- United States

- /

- Auto Components

- /

- NasdaqGM:WRD

WeRide (WRD) Is Up After Securing Abu Dhabi's First Fully Driverless Robotaxi License—Is Regional Expansion Next?

Reviewed by Sasha Jovanovic

- WeRide has been granted approval to operate fully driverless Robotaxi services in Abu Dhabi, allowing commercial operations without an onboard safety driver and making it the first international company outside the U.S. to achieve this milestone at the city level.

- This regulatory success not only enables WeRide to reach financial breakeven on unit economics but also positions the company to expand its autonomous fleet and geographic coverage in the region.

- We'll explore how the elimination of the in-vehicle safety driver requirement shapes WeRide's investment narrative and future expansion potential.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is WeRide's Investment Narrative?

For anyone looking at WeRide today, the big picture story revolves around whether the company can convert leading-edge global regulatory wins into a sustainable business model before ongoing losses and volatility erode investor confidence. The Abu Dhabi permit for fully driverless commercial Robotaxi services is a material catalyst, bringing real-world validation and a credible path towards better unit economics by allowing operations without a safety driver. This could accelerate near-term fleet expansion and help narrow losses, raising the stakes for next quarter’s earnings and the pace of growth in other new regions. However, given the recent sharp correction in WeRide’s share price, the market seems uncertain whether such milestones will overcome profound ongoing risks: persistent unprofitability, previous dilution, high executive payouts, and questions around board depth. For shareholders, the core test remains: can WeRide transition from regulatory frontrunner to a commercially viable, growing enterprise?

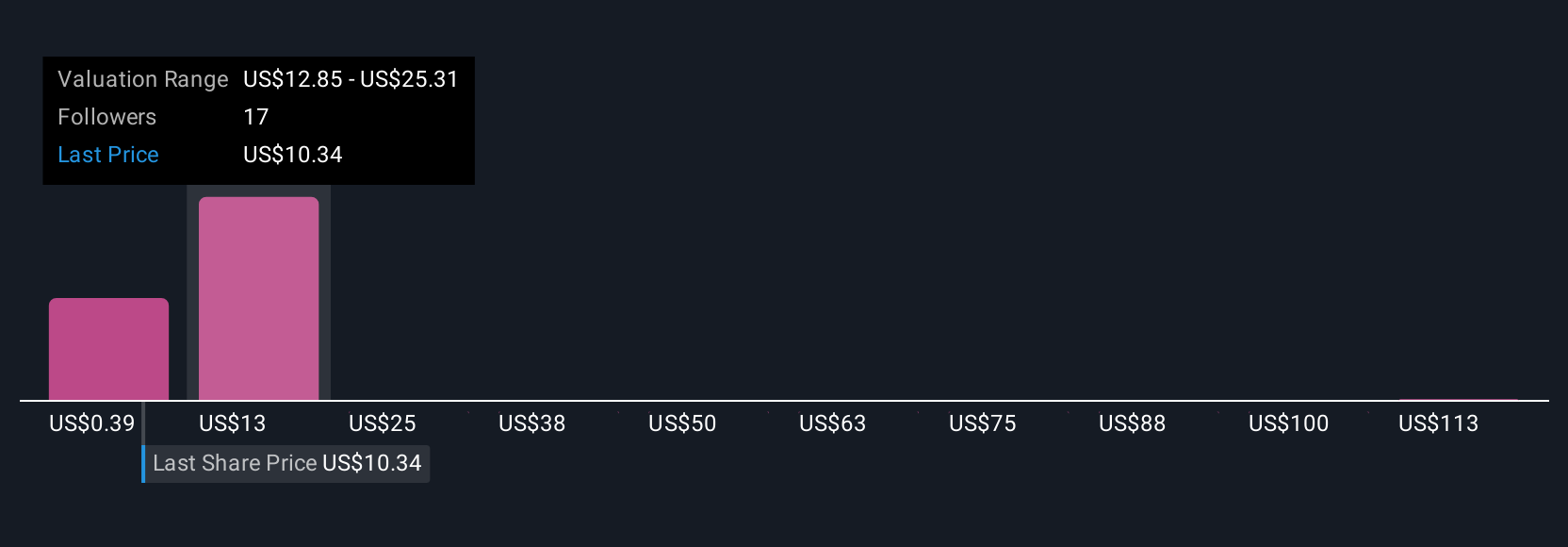

But regulatory wins don’t erase the pressure from WeRide’s ongoing high losses and volatile valuation. Our valuation report here indicates WeRide may be overvalued.Exploring Other Perspectives

Explore 15 other fair value estimates on WeRide - why the stock might be a potential multi-bagger!

Build Your Own WeRide Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WeRide research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free WeRide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WeRide's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WeRide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WRD

WeRide

An investment holding company, provides autonomous driving products and solutions for mobility, logistics, and sanitation industries in the People’s Republic of China.

Excellent balance sheet with low risk.

Market Insights

Community Narratives