- United States

- /

- Auto Components

- /

- NYSE:DAN

Improved Revenues Required Before Dana Incorporated (NYSE:DAN) Shares Find Their Feet

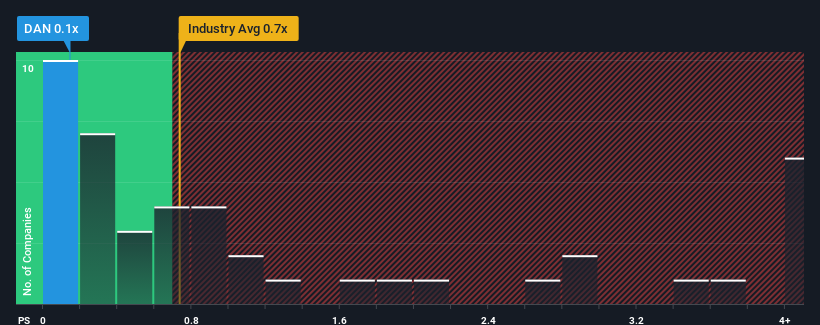

Dana Incorporated's (NYSE:DAN) price-to-sales (or "P/S") ratio of 0.1x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Auto Components industry in the United States have P/S ratios greater than 0.7x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Dana

What Does Dana's Recent Performance Look Like?

Dana's revenue growth of late has been pretty similar to most other companies. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Keen to find out how analysts think Dana's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Dana?

In order to justify its P/S ratio, Dana would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Regardless, revenue has managed to lift by a handy 24% in aggregate from three years ago, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 1.7% over the next year. Meanwhile, the rest of the industry is forecast to expand by 8.5%, which is noticeably more attractive.

In light of this, it's understandable that Dana's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Dana's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Dana that you should be aware of.

If these risks are making you reconsider your opinion on Dana, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DAN

Dana

Provides power-conveyance and energy-management solutions for vehicles and machinery in North America, Europe, South America, and the Asia Pacific.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives