- United States

- /

- Auto Components

- /

- NYSE:DAN

Assessing Dana’s (DAN) Valuation Following Strong Year-to-Date Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Dana.

Dana’s 1-month share price return of nearly 6% adds to a compelling year-to-date rally, with momentum still positive despite some recent volatility. The 1-year total shareholder return of over 160% highlights how much enthusiasm has built around the stock’s turnaround.

Curious how other auto manufacturers are performing? Now’s a great time to discover See the full list for free.

With shares surging in recent months and trading roughly 30% below average analyst price targets, the big question for investors is whether Dana’s turnaround potential is still undervalued or if expectations for future growth are already reflected in the current price.

Most Popular Narrative: 23.5% Undervalued

With Dana trading at $20, the current narrative pegs fair value much higher. That gap points to a bullish long-term outlook among the most closely-followed analysts.

Dana's aggressive cost reduction and operational efficiency initiatives, such as the $310 million run-rate cost savings target by 2026, significant margin lift from stranded cost eliminations, and ongoing plant automation, should meaningfully increase net margins and profit sustainability over the next several years.

What is the real engine behind this valuation? The core of the bullish case rests on relentless profit expansion plans, a radical transformation of cost structure, and bold forecasts for future margins. Want to see how high earnings are expected to climb, and what financial milestones drive this price target? Jump in to discover the assumptions that fuel Dana’s narrative.

Result: Fair Value of $26.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps on cost cuts or unexpected slowdowns in key customer demand could quickly shift expectations and challenge the current bullish outlook.

Find out about the key risks to this Dana narrative.

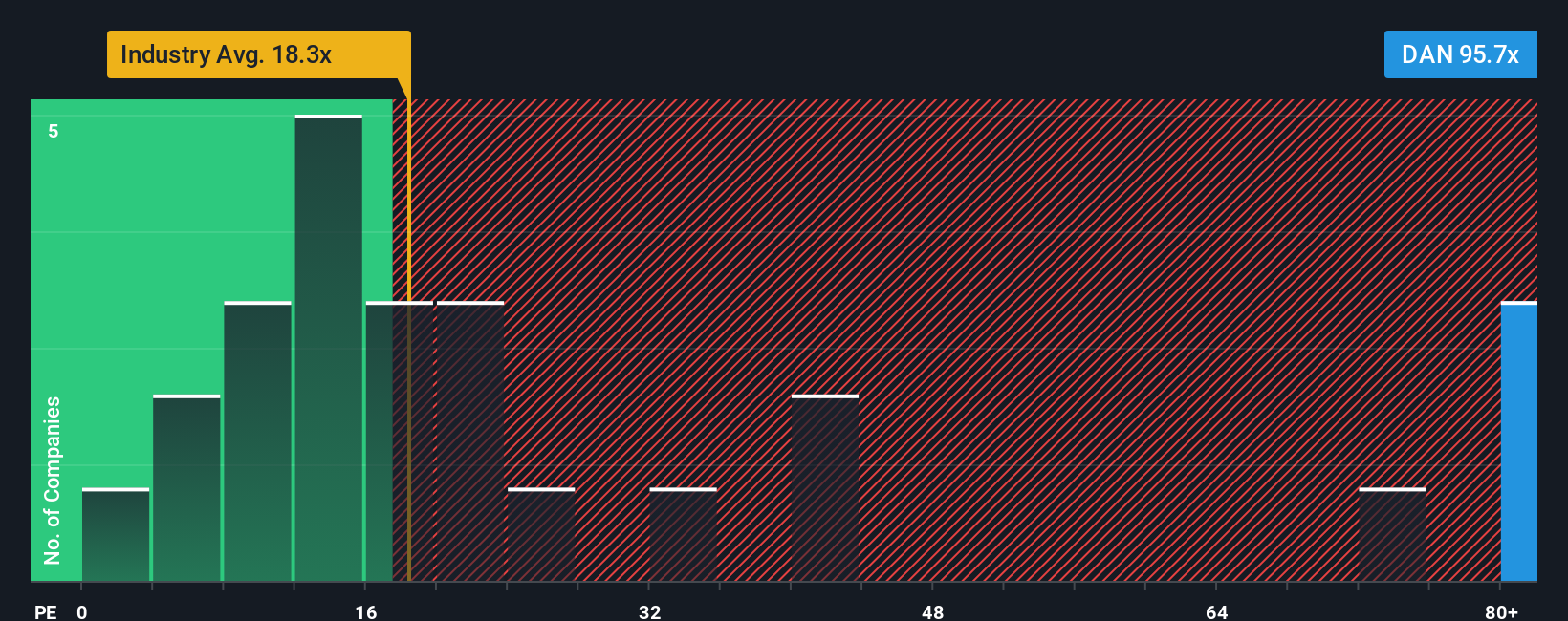

Another View: Market Multiples Tell a Different Story

Looking at traditional market multiples, Dana trades at a price-to-earnings ratio of 35.9x, which is much higher than both the US Auto Components industry average (22.4x) and peer average (13.9x). Even compared to its fair ratio of 27.5x, Dana appears expensive. This sizable gap raises important questions about valuation risk and makes us wonder if current expectations are too high, or if the earnings story could accelerate further from here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dana Narrative

If you see things differently or want to dive deeper into the numbers, you can build your own Dana outlook in just a few minutes. Do it your way

A great starting point for your Dana research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t settle for just one opportunity when you could capture several. Use the Simply Wall Street Screener to chase the potential of tomorrow’s winners today.

- Catch solid yield opportunities and secure your portfolio by checking out these 18 dividend stocks with yields > 3% with payouts above 3%.

- Spot companies backed by real innovation when you scan these 27 AI penny stocks for leading-edge AI breakthroughs and market disruption.

- Unlock hidden gems trading below true worth with these 905 undervalued stocks based on cash flows based on reliable cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAN

Dana

Provides power-conveyance and energy-management solutions for vehicles and machinery in North America, Europe, South America, and the Asia Pacific.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives