- United States

- /

- Auto Components

- /

- NasdaqGS:VC

Visteon Corporation (NASDAQ:VC) Held Back By Insufficient Growth Even After Shares Climb 27%

Despite an already strong run, Visteon Corporation (NASDAQ:VC) shares have been powering on, with a gain of 27% in the last thirty days. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

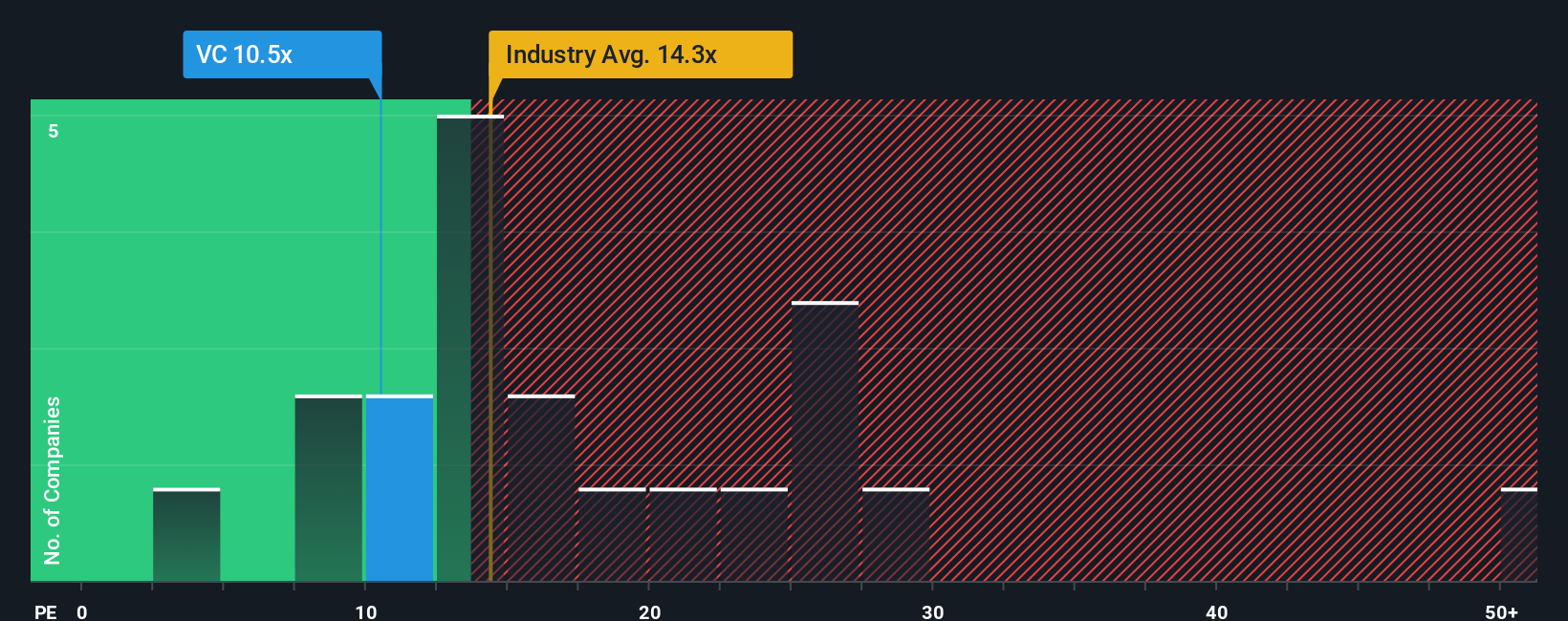

Although its price has surged higher, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 19x, you may still consider Visteon as an attractive investment with its 10.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Visteon hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Visteon

Is There Any Growth For Visteon?

There's an inherent assumption that a company should underperform the market for P/E ratios like Visteon's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 39% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 550% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 3.8% per annum as estimated by the analysts watching the company. That's not great when the rest of the market is expected to grow by 10% per year.

In light of this, it's understandable that Visteon's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Despite Visteon's shares building up a head of steam, its P/E still lags most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Visteon maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Visteon (1 is concerning!) that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VC

Visteon

An automotive technology company, designs, manufactures, and sells automotive electronics and connected car solutions for vehicle manufacturers.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives