- United States

- /

- Auto Components

- /

- NYSE:APTV

Will Aptiv’s (APTV) Spin-Off Unlock Value or Complicate Its Advanced Mobility Ambitions?

Reviewed by Sasha Jovanovic

- At its recent Investor Day, Aptiv announced plans to spin off its Electrical Distribution Systems segment in order to create two focused public companies with an enhanced emphasis on intelligent systems, electrification, and advanced mobility technologies.

- This move is paired with stated intentions to pursue acquisitions, invest in software-defined features and non-automotive markets, and return excess cash to shareholders, reflecting a multifaceted strategy aimed at accelerating growth and capital efficiency.

- We’ll now explore how Aptiv’s decision to spin off a core segment and target non-automotive markets could reshape its investment outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Aptiv Investment Narrative Recap

To be a shareholder in Aptiv, you need to believe in the company's ability to execute on its transition toward intelligent systems, advanced electronics, and growth in both automotive and non-automotive markets. The recent spin-off announcement sets the stage for a nimbler business aligned with its stated growth catalysts; however, the biggest near-term risk, macroeconomic uncertainty and potential slumps in global vehicle production, remains, and the spin-off does not materially reduce this exposure for now.

Among the recent announcements, Aptiv’s new partnership with Robust.AI stands out. This tie-up advances software-defined features and expands Aptiv’s reach into industrial automation, an area that may help offset slowing automotive demand and directly supports the company’s strategy of increasing exposure to non-automotive, higher-margin opportunities.

But even with promising alliances, investors should be aware that sudden shifts in regional auto production, especially in China, could quickly challenge near-term growth expectations and...

Read the full narrative on Aptiv (it's free!)

Aptiv's narrative projects $23.3 billion revenue and $1.9 billion earnings by 2028. This requires 5.5% yearly revenue growth and a $0.9 billion earnings increase from $1.0 billion today.

Uncover how Aptiv's forecasts yield a $97.53 fair value, a 32% upside to its current price.

Exploring Other Perspectives

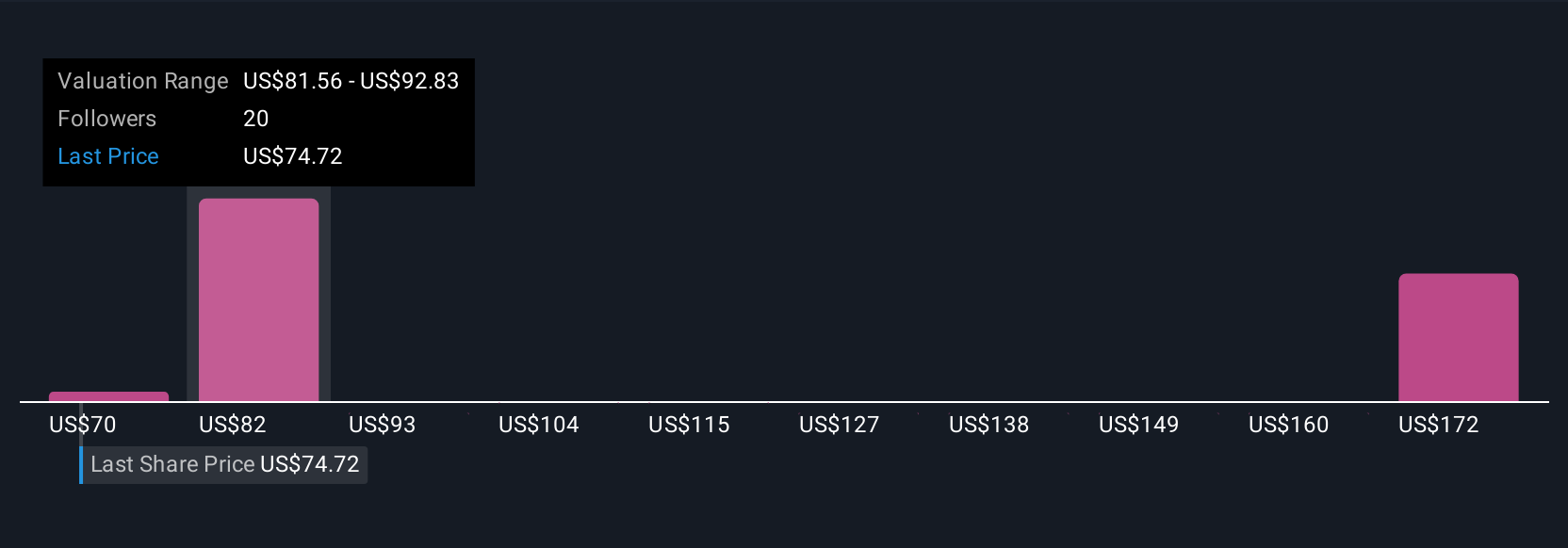

Six fair value estimates from the Simply Wall St Community range from US$70.29 to US$156.33 per share. Many see potential in Aptiv’s expansion into high-growth, non-automotive markets, but your outlook may differ, compare these perspectives to your own.

Explore 6 other fair value estimates on Aptiv - why the stock might be worth over 2x more than the current price!

Build Your Own Aptiv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aptiv research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Aptiv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aptiv's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APTV

Aptiv

Engages in design, manufacture, and sale of vehicle components for the automotive and commercial vehicle markets in North America, Europe, the Middle East, Africa, the Asia Pacific, South America, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives