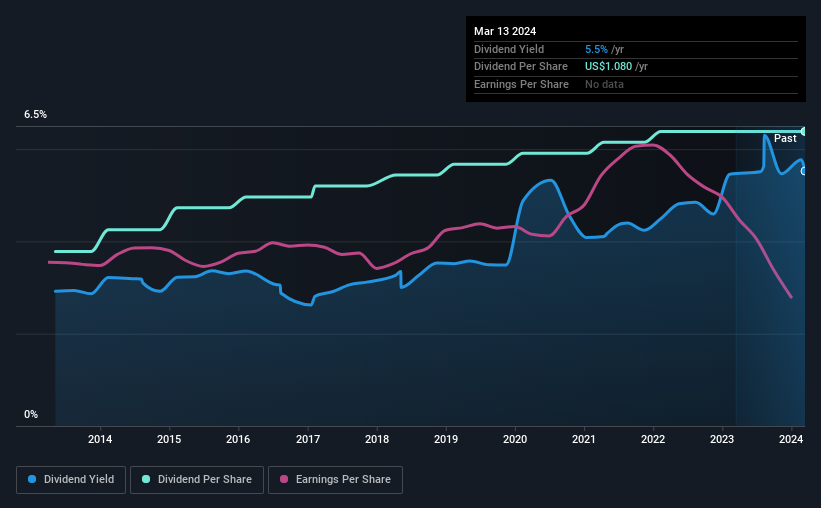

Ames National Corporation (NASDAQ:ATLO) has announced that it will pay a dividend of $0.27 per share on the 15th of May. This makes the dividend yield 5.5%, which will augment investor returns quite nicely.

View our latest analysis for Ames National

Ames National Not Expected To Earn Enough To Cover Its Payments

If the payments aren't sustainable, a high yield for a few years won't matter that much.

Ames National has established itself as a dividend paying company with over 10 years history of distributing earnings to shareholders. Based on Ames National's last earnings report, the payout ratio is at a decent 90%, meaning that the company is able to pay out its dividend with a bit of room to spare.

Looking forward, EPS could fall by 8.0% if the company can't turn things around from the last few years. If the dividend continues along recent trends, we estimate the future payout ratio could reach 103%, which could put the dividend in jeopardy if the company's earnings don't improve.

Ames National Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2014, the dividend has gone from $0.64 total annually to $1.08. This works out to be a compound annual growth rate (CAGR) of approximately 5.4% a year over that time. Companies like this can be very valuable over the long term, if the decent rate of growth can be maintained.

Dividend Growth Is Doubtful

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, initial appearances might be deceiving. In the last five years, Ames National's earnings per share has shrunk at approximately 8.0% per annum. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends.

The Dividend Could Prove To Be Unreliable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. In the past the payments have been stable, but we think the company is paying out too much for this to continue for the long term. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 2 warning signs for Ames National you should be aware of, and 1 of them is potentially serious. Is Ames National not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ATLO

Ames National

Operates as a multi-bank holding company that provides banking products and services primarily in Boone, Clarke, Hancock, Marshall, Polk, Story, Taylor, and Union Counties in central, north-central, and south-central Iowa.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth