- United States

- /

- Auto Components

- /

- NYSE:APTV

Aptiv (APTV) Valuation in Focus as Guidance Rises and Software Spin-Off Draws Analyst Interest

Reviewed by Simply Wall St

Aptiv (APTV) sparked investor interest after raising its full-year earnings guidance following a challenging third quarter, which was marked by significant goodwill impairment charges. The company’s focus on a planned software business spin-off is also drawing attention.

See our latest analysis for Aptiv.

Despite some headline-grabbing challenges earlier in the year, Aptiv's momentum has picked up speed. Its share price has surged 27% over the past 90 days and climbed nearly 39% for the year-to-date. Even with recent high-profile impairment charges and a major buyback, the stock’s total return over the past twelve months sits at an impressive 55%, far outpacing peers and signaling that investors are growing more optimistic about the company’s repositioning and new growth initiatives.

If you want to keep up with the shifting landscape in the auto sector, check out the latest movers with our See the full list for free.

With shares rallying and analyst targets trending higher, the key question for investors now is whether Aptiv is undervalued at current levels or if the market has already priced in the next stage of growth opportunity.

Most Popular Narrative: 12.5% Undervalued

Aptiv’s fair value, according to the most popular narrative, stands at $95.53, which is noticeably above the latest close of $83.61. Analysts project considerable upside, raising questions about what is fueling such heightened expectations.

Accelerating adoption of advanced driver-assistance systems (ADAS) and increased regulatory requirements for safety and automation are fueling demand for Aptiv's next-generation, scalable ADAS platforms, as evidenced by large system wins with both global and Chinese OEMs. This should drive recurring, higher-margin software and systems revenue, supporting gross margin expansion and earnings growth.

Curious which game-changing assumptions produced this bullish outlook? The core of this narrative is not just about past performance, but bold projections for future profitability, margin expansion, and valuation multiples rarely seen in this sector. Want to see what makes the difference? Hit the full narrative to unlock the surprising projections behind this premium valuation.

Result: Fair Value of $95.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing global economic uncertainty and volatility in raw material costs remain potential catalysts that could undermine these bullish expectations for Aptiv.

Find out about the key risks to this Aptiv narrative.

Another View: Multiples Show a Different Story

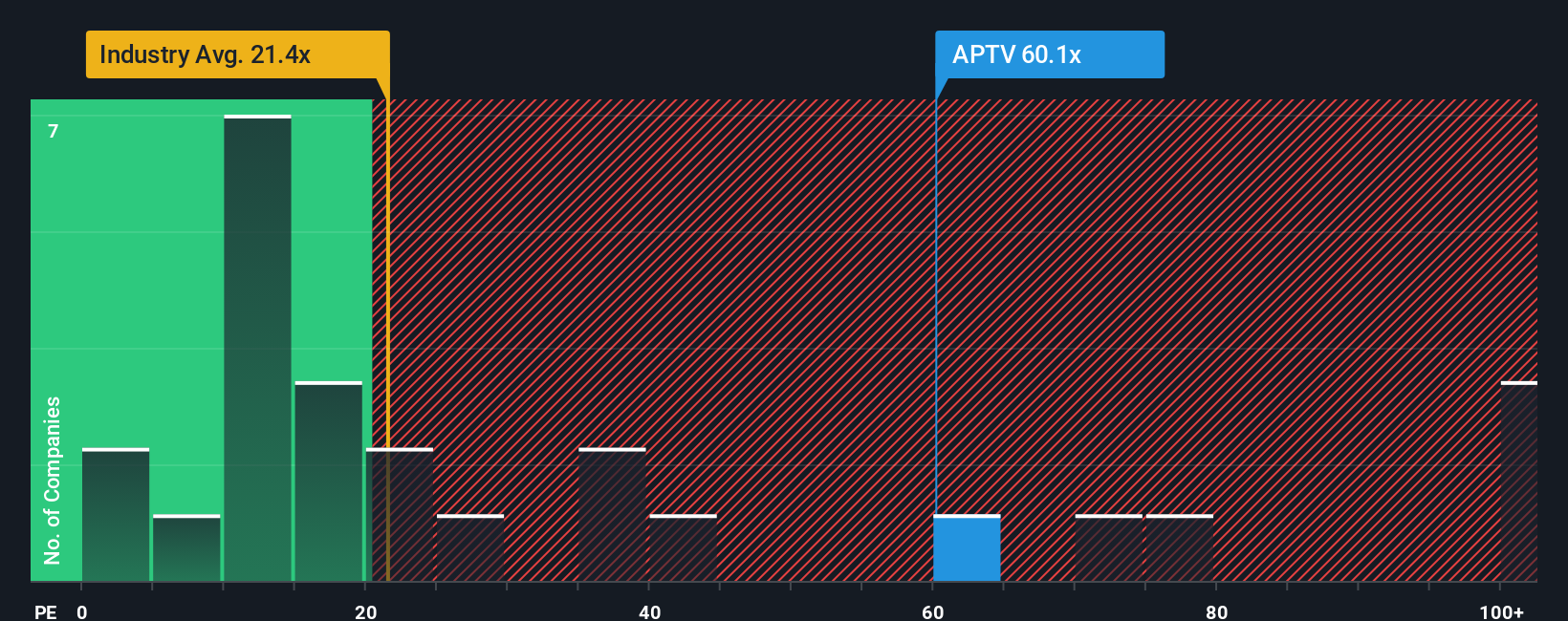

While the fair value narrative paints Aptiv as 12.5% undervalued, looking at its price-to-earnings ratio tells a more cautious story. Aptiv trades at a lofty 61.2 times earnings, well above both its peer average of 34.6x and the industry average of 19.9x. Intriguingly, the fair ratio suggests the market could eventually move closer to 77.2x. Is this premium justified, or does it signal increased valuation risk as investors chase future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aptiv Narrative

If you see things differently or want to test your own perspective, you can dive into the numbers and craft your own view in just minutes with our tools: Do it your way

A great starting point for your Aptiv research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Seize the opportunity to spot tomorrow’s leaders and strengthen your portfolio. Savvy investors are already finding new winners in every corner of the market.

- Unlock long-term potential by tapping into consistent yield opportunities through these 20 dividend stocks with yields > 3%, featuring companies with attractive dividends and stable growth prospects.

- Ride the wave of tech disruption and see which innovators stand out among these 26 AI penny stocks, focused on artificial intelligence breakthroughs set to transform industries.

- Spot undervalued gems before the crowd and position yourself for upside with these 845 undervalued stocks based on cash flows, meeting strict cash flow criteria for genuine value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APTV

Aptiv

Engages in design, manufacture, and sale of vehicle components for the automotive and commercial vehicle markets in North America, Europe, the Middle East, Africa, the Asia Pacific, South America, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives