- United States

- /

- Banks

- /

- NasdaqGS:BFIN

BankFinancial (BFIN) Margin Miss Reinforces Concerns Over Elevated Valuation

Reviewed by Simply Wall St

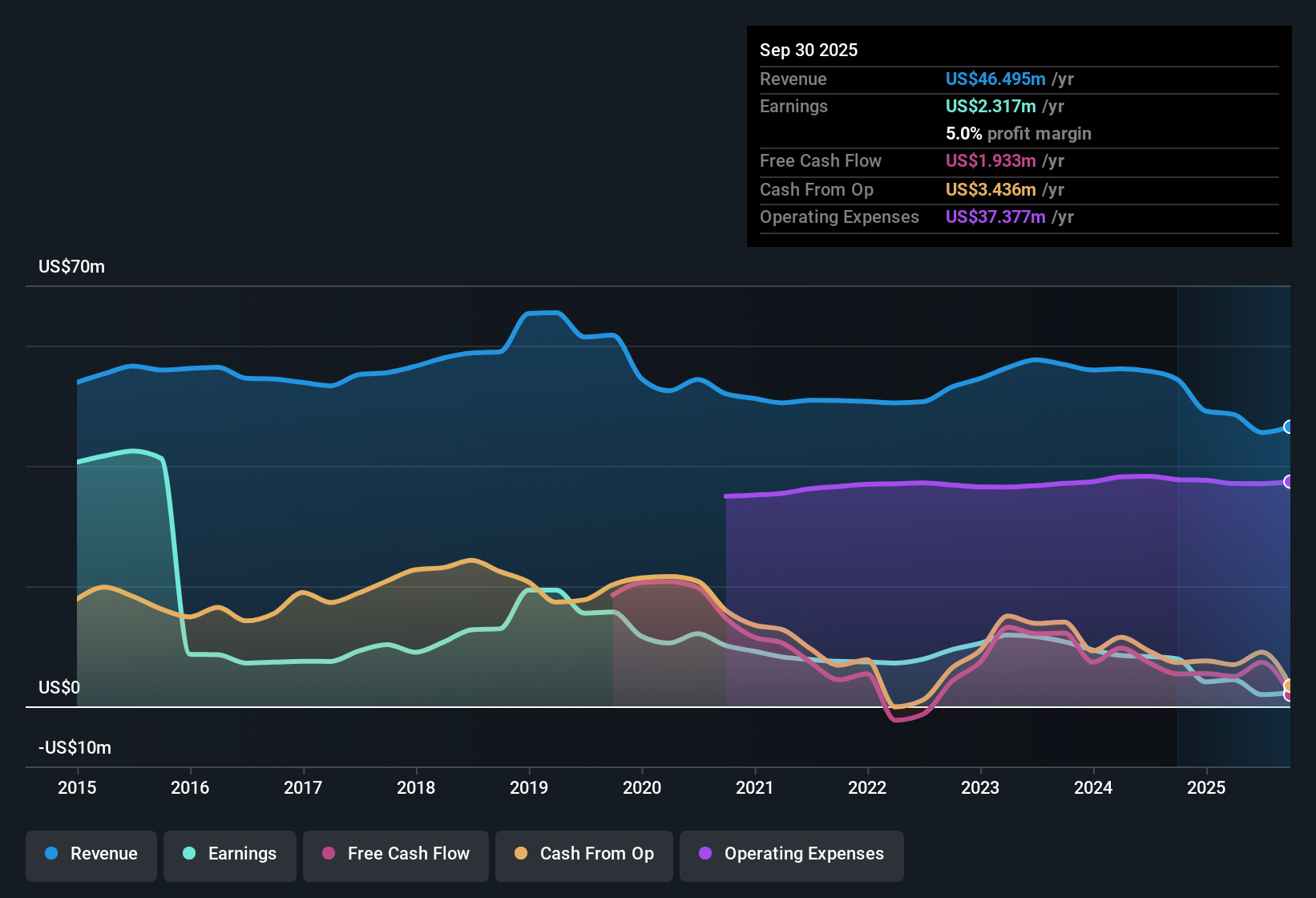

BankFinancial (BFIN) posted net profit margins of 4.3%, down sharply from 14.9% a year earlier, highlighting a significant deterioration in profitability. Over the past five years, the company’s earnings have declined at an average annual rate of 8.8%. The stock trades at $11.07, giving it a Price-To-Earnings Ratio of 70.7x, which is well above the peer average of 12x and the US Banks industry average of 11x. Its share price remains higher than the estimated fair value of $8.97. Margins have compressed and top-line growth remains elusive, leaving valuation on a cautious footing despite the company’s reputation for high quality earnings.

See our full analysis for BankFinancial.The next section puts these headline results next to the dominant narratives in the market, revealing which expectations hold up and where the consensus might be off the mark.

Curious how numbers become stories that shape markets? Explore Community Narratives

DCF Fair Value Sits Below Current Price

- BankFinancial’s share price of $11.07 remains above its DCF fair value estimate of $8.97, highlighting a market premium of more than 23% over the fundamental valuation model.

- The prevailing market view stresses that when a stock trades well above its calculated fair value, especially without visible profit growth, investors face a tougher investment case.

- This valuation gap draws scrutiny, particularly as sector peers trade at lower Price-To-Earnings Ratios. This puts the spotlight on whether quality alone justifies paying up.

- Market watchers note that without signs of top-line rebound or margin recovery, premium pricing could signal heightened risk rather than untapped upside.

- Curious how numbers become stories that shape markets? Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Compress Sharply Year on Year

- Net profit margins fell to 4.3% from 14.9% the previous year, pointing to a significant reduction in efficiency and bottom-line resilience.

- According to the prevailing market view, this steep drop contradicts hopes that BankFinancial can maintain its reputation for consistently high-quality earnings.

- Such margin pressure may cause cautious investors to reconsider, since sector peers have not typically faced compression this severe.

- For value-focused investors, weak profitability combined with high valuations undercuts the argument for a “safer” regional play.

Five-Year Earnings Decline Poses Growth Question

- Earnings have decreased at an average annual rate of 8.8% over the past five years, reaffirming a multi-year contraction that overshadows short-term volatility.

- The prevailing market view holds that this persistent decline challenges notions of stability, and without a turnaround in trend, long-term growth optimism seems out of reach.

- Bulls who emphasize balance sheet quality face direct tension from these figures, since even strong fundamentals have not delivered sustained profit improvement.

- With revenue growth elusive and no evidence of renewed dividend support, the long-term trajectory may weigh heavily on valuation debates.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on BankFinancial's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

BankFinancial faces persistent earnings declines, falling profit margins, and trades at a premium valuation. This raises questions about its long-term growth prospects.

If you want more value for your money and lower valuation risk, use these 839 undervalued stocks based on cash flows to find stocks that offer stronger fundamentals at a better price point.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BankFinancial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BFIN

BankFinancial

Operates as the bank holding company for BankFinancial, National Association that provides banking, financial planning, and fiduciary services to individuals, families, and businesses.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives