- United States

- /

- Auto

- /

- NasdaqGS:LOT

Lotus Technology (NasdaqGS:LOT): Exploring Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

See our latest analysis for Lotus Technology.

Lotus Technology’s recent share price return of -24% over the past month highlights how momentum has faded compared to its earlier days as a newly listed EV maker. Total shareholder return for the past year sits notably lower at -63%. This downturn reflects shifting investor sentiment and an industry searching for stability amid fierce competition and evolving expectations.

If you’re weighing other opportunities in the automotive space, now would be a great time to discover See the full list for free.

With shares trading well below analyst targets but the company posting steep losses, the key question is whether the market is overlooking future growth potential or if all the risks are already reflected in the stock price.

Most Popular Narrative: 46% Undervalued

With Lotus Technology’s fair value set at $3.00, nearly double the last close, analysts see ample upside, driven by bold growth ambitions and expected margin reversal. This sets up a fundamentally optimistic case, despite short-term turbulence.

The recently completed funding agreements, including a $300 million convertible note with ATW Partners and new credit facilities from Geely, enhance balance sheet flexibility and ensure sufficient capital for accelerated product development, technology innovation, and global expansion, supporting higher future revenues and improved operating margins.

What’s really fueling this bullish stance? Analysts are betting on a dramatic shift from deep losses to strong profitability, propelled by aggressive revenue growth assumptions and a valuation multiple rarely seen outside high-octane sectors. Craving the details? Get the full story behind these numbers and find out what underpins the premium price target.

Result: Fair Value of $3.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shrinking deliveries and ongoing net losses could undermine Lotus Technology’s growth outlook and threaten the turnaround that bullish analysts anticipate.

Find out about the key risks to this Lotus Technology narrative.

Another View: Pricing in Uncertainty

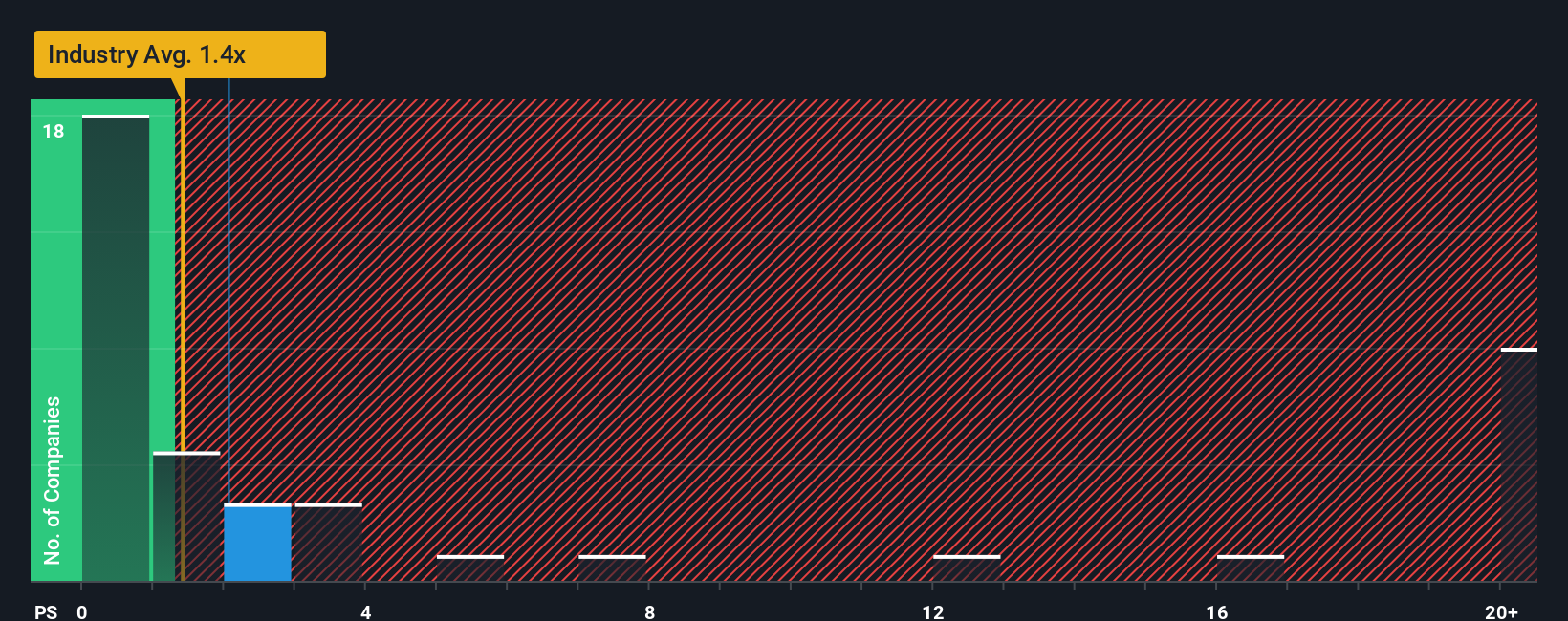

While analyst targets see upside, looking at the company’s price-to-sales ratio presents a more complicated picture. Lotus Technology trades at 1.5x sales, which is higher than the US auto industry average of 1.1x but much lower than the peer group average of 7.1x. However, the fair ratio stands at 2.2x. This suggests that the market is not convinced about near-term growth or risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lotus Technology Narrative

If you want to dig into the numbers yourself or challenge the consensus, it only takes a few minutes to build your own perspective. Do it your way

A great starting point for your Lotus Technology research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Uncover hidden opportunities beyond Lotus Technology and take control of your investing future. Here are three standout ways to find your next potential winner using Simply Wall Street:

- Unlock the potential for big returns by targeting these 3587 penny stocks with strong financials that demonstrate strong financial resilience, even at lower share prices.

- Boost your passive income strategy by focusing on these 17 dividend stocks with yields > 3% offering yields above 3%. This can help you build steady cash flow in your portfolio.

- Position yourself ahead of tech megatrends by tracking these 24 AI penny stocks at the forefront of artificial intelligence innovation and disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LOT

Lotus Technology

Engages in the design, development, and sale of battery electric lifestyle vehicles worldwide.

High growth potential and slightly overvalued.

Market Insights

Community Narratives