair Ratio of 16.31x, the shares appear undervalued by this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1396 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Investar Holding Narrative

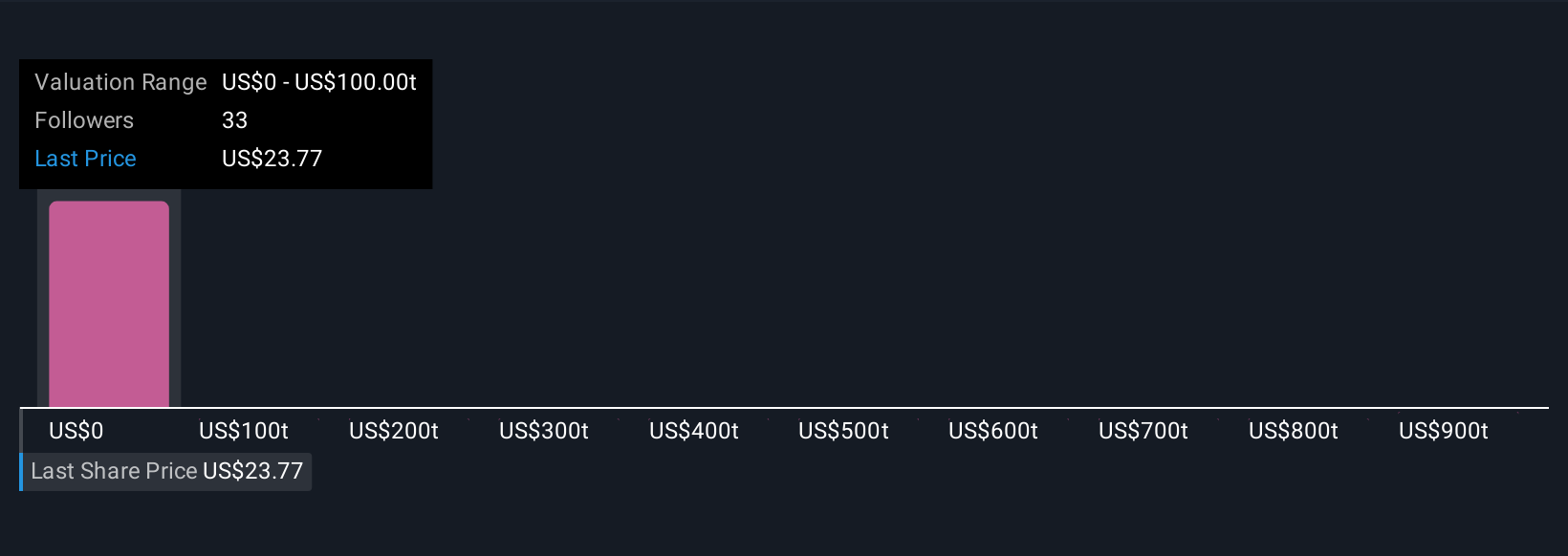

Earlier, we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is your personal story behind a company’s numbers, where you connect your own expectations for future revenue, earnings, and margins to a fair value, giving context to all the data.

Narratives help bring your investment decision to life by linking a company’s story to financial forecasts and then to a fair value estimate. They are straightforward and accessible, featured right on Simply Wall St’s Community page, where millions of investors build and follow Narratives tailored to their own insights.

By creating your own Narrative, you can easily compare your calculated Fair Value with the current market price, making it clear how different factors impact your decision-making process. Narratives update dynamically in response to new information, such as earnings releases or major news, so your outlook always stays relevant.

For example, some investors in the community see Investar Holding’s fair value as substantially higher than today’s price, while others set it lower, based on their different expectations for future growth and profitability.

Do you think there's more to the story for Investar Holding? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ISTR

Investar Holding

Operates as the bank holding company for Investar Bank that provides a range of commercial banking products to individuals, professionals, and small to medium-sized businesses in south Louisiana, southeast Texas, and Alabama in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives