- United States

- /

- Auto

- /

- NasdaqCM:MAMO

With A 25% Price Drop For Massimo Group (NASDAQ:MAMO) You'll Still Get What You Pay For

Massimo Group (NASDAQ:MAMO) shares have had a horrible month, losing 25% after a relatively good period beforehand. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

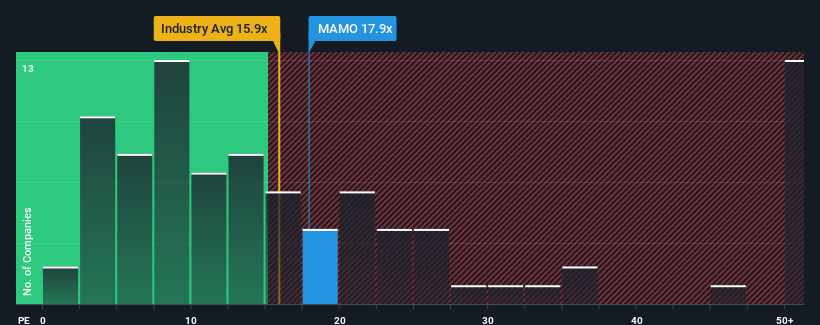

In spite of the heavy fall in price, it's still not a stretch to say that Massimo Group's price-to-earnings (or "P/E") ratio of 17.9x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 19x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

As an illustration, earnings have deteriorated at Massimo Group over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Massimo Group

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Massimo Group's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 3.8%. Still, the latest three year period has seen an excellent 50% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 15% shows it's about the same on an annualised basis.

In light of this, it's understandable that Massimo Group's P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Final Word

With its share price falling into a hole, the P/E for Massimo Group looks quite average now. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Massimo Group maintains its moderate P/E off the back of its recent three-year growth being in line with the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Massimo Group (1 shouldn't be ignored) you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:MAMO

Massimo Group

Through its subsidiaries, manufactures and sells utility terrain vehicles, all-terrain vehicles, and pontoon and tritoon boats in the United States.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives