- United States

- /

- Auto Components

- /

- NYSE:LEA

Will Lear's (LEA) Elevated 2025 Guidance and Cash Flow Shift Its Long-Term Growth Narrative?

Reviewed by Sasha Jovanovic

- On October 31, 2025, Lear Corporation raised its full-year 2025 earnings guidance, projecting net sales between US$22.85 billion and US$23.15 billion, alongside third-quarter results showing a 2% year-over-year revenue increase despite industry disruptions.

- The company cited accelerated share repurchases, robust operating cash flow, ongoing innovation in its E-Systems segment, and a US$1.2 billion future sales backlog as key drivers supporting its optimistic outlook.

- We'll explore how Lear's raised full-year guidance and strong cash generation impact its investment narrative and growth outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Lear Investment Narrative Recap

To be a shareholder in Lear Corporation, you need to believe the company can outperform through cyclical auto industry swings by capitalizing on vehicle electrification and digital manufacturing, while defending its margin despite pricing and input cost pressures. The company’s recent guidance increase, underpinned by healthy cash flow and strong E-Systems orders, is a positive, but it does not fundamentally alter the short-term catalyst, the need for increased new program awards, and the risk from potential declines in customer platform volumes remains unchanged.

One of the most relevant recent announcements is Lear’s robust third-quarter operating cash flow, which was among its highest ever. This cash strength not only supported accelerated share buybacks but also provided flexibility amid ongoing restructuring costs, reinforcing the company’s stability as it works through industry disruptions and executes on high-value EV programs.

But with all this momentum, investors should still watch for fallout from weaker volumes on major customer platforms and what that could mean for...

Read the full narrative on Lear (it's free!)

Lear's outlook projects $24.7 billion in revenue and $1.0 billion in earnings by 2028. This assumes 2.5% annual revenue growth and a $530 million increase in earnings from the current $469.8 million.

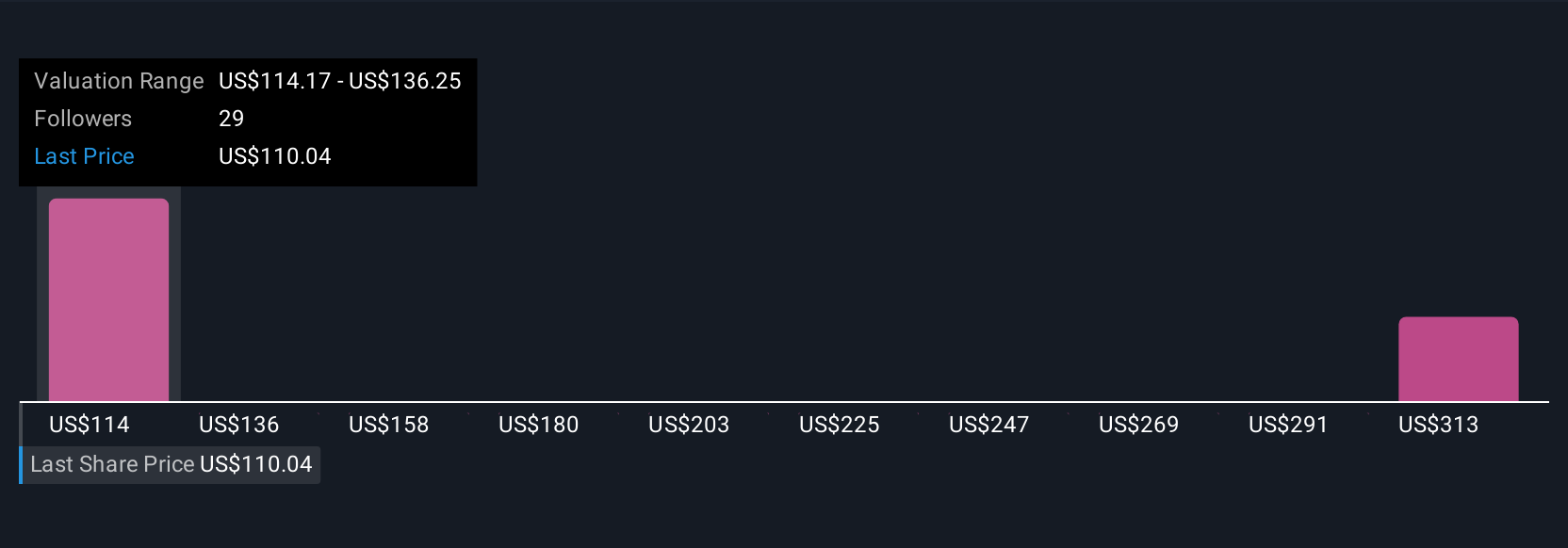

Uncover how Lear's forecasts yield a $115.92 fair value, a 11% upside to its current price.

Exploring Other Perspectives

You’ll find US$115.92 to US$144.53 in fair value estimates from just two Simply Wall St Community members. Some expect recent E-Systems innovation wins to boost revenue per vehicle but potential declines in core platform volumes could affect the path forward, see how other investors compare these signals.

Explore 2 other fair value estimates on Lear - why the stock might be worth as much as 38% more than the current price!

Build Your Own Lear Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lear research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Lear research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lear's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEA

Lear

Designs, develops, engineers, manufactures, assembles, and supplies automotive seating, and electrical distribution systems and related components for automotive original equipment manufacturers in North America, Europe, Africa, Asia, and South America.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives