Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in THOR Industries (NYSE:THO). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for THOR Industries

THOR Industries' Improving Profits

THOR Industries has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. In impressive fashion, THOR Industries' EPS grew from US$11.93 to US$21.20, over the previous 12 months. Year on year growth of 78% is certainly a sight to behold. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that THOR Industries is growing revenues, and EBIT margins improved by 2.0 percentage points to 9.4%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

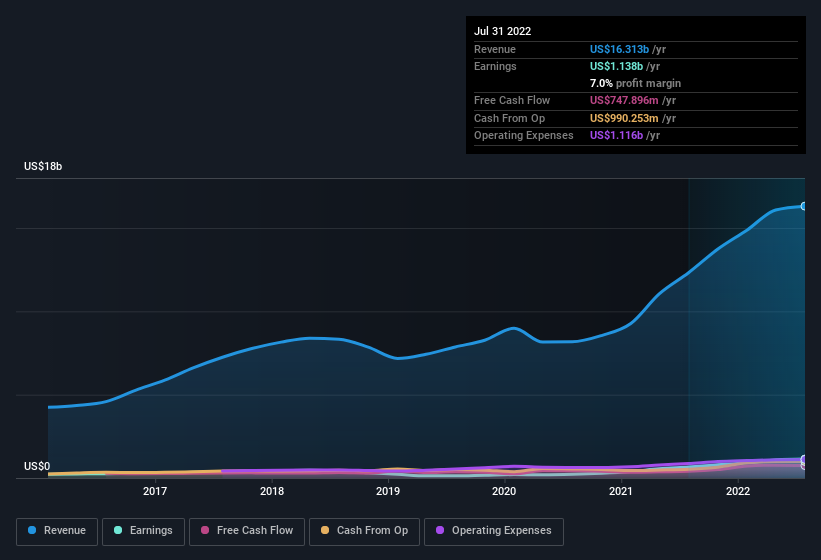

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of THOR Industries' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are THOR Industries Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's pleasing to note that insiders spent US$5.6m buying THOR Industries shares, over the last year, without reporting any share sales whatsoever. Buying like that is a fantastic look for the company and should rouse the market in anticipation for the future. It is also worth noting that it was Co-Founder & Chairman Emeritus Peter Orthwein who made the biggest single purchase, worth US$1.5m, paying US$72.50 per share.

Along with the insider buying, another encouraging sign for THOR Industries is that insiders, as a group, have a considerable shareholding. Notably, they have an enviable stake in the company, worth US$202m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Should You Add THOR Industries To Your Watchlist?

THOR Industries' earnings per share have been soaring, with growth rates sky high. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest THOR Industries belongs near the top of your watchlist. Still, you should learn about the 3 warning signs we've spotted with THOR Industries (including 1 which is significant).

Keen growth investors love to see insider buying. Thankfully, THOR Industries isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if THOR Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:THO

THOR Industries

Designs, manufactures, and sells recreational vehicles (RVs), and related parts and accessories in the United States, Germany, Canada, rest of Europe, and internationally.

Flawless balance sheet average dividend payer.