Stock Analysis

- United States

- /

- Auto Components

- /

- NYSE:ADNT

Positive earnings growth hasn't been enough to get Adient (NYSE:ADNT) shareholders a favorable return over the last year

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the Adient plc (NYSE:ADNT) share price is down 40% in the last year. That's well below the market return of 25%. Notably, shareholders had a tough run over the longer term, too, with a drop of 37% in the last three years. But it's up 8.2% in the last week.

The recent uptick of 8.2% could be a positive sign of things to come, so let's take a look at historical fundamentals.

See our latest analysis for Adient

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year Adient saw its earnings per share increase strongly. We don't think the growth guide to the sustainable growth rate in this case, but we do think this sort of increase is impressive. As a result, we're surprised to see the weak share price. So it's worth taking a look at some other metrics.

Adient managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

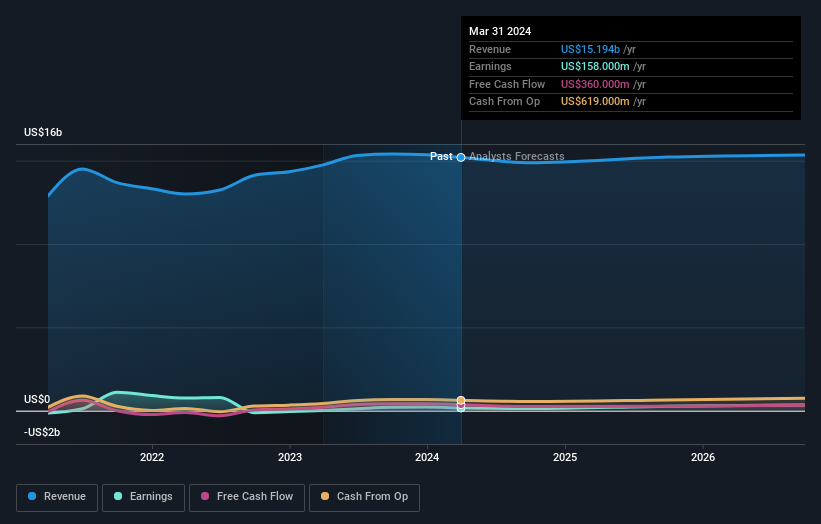

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Adient is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Adient stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Adient shareholders are down 40% for the year, but the market itself is up 25%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 1.8% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Adient (1 can't be ignored) that you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Adient is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Adient is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADNT

Adient

Engages in the design, development, manufacture, and market of seating systems and components for passenger cars, commercial vehicles, and light trucks.

Undervalued with proven track record.