- United States

- /

- Banks

- /

- NasdaqGS:GABC

German American Bancorp (GABC): Exploring Valuation as Shares Drift Despite Rising Revenue and Earnings

Reviewed by Simply Wall St

German American Bancorp (GABC) shares have drifted down nearly 5% over the past three months, even as annual revenue and net income both show solid growth. Investors appear to be weighing the company’s recent financial momentum in relation to broader market trends.

See our latest analysis for German American Bancorp.

While German American Bancorp’s steady annual growth in revenue and net income signals operational strength, the share price has edged down 2.2% year-to-date and delivered a 12.9% total return loss over the past year. This suggests that despite underlying improvement, market sentiment is still catching up or that some investors see renewed risks on the horizon.

If you're weighing your next move, now is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares currently trading at a notable discount to analyst targets, could German American Bancorp now represent an overlooked value play? Or is the market already factoring in all of its future growth prospects?

Price-to-Earnings of 14.2x: Is it justified?

German American Bancorp is currently valued at a price-to-earnings (P/E) ratio of 14.2x, which stands notably above both the industry average and what analysis suggests is a fair level for its earnings profile. With a last close of $37.99, the market is pricing in a premium compared to its peers.

The P/E ratio reflects how much investors are willing to pay today for a dollar of current earnings. This is a common yardstick for banks and financial institutions. A higher P/E can imply expectations for superior growth, stability, or quality, but it can also signal that shares are priced for perfection.

In this case, German American Bancorp’s P/E ratio of 14.2x is above the peer average of 11.8x and also exceeds an estimated fair P/E ratio of 12.1x. This positions the stock at a noticeable premium, hinting that either the market expects continued robust growth or may be overpricing current results relative to benchmarks. Should sentiment shift or growth moderate, the market could move closer to that fair ratio.

Explore the SWS fair ratio for German American Bancorp

Result: Price-to-Earnings of 14.2x (OVERVALUED)

However, broader market uncertainty and the stock's current premium relative to peers could present challenges to sustained upside in the near term.

Find out about the key risks to this German American Bancorp narrative.

Another View: Discounted Cash Flow Signals Undervaluation

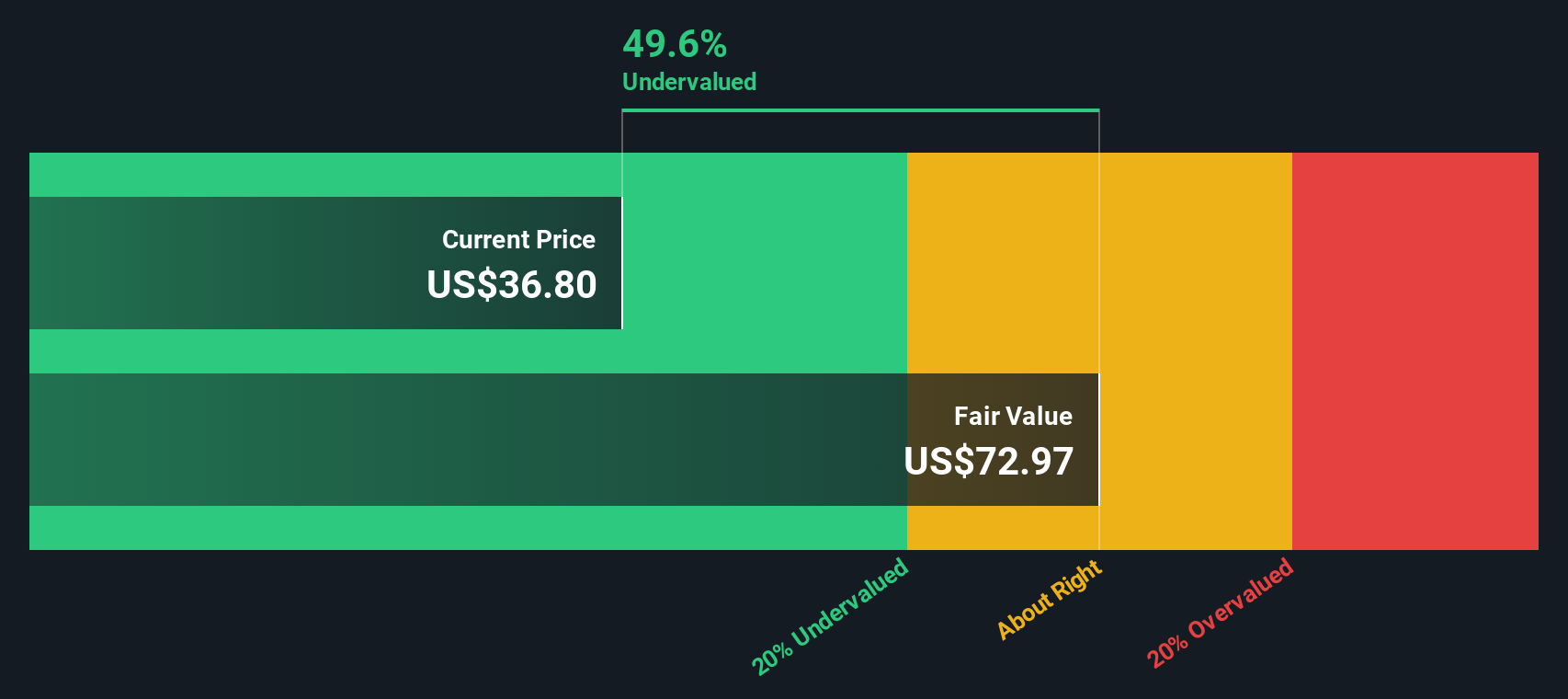

While the current price-to-earnings multiple presents German American Bancorp as expensive relative to peers, our DCF model offers a sharply different perspective. According to this approach, shares are trading 48% below the model's fair value estimate of $73.43. This suggests the market may be overlooking significant long-term value. Which view will prove more accurate over time?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out German American Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 895 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own German American Bancorp Narrative

If you have a different perspective or want to dig deeper into the numbers, you can easily build your own narrative in just a few minutes. Do it your way

A great starting point for your German American Bancorp research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Your next winning pick could be just a click away. Join thousands of smart investors finding standout stocks and new opportunities before the rest of the market catches on.

- Unlock unique growth potential by starting with these 27 AI penny stocks that power innovation in artificial intelligence.

- Boost your steady income and long-term security by checking out these 15 dividend stocks with yields > 3% offering proven high yields above 3%.

- Seize undervalued gems hidden in plain sight with these 895 undervalued stocks based on cash flows, which screens for lasting value and market mispricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GABC

German American Bancorp

Operates as a financial holding company for German American Bank that provides retail and commercial banking, and health management services.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives