- United States

- /

- Auto Components

- /

- NasdaqGS:GTX

Will Strong Q3 Results and Enhanced Shareholder Returns Change Garrett Motion's (GTX) Narrative?

Reviewed by Sasha Jovanovic

- Garrett Motion Inc. recently reported third quarter results showing year-over-year growth in sales to US$902 million and net income to US$77 million, alongside increased basic and diluted earnings per share compared to the same period last year.

- The company also raised its full-year sales and net income outlook, announced a dividend hike, and completed a sizeable share buyback, highlighting management’s confidence and returning additional value to shareholders.

- We'll explore how Garrett's raised full-year outlook and dividend increase may reshape the evolving investment narrative for the company.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Garrett Motion Investment Narrative Recap

To be a shareholder in Garrett Motion, you need to believe the company’s core turbocharger business can sustain growth while it transitions toward electrified technologies. The recent sales and earnings beat, combined with a raised outlook and increased dividend, bolster management’s case in the short term. However, these positive updates do not materially change the biggest catalyst, expansion in zero-emission products, or the central risk: the pace at which internal combustion engine (ICE) demand erodes due to electric vehicle adoption.

Among the announcements, the updated full-year guidance is particularly relevant. Garrett’s improved target for both net sales and net income acknowledges current momentum but does not resolve investor concerns about the longer-term shift away from ICE, nor does it fully offset margin pressures from sales mix. How these financial milestones intersect with structural challenges remains a key area of focus.

Yet, despite these positive signals, investors should not overlook the ongoing margin pressure stemming from an unfavorable product mix…

Read the full narrative on Garrett Motion (it's free!)

Garrett Motion's narrative projects $3.8 billion revenue and $339.1 million earnings by 2028. This requires 3.1% yearly revenue growth and a $38.1 million earnings increase from $301.0 million today.

Uncover how Garrett Motion's forecasts yield a $18.75 fair value, a 11% upside to its current price.

Exploring Other Perspectives

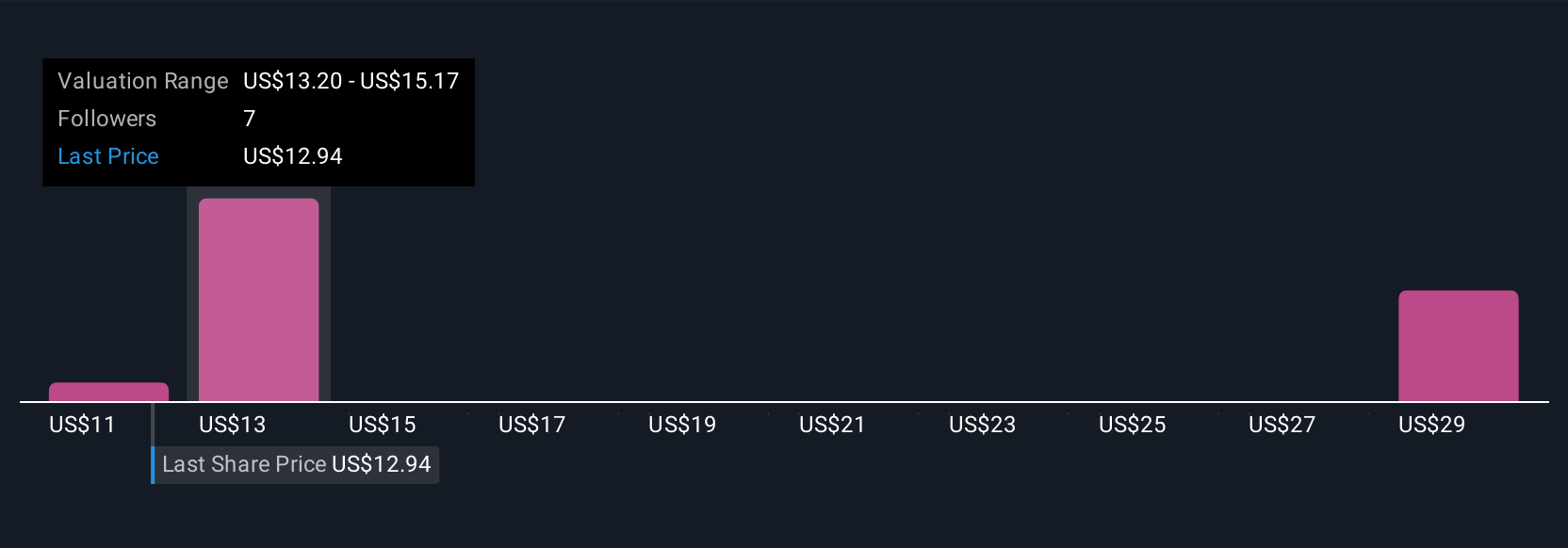

You will find that Simply Wall St Community fair value estimates for Garrett Motion range from US$18.75 to US$37.74, across two distinct viewpoints. As you explore these opinions, remember that margin pressure from the sales mix continues to weigh on near-term profitability and may impact future performance, prompting many to reassess opportunities and risks.

Explore 2 other fair value estimates on Garrett Motion - why the stock might be worth over 2x more than the current price!

Build Your Own Garrett Motion Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Garrett Motion research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Garrett Motion research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Garrett Motion's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTX

Garrett Motion

Designs, manufactures, and sells turbocharging, air and fluid compression, and high-speed electric motor technologies for original equipment manufacturers and distributors in the United States, Europe, Asia, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives