- United States

- /

- Auto Components

- /

- NasdaqGS:GTX

Garrett Motion Shares Soar 132% as EV Partnerships Spark Debate on True Value

Reviewed by Bailey Pemberton

- Thinking about whether Garrett Motion could be undervalued, a hidden gem, or finally catching up to its true worth? Let’s dig into what might set this stock apart for value-conscious investors.

- Shares have surged, gaining 29.8% in the last month and skyrocketing 132.4% over the past year, signaling that the market is waking up to something new here.

- Fueling these moves are headlines about Garrett Motion’s innovative expansion into electric vehicle technologies and strategic partnerships with OEMs, which have put the company in the spotlight. This recent news has clearly played a role in shifting investor sentiment and highlighting potential long-term growth stories.

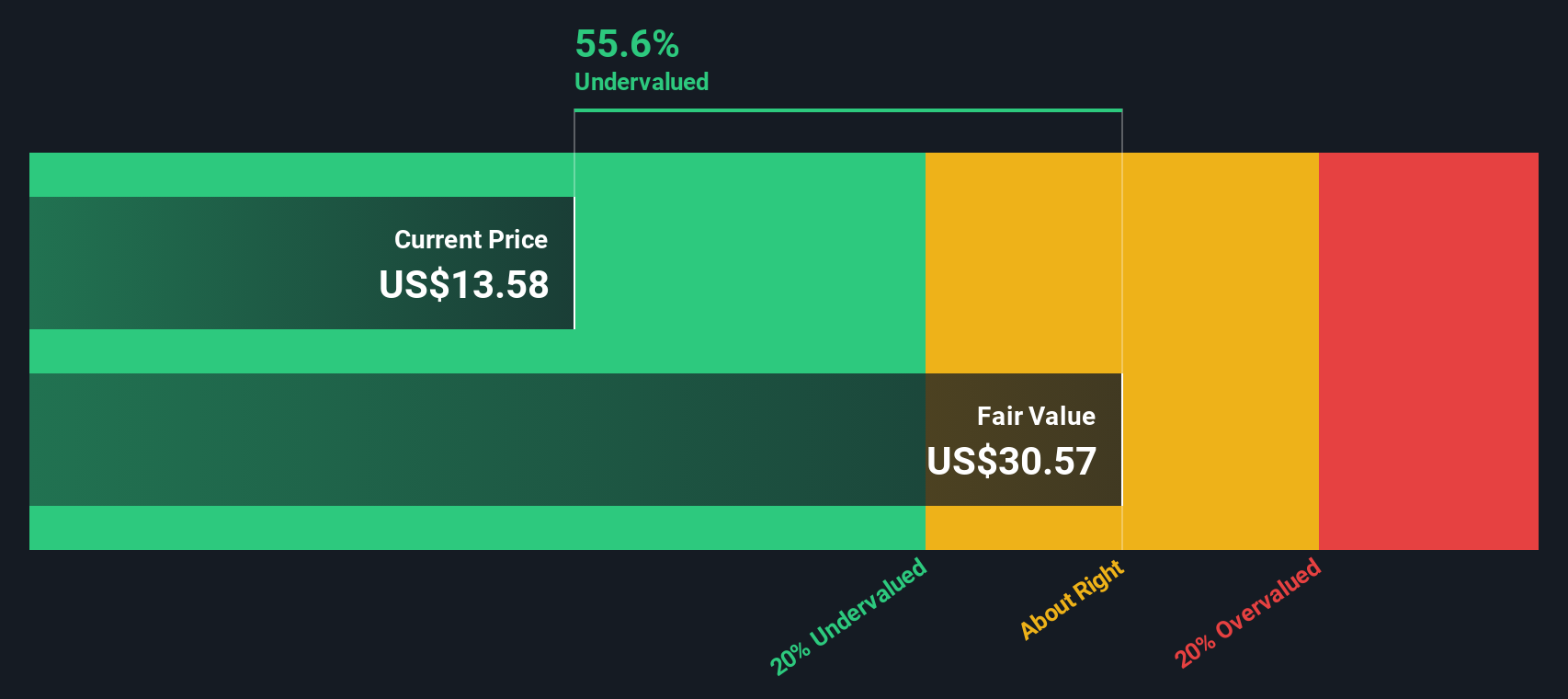

- On our official valuation scorecard, Garrett Motion is undervalued in 5 out of 6 checks (score: 5/6). This means there is a lot to unpack about how the market is pricing this business. Stay tuned for a breakdown of valuation methods, along with an even more insightful approach at the end of this article.

Approach 1: Garrett Motion Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model projects a company's future cash flows and discounts them back to today, giving an estimate of what the business is intrinsically worth at present. It is one of the most widely used fundamental valuation tools.

For Garrett Motion, the DCF analysis starts with its latest twelve-month Free Cash Flow, which stands at $368 million. Analysts estimate that cash flows will continue to expand, reaching $386.55 million in 2026 and $403.95 million by 2027. Beyond those years, projections use a moderate growth rate, showing that Free Cash Flow could climb to $525.67 million by 2035. All figures represent steady, consistent growth over the next decade.

When all these projected cash flows are discounted back to today, the estimated fair value per share is $35.32. This figure is based on a rigorous 2 Stage Free Cash Flow to Equity model.

Importantly, the model finds that Garrett Motion trades at a 50.6% discount to its intrinsic value. This suggests that the current share price may not fully reflect the company’s long-term cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Garrett Motion is undervalued by 50.6%. Track this in your watchlist or portfolio, or discover 836 more undervalued stocks based on cash flows.

Approach 2: Garrett Motion Price vs Earnings (P/E) Analysis

The Price-to-Earnings (P/E) ratio is one of the most time-tested and popular ways to value profitable companies. It measures how much investors are currently willing to pay per dollar of earnings, allowing for apples-to-apples comparisons with peers and industry benchmarks.

Growth expectations and risk play an important role in what a "normal" or "fair" P/E should look like. Fast-growing or lower-risk businesses often command higher P/E multiples, while slower growth or higher perceived risk tend to push the P/E down.

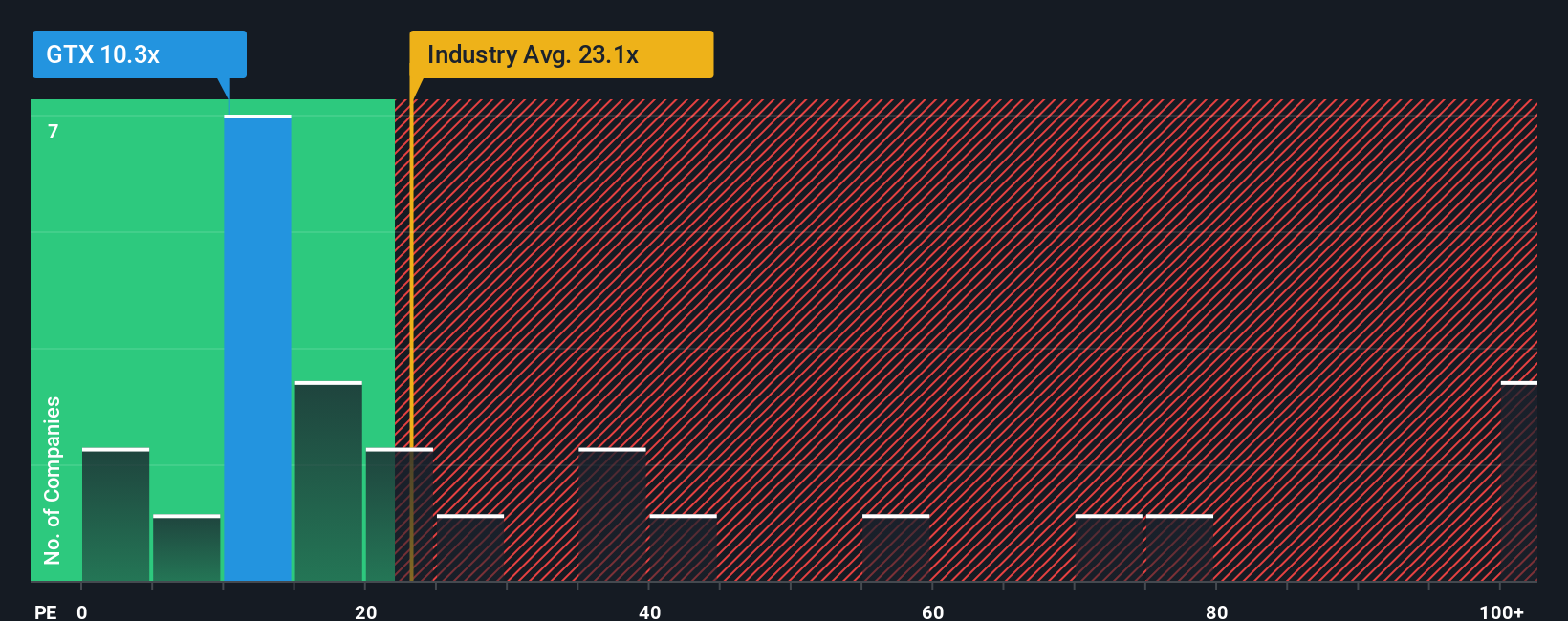

Garrett Motion currently trades at a P/E ratio of 10.42x. This is well below both the average for industry peers (23.42x) and the broader Auto Components sector average of 20.08x. At first glance, this suggests Garrett Motion may be undervalued by typical market standards.

Simply Wall St’s proprietary "Fair Ratio" goes a step further, factoring in company-specific drivers such as earnings growth, risks, profit margins, industry context, and market cap. For Garrett Motion, the calculated Fair Ratio is 12.31x. This means that, even when accounting for the company’s unique profile, the stock’s P/E remains below its fair metric.

Because the company’s current P/E is not only lower than peers and industry averages, but also below the Fair Ratio, it appears that Garrett Motion is trading at a notable discount. This is true even after factoring in its growth and risk profile. The share price may still be catching up to its full potential as indicated by normalized multiples.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Garrett Motion Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives.

A Narrative is your own investment story about the company, a perspective on where Garrett Motion is headed, grounded in your expectations for its future revenue, earnings, and margins, and the fair value you assign based on those beliefs.

Instead of relying on a single “official” target price or forecast, Narratives let you link the company’s story to your actual financial outlook, making your investment thesis transparent and actionable.

This tool is integrated directly into the Simply Wall St Community page, where millions of investors simplify their research by writing, sharing, and comparing Narratives about the same stock.

With Narratives, you can instantly see how your estimated fair value compares to the market price and decide if now is a good time to buy or sell, all while your view updates automatically whenever new information, like earnings or breaking news, emerges.

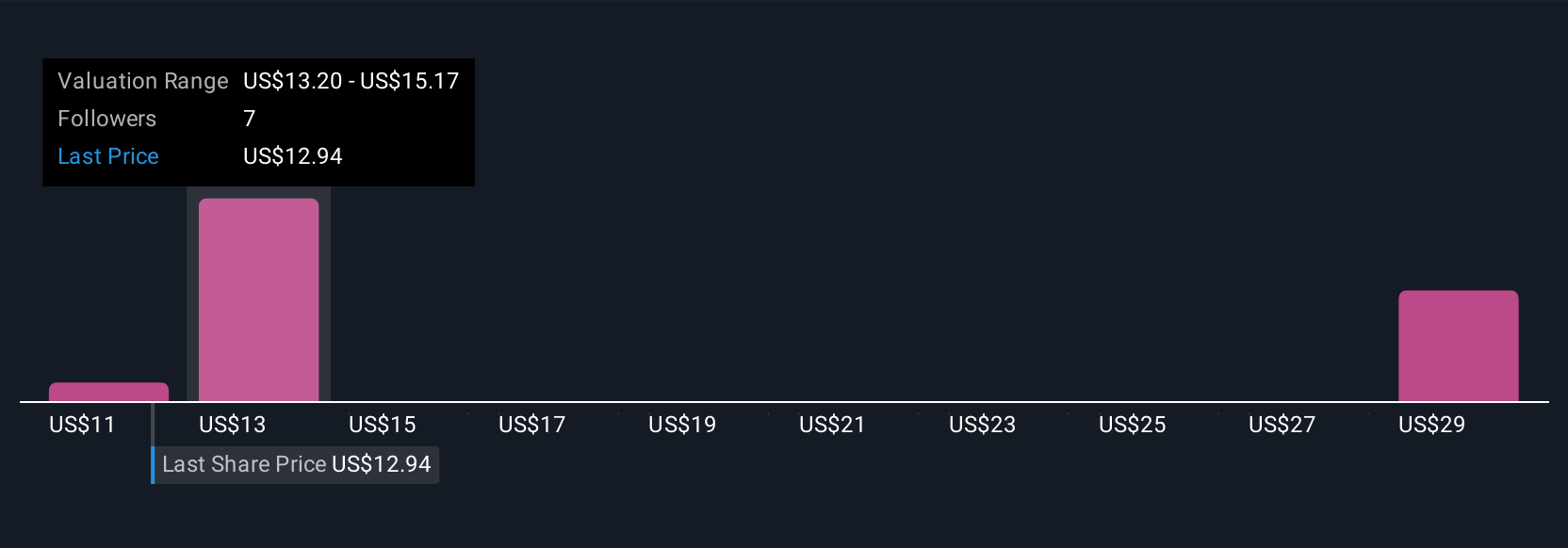

For example, regarding Garrett Motion, some investors believe expansion into electrification and rising margins justify a fair value near $18.75 per share, while others, cautious about ICE market headwinds and margin pressures, see a value closer to $15. This is a clear illustration of how perspectives can differ and how Narratives connect those viewpoints directly to actionable numbers.

Do you think there's more to the story for Garrett Motion? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTX

Garrett Motion

Designs, manufactures, and sells turbocharging, air and fluid compression, and high-speed electric motor technologies for original equipment manufacturers and distributors in the United States, Europe, Asia, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives