- United States

- /

- Auto Components

- /

- NasdaqGS:GTX

Garrett Motion Inc. (NASDAQ:GTX) Investors Are Less Pessimistic Than Expected

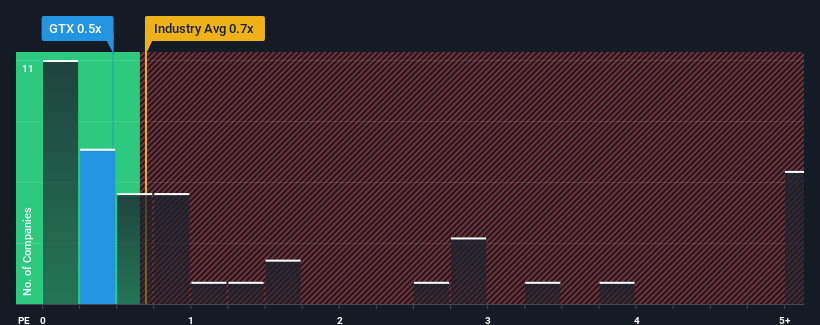

With a median price-to-sales (or "P/S") ratio of close to 0.7x in the Auto Components industry in the United States, you could be forgiven for feeling indifferent about Garrett Motion Inc.'s (NASDAQ:GTX) P/S ratio of 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Garrett Motion

How Has Garrett Motion Performed Recently?

While the industry has experienced revenue growth lately, Garrett Motion's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Garrett Motion's future stacks up against the industry? In that case, our free report is a great place to start.How Is Garrett Motion's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Garrett Motion's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.0%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 1.9% as estimated by the dual analysts watching the company. That's not great when the rest of the industry is expected to grow by 23%.

In light of this, it's somewhat alarming that Garrett Motion's P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From Garrett Motion's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It appears that Garrett Motion currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Garrett Motion that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GTX

Garrett Motion

Designs, manufactures, and sells turbocharging, air and fluid compression, and high-speed electric motor technologies for original equipment manufacturers and distributors in the United States, Europe, Asia, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives