- United States

- /

- Banks

- /

- NasdaqGS:BOKF

BOK Financial (BOKF): Assessing Valuation Following Recent Share Price Drift

Reviewed by Simply Wall St

BOK Financial (BOKF) shares have been drifting lower over the past month, with the stock down about 4%. Investors may be weighing mixed signals coming from recent financial results and broader market sentiment.

See our latest analysis for BOK Financial.

BOK Financial's share price has seen a modest pullback lately, continuing a trend of fading momentum since the start of the year. Over the past 12 months, the company delivered a total shareholder return of -8.04%, which lags its strong 5-year result of 66.4% as investors assess both growth potential and emerging risks in the banking sector.

If you're interested in broadening your scope beyond banks, it's a great time to discover fast growing stocks with high insider ownership.

With shares now trading at a roughly 15% discount to analyst price targets and valuation measures showing some room for upside, the question for investors is clear: Is BOK Financial undervalued, or is the market accurately factoring in its future growth?

Most Popular Narrative: 13.1% Undervalued

BOK Financial's most widely followed narrative suggests its fair value stands at $118.70, which is a notable gap above the current share price of $103.16. This narrative frames the company's prospects through the lens of regional expansion, improving deposit mix, and shareholder-focused capital management.

"Strategic expansion into growth regions and enhanced digital banking drive operational efficiencies, increased loan activity, and resilient earnings diversification. Robust wealth management fueled by demographic trends and strong fee income streams supports sustained, stable growth amid shifting economic conditions."

Why do analysts see more upside for BOK Financial than the market? The answer lies in ambitious growth targets, stable margins, and an earnings forecast that may surprise even experienced investors. Want to see how these numbers add up to a bullish price target? Dive into the narrative’s core projections; you could be missing a key detail that drives the valuation higher.

Result: Fair Value of $118.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a downturn in key regional economies or weaker loan quality could quickly challenge the upbeat growth outlook and shift market sentiment for BOK Financial.

Find out about the key risks to this BOK Financial narrative.

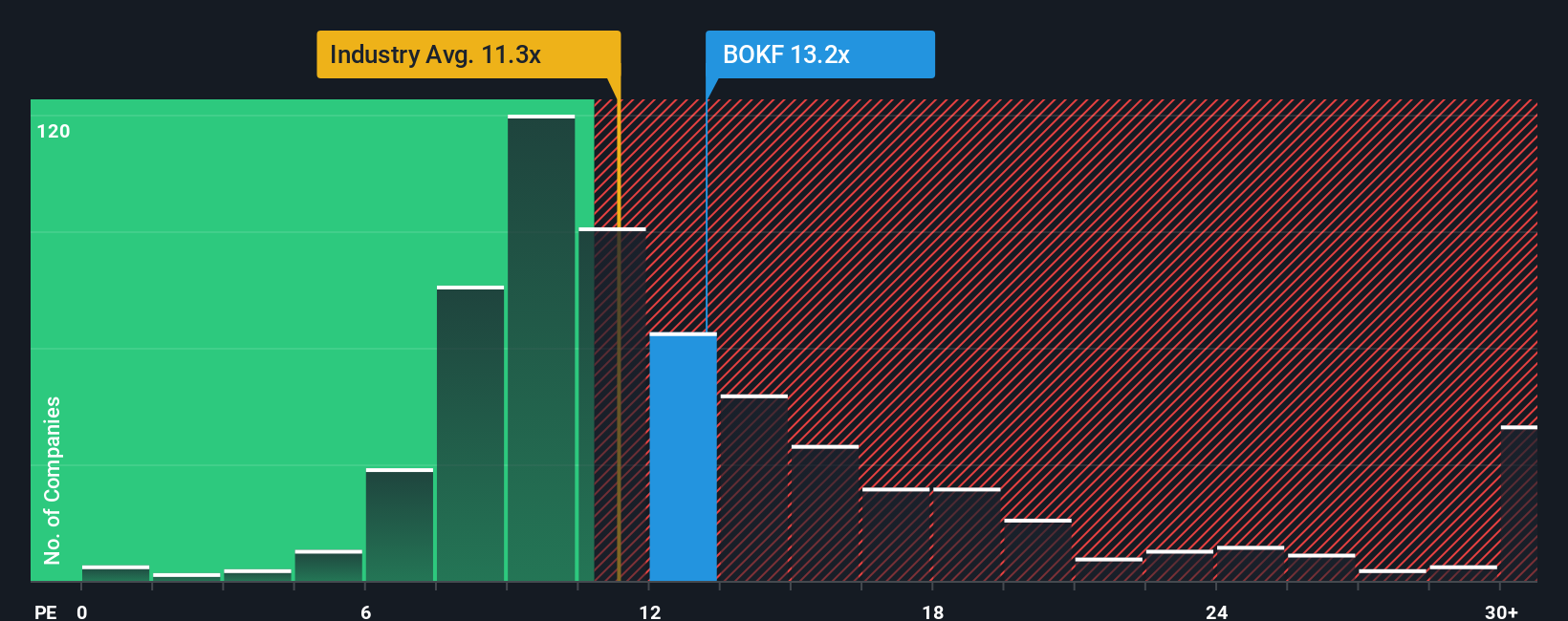

Another View: Multiples Tell a Different Story

Looking through the lens of price-to-earnings, BOK Financial trades at 12.3x, higher than the US Banks industry average of 11.2x, its peers at 12x, and above the fair ratio of 11x. This comparison suggests the shares might be a bit expensive versus typical industry norms. Could these valuation gaps signal more caution is warranted, or are investors right to pay a premium for BOK Financial’s potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BOK Financial Narrative

If you see the story differently or want to chart your own perspective, you’re invited to analyze the numbers for yourself and build a custom outlook in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding BOK Financial.

Looking for more investment ideas?

Sharpen your portfolio strategy and seize your edge with Simply Wall Street’s powerful screeners, which reveal hidden gems and big opportunities that others may overlook. Don’t let great stocks pass you by.

- Boost your long-term income by scanning for these 18 dividend stocks with yields > 3% with yields above 3%, giving your portfolio consistent cash flow alongside growth potential.

- Tap into the future of medicine by seeking out these 31 healthcare AI stocks making waves in digital health, diagnostics, and personalized care powered by artificial intelligence.

- Get ahead of market trends by tracking these 899 undervalued stocks based on cash flows that our models show as trading below their true worth, putting value right within your reach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BOK Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BOKF

BOK Financial

Operates as the financial holding company for BOKF, NA that provides various financial products and services in Oklahoma, Texas, New Mexico, Northwest Arkansas, Colorado, Arizona, and Kansas/Missouri.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives