- United States

- /

- Auto Components

- /

- NYSE:MOD

Is Modine Manufacturing’s Stock Run Justified After Move Into Energy Efficiency in 2025?

Reviewed by Bailey Pemberton

- Wondering if Modine Manufacturing is trading at a bargain or if its recent run has pushed it past fair value? You are not alone, and it makes sense to take a closer look if you are eyeing this stock.

- The share price has been on a rollercoaster, up 8.0% over the past week, but still down 11.3% over the last month. Year-to-date, Modine is up an impressive 19.7%, even though it has slipped by 1.1% over the past year.

- Behind these moves, recent headlines have highlighted Modine’s continued momentum in thermal management solutions and its expansion into electrification and energy efficiency markets. These shifts are grabbing investor attention and adding new context to the company’s stock performance.

- On traditional valuation checks, Modine Manufacturing scores a 3 out of 6 for being undervalued, which is a solid starting point for any analysis. We will break down what this means across a few different valuation methods, but stay tuned, as the most insightful approach might be one you have not considered yet.

Find out why Modine Manufacturing's -1.1% return over the last year is lagging behind its peers.

Approach 1: Modine Manufacturing Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today's value. This method aims to reflect what those future dollars are worth in current terms, considering both analyst forecasts and longer-term projections.

For Modine Manufacturing, the most recent free cash flow reported is $53.0 Million. Analysts expect strong growth, with projected free cash flow reaching $362.4 Million by 2028. Beyond the next five years, Simply Wall St extrapolates forecasts, suggesting Modine’s annual cash flow could potentially surpass $900 Million by 2035 if the growth trend continues.

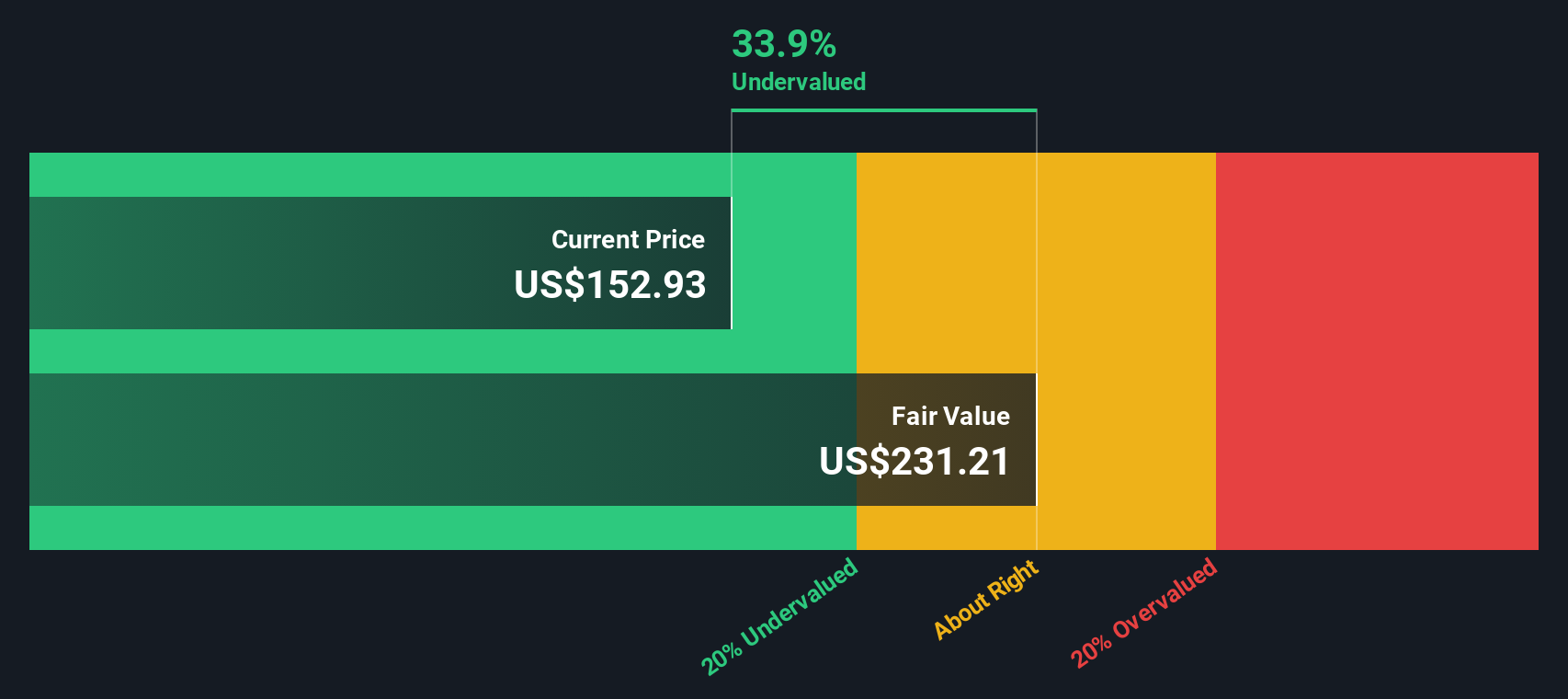

According to the DCF calculation, using the 2 Stage Free Cash Flow to Equity model, the intrinsic value for Modine Manufacturing is $216.93 per share. This figure represents a 35.9% discount to the current share price, indicating the stock is significantly undervalued by this method.

In simple terms, if Modine's estimated growth and future cash flows come to fruition, the current share price does not fully reflect the company’s long-term earnings power.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Modine Manufacturing is undervalued by 35.9%. Track this in your watchlist or portfolio, or discover 919 more undervalued stocks based on cash flows.

Approach 2: Modine Manufacturing Price vs Earnings

The Price-to-Earnings (PE) ratio is widely recognized as one of the best tools for valuing profitable companies, as it directly compares a company’s share price with its earnings power. This makes it particularly useful for understanding how much investors are willing to pay for each dollar of earnings today.

What counts as a “normal” or “fair” PE ratio is partly shaped by a company’s expected earnings growth and the risks it faces. Typically, faster-growing companies or those with less risk trade at higher PE multiples, while slower or riskier businesses earn discounts.

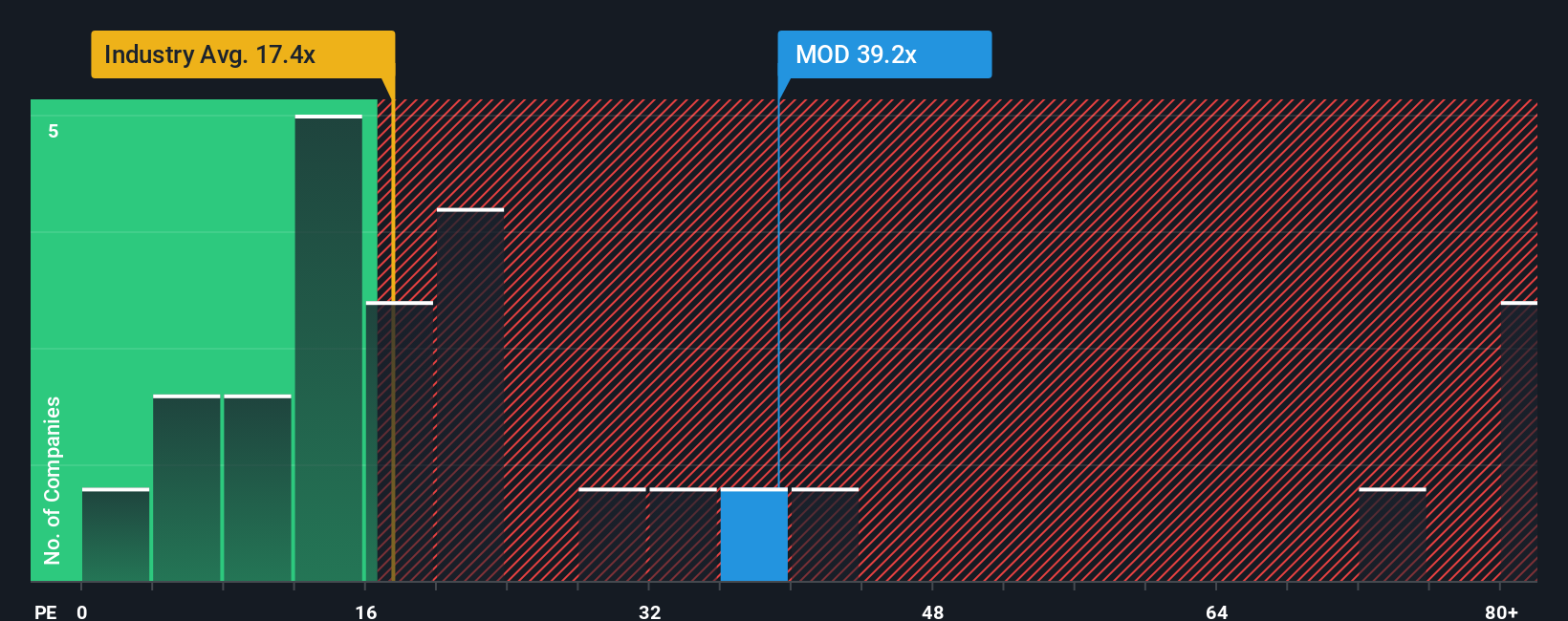

Currently, Modine Manufacturing trades at a PE ratio of 39.3x. That stands well above the Auto Components industry average of 22.7x and the peer average of 25.1x, suggesting the market is expecting above-average earnings growth or rewards Modine for lower perceived risk. However, benchmarks alone can miss important company-specific factors.

This is why Simply Wall St’s “Fair Ratio” is insightful, as it estimates what Modine’s PE should be by weighing earnings growth, profit margins, market cap, industry trends, and risk. For Modine, the Fair Ratio is 30.0x. Unlike simple peer or industry comparisons, this custom benchmark adjusts for what makes Modine unique in its sector.

Comparing Modine’s actual multiple of 39.3x to the Fair Ratio of 30.0x, the stock trades noticeably above its custom fair valuation based on these metrics. This suggests investors are pricing in more optimism than the fundamentals account for right now.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1423 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Modine Manufacturing Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, yet powerful, way for investors to combine their view of a company’s story—from anticipated growth and business changes to perceived risks—with the actual numbers, such as their own forecasts for revenue, earnings, and margins. Instead of just relying on standard models, Narratives help you link Modine Manufacturing’s real-world developments directly to a financial forecast and a resulting fair value, giving meaning to the numbers behind the share price.

Narratives are available right on Simply Wall St’s Community page, used by millions of investors, and are designed so anyone can easily create and share their perspective, no matter their experience level. The real strength of Narratives is their dynamism. Your estimates and fair value update automatically with new earnings or breaking news, so your decision to buy or sell keeps pace with reality. For example, one investor may tell Modine’s story around surging data center demand with a bullish $185 price target, while another could focus on execution risk and margin pressures to justify the lowest $145 target. Both views are anchored in specific forecasts for revenue, earnings, and industry events.

Do you think there's more to the story for Modine Manufacturing? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOD

Modine Manufacturing

Designs, engineers, tests, manufactures, and sells mission-critical thermal solutions in the United States, Canada, Italy, Hungary, the United Kingdom, China, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives