- United States

- /

- Banks

- /

- NasdaqCM:ATLO

Shareholders Will Probably Not Have Any Issues With Ames National Corporation's (NASDAQ:ATLO) CEO Compensation

Shareholders may be wondering what CEO John Nelson plans to do to improve the less than great performance at Ames National Corporation (NASDAQ:ATLO) recently. At the next AGM coming up on 28 April 2021, they can influence managerial decision making through voting on resolutions, including executive remuneration. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. We think CEO compensation looks appropriate given the data we have put together.

See our latest analysis for Ames National

Comparing Ames National Corporation's CEO Compensation With the industry

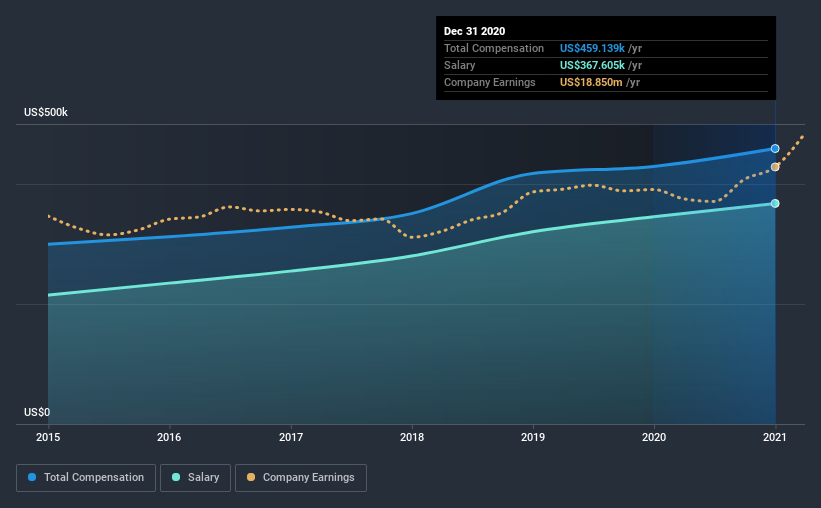

Our data indicates that Ames National Corporation has a market capitalization of US$230m, and total annual CEO compensation was reported as US$459k for the year to December 2020. That's just a smallish increase of 6.9% on last year. Notably, the salary which is US$367.6k, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations ranging from US$100m to US$400m, the reported median CEO total compensation was US$777k. Accordingly, Ames National pays its CEO under the industry median. Furthermore, John Nelson directly owns US$291k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$368k | US$345k | 80% |

| Other | US$92k | US$84k | 20% |

| Total Compensation | US$459k | US$429k | 100% |

Speaking on an industry level, nearly 42% of total compensation represents salary, while the remainder of 58% is other remuneration. Ames National pays out 80% of remuneration in the form of a salary, significantly higher than the industry average. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Ames National Corporation's Growth

Ames National Corporation's earnings per share (EPS) grew 15% per year over the last three years. Its revenue is up 17% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Ames National Corporation Been A Good Investment?

Given the total shareholder loss of 0.9% over three years, many shareholders in Ames National Corporation are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

The lacklustre share price returns is rather divergent to the robust growth in EPS, suggesting that there may be other factors weighing on it apart from fundamentals. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board and assess if the board's plan is likely to improve company performance.

CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling Ames National (free visualization of insider trades).

Switching gears from Ames National, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Ames National or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:ATLO

Ames National

Operates as a multi-bank holding company that provides banking products and services primarily in Boone, Clarke, Hancock, Marshall, Polk, Story, Taylor, and Union Counties in central, north-central, and south-central Iowa.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives