- United States

- /

- Auto Components

- /

- NYSE:PHIN

PHINIA Inc. (NYSE:PHIN) Stock Goes Ex-Dividend In Just Four Days

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that PHINIA Inc. (NYSE:PHIN) is about to go ex-dividend in just 4 days. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Meaning, you will need to purchase PHINIA's shares before the 25th of November to receive the dividend, which will be paid on the 13th of December.

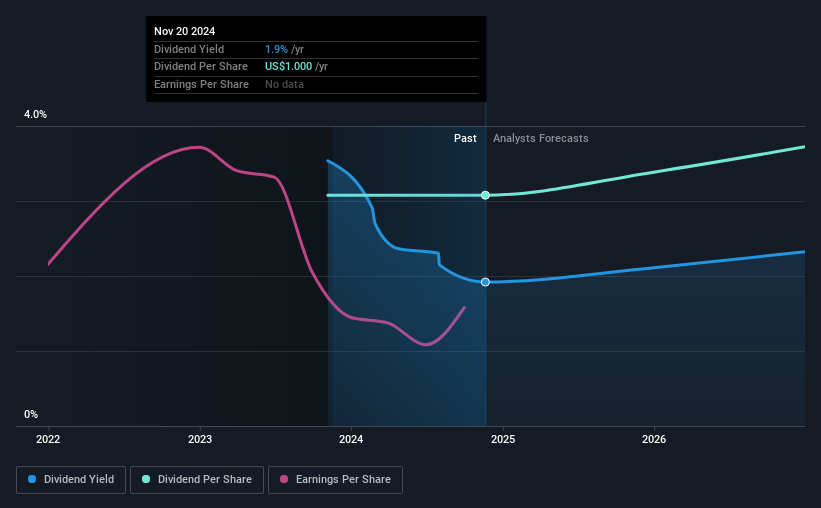

The company's next dividend payment will be US$0.25 per share, on the back of last year when the company paid a total of US$1.00 to shareholders. Based on the last year's worth of payments, PHINIA stock has a trailing yield of around 1.9% on the current share price of US$52.11. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for PHINIA

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. That's why it's good to see PHINIA paying out a modest 42% of its earnings. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Luckily it paid out just 25% of its free cash flow last year.

It's positive to see that PHINIA's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. With that in mind, we're discomforted by PHINIA's 23% per annum decline in earnings in the past three years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

Given that PHINIA has only been paying a dividend for a year, there's not much of a past history to draw insight from.

The Bottom Line

Should investors buy PHINIA for the upcoming dividend? Earnings per share are down meaningfully, although at least the company is paying out a low and conservative percentage of both its earnings and cash flow. It's definitely not great to see earnings falling, but at least there may be some buffer before the dividend needs to be cut. Overall we're not hugely bearish on the stock, but there are likely better dividend investments out there.

Wondering what the future holds for PHINIA? See what the three analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PHIN

PHINIA

Engages in the development, design, and manufacture of integrated components and systems that optimize performance, increase efficiency, and reduce emissions in combustion and hybrid propulsion for commercial and light vehicles, and industrial applications.

Excellent balance sheet and fair value.