- United States

- /

- Banks

- /

- NasdaqGS:EBC

Eastern Bankshares (EBC): Valuation in Focus After Activist Urges Strategic Review and Board Shake-Up

Reviewed by Simply Wall St

Eastern Bankshares (EBC) is in the spotlight after HoldCo Asset Management publicly challenged its board to consider selling the company instead of pursuing more acquisitions. The move highlights shareholder concerns.

See our latest analysis for Eastern Bankshares.

The activist pressure arrives just as Eastern Bankshares’ share price shows signs of gathering momentum, with a strong 90-day share price return of nearly 13% despite some choppiness over the past month. Looking a bit further out, the one-year total shareholder return sits at 8.9%. The stock’s longer-term track record remains solid. Recent headlines about activist involvement, board changes, earnings improvements, and a fresh buyback program have all kept investors on their toes and could continue to drive sentiment in the coming months.

If you’re looking to expand beyond the usual names, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock still trading below analysts’ price targets and fresh strategic debate swirling, investors now face a pivotal decision: is this the entry point for value seekers, or is the market already factoring in the company’s next phase of growth?

Most Popular Narrative: 21.5% Undervalued

Eastern Bankshares' consensus narrative puts its fair value well above the recent closing price, highlighting the disconnect between analyst projections and current trading levels.

The successful merger with Cambridge Trust and its integration into Eastern Bankshares creates a stronger organization with enhanced service offerings. This is expected to drive future revenue and earnings growth, particularly in the Greater Boston, Eastern Massachusetts, and New Hampshire markets.

Want to uncover why a regional bank commands a premium more common among high-flying growth companies? The full narrative reveals bold assumptions about explosive revenue and margin expansion, setting up a valuation outlook that could surprise even seasoned bank investors.

Result: Fair Value of $22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, mounting concerns over commercial real estate loan performance and recent merger-related volatility could quickly challenge the upbeat outlook for Eastern Bankshares.

Find out about the key risks to this Eastern Bankshares narrative.

Another View: The Market Ratios Angle

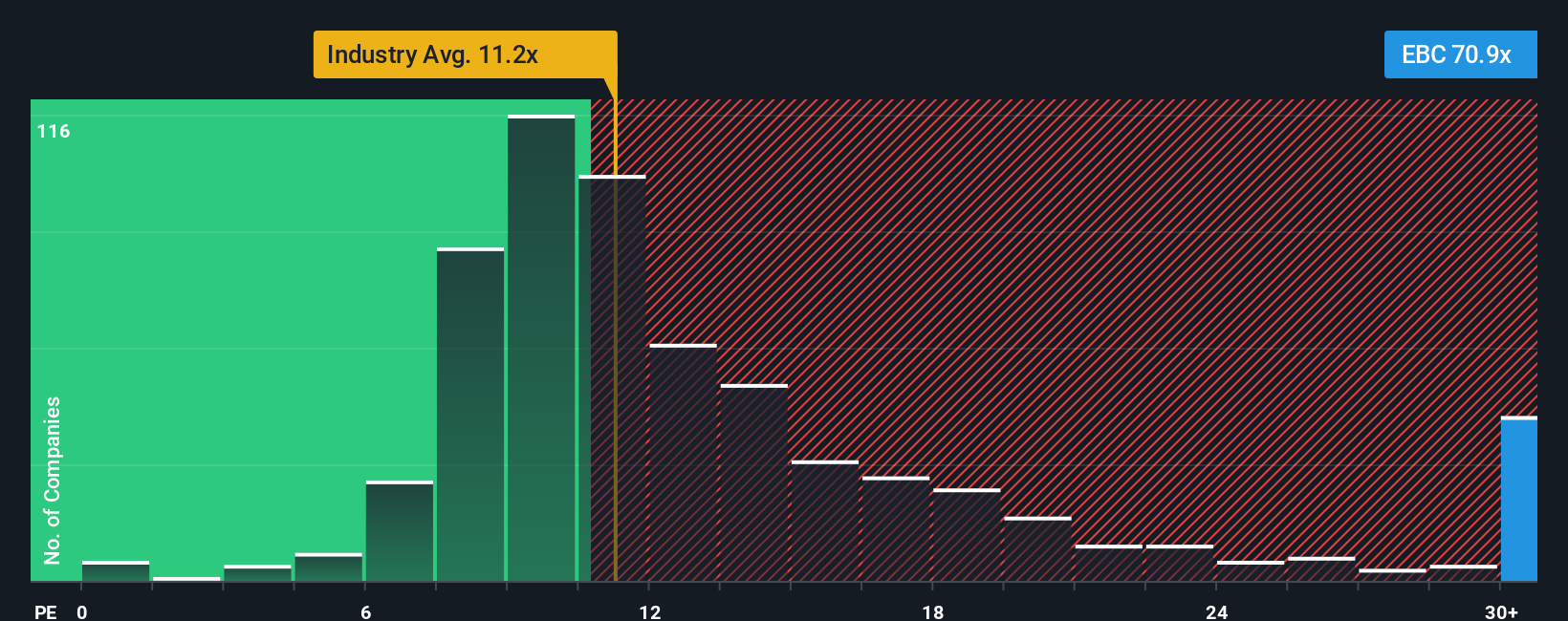

Looking beyond fair value estimates, Eastern Bankshares is trading at a strikingly high price-to-earnings ratio of 69.4x, which is significantly higher than both the US Banks sector average of 11x and its peers at 14.4x. The so-called fair ratio for this company currently stands at just 35.1x. This sharp gap suggests investors may be paying a premium that the business will need to justify over time. Is the market being too optimistic about future growth, or could this multiple shift if sentiment changes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eastern Bankshares Narrative

If you think the story could play out differently, or want to dive into the numbers yourself, it’s easy to shape your own perspective in just a few minutes. Do it your way

A great starting point for your Eastern Bankshares research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stop waiting for opportunities to come to you. The Simply Wall Street Screener finds stocks most investors overlook, so you can seize the next big move before others.

- Capitalize on high yields by searching for consistent income with these 18 dividend stocks with yields > 3%, and spot companies offering reliable cash returns above 3%.

- Get ahead of the curve on tomorrow’s tech trends by targeting breakthrough innovators among these 28 quantum computing stocks, making your portfolio future-ready.

- Pinpoint outstanding bargains using these 843 undervalued stocks based on cash flows to uncover companies the market has mispriced based on strong underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastern Bankshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EBC

Eastern Bankshares

Operates as the bank holding company for Eastern Bank that provides banking, trust, and investment services to retail, commercial, and small business customers.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives